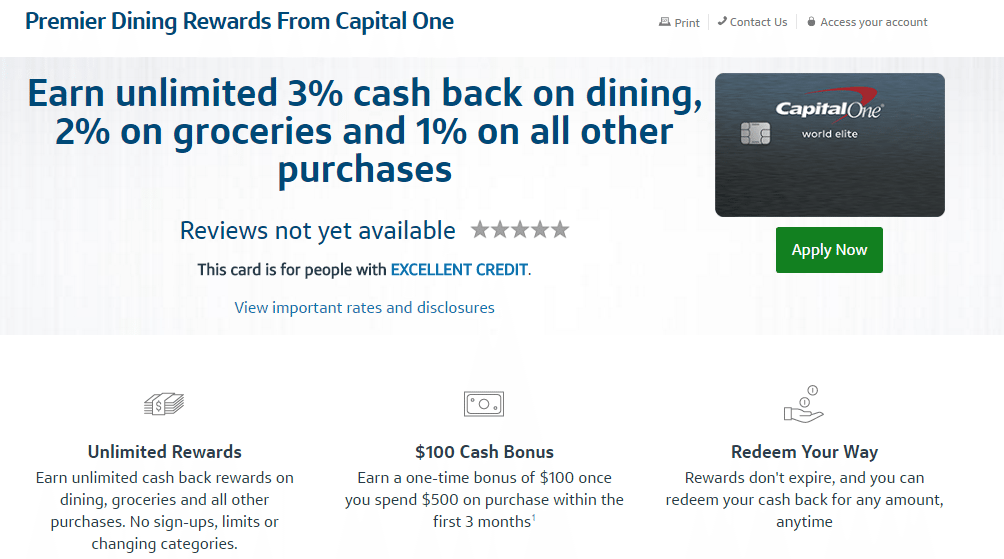

Capital One has launched a new credit card called “Premier Dining Rewards“. Let’s take a quick look at the cards benefits and features:

- Sign up bonus of $100 after $500 in spend within the first three months

- No annual fee

- Card earns at the following rates:

- 3% cash back on dining

- 2% cash back on groceries

- 1% cash back on all other purchases

Card really isn’t that interesting as plenty of cards have higher cash sign up bonuses and some cards earn 2% cash back (or more) on all purchases. 3% on dining is really the only thing of interest as 3% cash back is equal best (aside from points) across all cards (read: best credit cards for restaurant purchases). I don’t think the card is worth applying for just because of that benefit, especially when you remember that Capital One pulls all three credit bureaus.

If you’re an existing Capital One cardholder you can’t currently product change to this card either. Once it is available to product change to it might make sense for some people to do so as it has no annual fee and that 3% earn rate. As always make sure you read through these things everybody should know about Capital One credit cards.

What are your thoughts on this card? Let me know in the comments below.

Hat tip to reader Mark

Whatever the case, hooray for capital one for finally releasing their new card they promised almost 8 months ago! It was supposed to be a game changer…not sure how this is a game changer.

If I were capital one, I would have made this WEMC a 1 or 2 HP type of card for folks with better credit, and have a significantly higher sign on bonus.

No PC now…but I certainly will be PCing to this later when its an option. Until then, I will be enjoying 10x MRs (although has FTFs) on my blue for biz amex!

If people really care that much about 1-2% extra cashback in dining, just tip 1-2% less than usual or don’t eat out as much and you’ll save a lot of money.

Call me cheap, but I usually tip between 10-15% when eating at a restaurant, 0% on takeout orders, and 0% on fast casual or fast food.

you’re cheap

Asia will be heaven to you — you pay exactly the same price on the menu, no taxes and no mandatory tips, and better service.

Yeah, but look what yur eating 🙂

Any recommendations for specific cities/countries to visit in Asia? I’ve heard that tipping isn’t customary in Asia, but I’m not sure if it’s the entire continent or just certain cities/countries.

East Asia (China, Japan, Korea) doesn’t require tipping, although occasionally some local western restaurants may add a service charge to the bill. If you like visiting big cities, places like Tokyo, Beijing, Shanghai, Hong Kong/Shenzhen, Singapore are good choices. If you prefer beaches, southeast Asia do have some nice ones, but those places may expect tipping from foreigners.

haha!

You are not cheap at all. Just being realistic. I like that.

Chase AARP is another to consider for 3% dining.

3% Dining, 3% Gas, 1% Others

I wish the travel version of that was available for signups..

I use the Chase AARP card for dining now, but it has some major drawbacks: redemptions must be done in $25 increments and it has foreign transaction fees. This CapOne card appears to be better on those fronts.

Eli – it is $20 min as a cash redemption, and even less for a g/c.

You can cash out for a $5 gift card if you want to.

