WalletHub is another site in the growing free credit monitoring/scores/report space (others include: Credit Karma, Credit Sesame, Quizzle, Credit.com & WisePiggy). WalletHub’s competitive advantage is that they update data daily (without any usage requirement) and also provide recommendations on a best offer available basis, rather than on advertiser dollars. Let’s have a look at their offering in a bit more detail to see if signing up for this service makes sense.

Contents

Free Credit Score

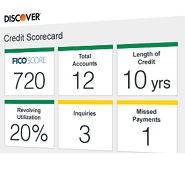

All of the data that WalletHub provides is based on your TransUnion credit report, they use the VantageScore V3.0 scoring model.

Is It Really Free?

Yes, WalletHub doesn’t require you to input a credit card and they don’t have a premium offering that they try to upgrade you to either.

Are The Scores They Provide Really Accurate?