Actually, I think this card is worth getting for infrequent travelers who may go out of the country. I’m planning a one off international trip. I have 2 Visas, and no MCs with no FTF and no AF. I don’t travel much, and have 2 2% cash back cards- only one is no FTF, no AF. My other card good for international travel is the Amazon Visa. That would make the Quicksilver only good for international travel or otherwise useless to me.

Given that while abroad one will eat out more, 3% in dining is huge with no FTF. Even though it is 1% more than the Amazon Visa, I can redeem at any amount and can get 2% on groceries abroad which is the best one can get, in case I would rather cook or just get some snacks. I only get 2% on groceries currently, because 1% more for the AMEX BCE, is not worth the $25 only increments (I don’t spend more than $3200 a year on groceries). Having no AF or FTF makes this a great card for people like me. And having open applications for everyone without having to join some membership makes this a fantastic card.

“Fantastic” might be a bit of a bloated overstatement. Use the three HPs to get additional cards that you can be spending on minimum spends. That’ll beat 3% dining any day.

You might be right about fantastic being overstated. However, the 3 HPs are 1 at each CB. For someone like me who doesn’t apply for 10 cards every time I come out of the garden, it doesn’t hurt nearly as much. I prefer to apply for cards as I find them useful to me.

This may be a mid-late June app, unless Freedom or Discover throw groceries on Q3 as well. And this beats the 1.5% on everything (or 2% with another card, Visa) while abroad in categories I would use most. The country I plan on visiting will require cash for most transportation and souvenirs. It will leave major stores (I don’t expect much spending in this), dining, and convenience/grocery stores for a majority of my spending.

So, in my opinion, the combination of no FTF and 3% dining in this card is useless.

If you aren’t spending, say, $1,000 on dining abroad (as an infrequent traveler would not), the card offers very little advantage compared to numerous no AF, no FTF cards at 1.5% and up. (www.doctorofcredit.com/master-list-no-annual-fee-no-foreign-transaction-fee-cards/)

If you do spend a lot on dining abroad (such as a frequent traveler would), you should already have some cards that equal this card just due to the travel benefits the other cards might offer.

So for me, I’m not going to open checking accounts and pay to join any of the US government based banks just to get a no FTF card. Most of the cards on the no AF, no FTF list involve using the rewards on a specific brand/store, which for me is a no-go. Or they offer 1% or less in cash, which this card beats.

The Arrival card can’t be applied for anymore, only PCed. And it requires a $100 min redemption for travel purchases, otherwise the 2 points are only worth 1 cent total. BoA requires the rewards be used on travel purchases.

JetBlue would be great, if I travelled much, but does require commitment to a specific airline (though the CSP/CSR would be better for the benefits, flexibility, and increasing the other Freedom cards value). Sam’s Club requires a membership with them, so not really a no AF card for those that don’t shop there. AAA is great (I don’t know how rewards are redeemed), but isn’t available in my state at all with either bank sadly.

That leaves a flat 1.5% card, the Quicksilver. Or the Premier Dining Rewards card which offers .5% less in most categories, but .5% more in groceries and 1.5% in dining. Considering most people have a 2% card who have excellent credit, a 1.5% card is useless unless abroad, assuming the 2% does have a FTF.

That makes the Premier Dining a great card for keeping in your wallet and still use regularly, considering no AF. If one does travel regularly, the CSR is far better, as the AF would be covered by the $300 travel credit and the at least 50% increase in value for all UR earning cards. But for the average consumer, this is a great card if they get out of the country occasionally.

Funny thing my Neighbor was talking about a Bank of the West CC that IMO is competitive to this one when the sign up bonus factor not considered

https://www.doctorofcredit.com/bank-west-cash-back-mastercard-review-3-groceries-dining-gas-purchases-az-ca-co-id-ia-ks-mn-mo-ne-nv-nm-nd-ok-sd-ut-wa-wi-wy/

I think the marvel mastercard is better. The signup bonus is lower, but 3% back on dining and entertainment is better (and applied automatically to each statement, so you don’t have to build it up to cash it out), looks cooler, and I’ve been getting targeted bonuses every other month.

Targeted bonuses on the Marvel Mastercard? I have the card and I have never received anything like that from them.

I got one in december (spend $500 in a month, get $25 back) and one right now (spend $500 in a month, get two tickets to Guardians of the Galaxy 2).

I can send you screenshots if you’d like

Yeah. Please do, as I haven’t received these offers either. How much do you put on the card normally? And how many accounts do you have total? I’m wondering if either one of these is getting you the offer.

This card could have place as 3% is uncapped, right?

Also its world elite, with zero AF.

Worth changing from quicksilver down the line IMO

Yup, product change will make since once offered.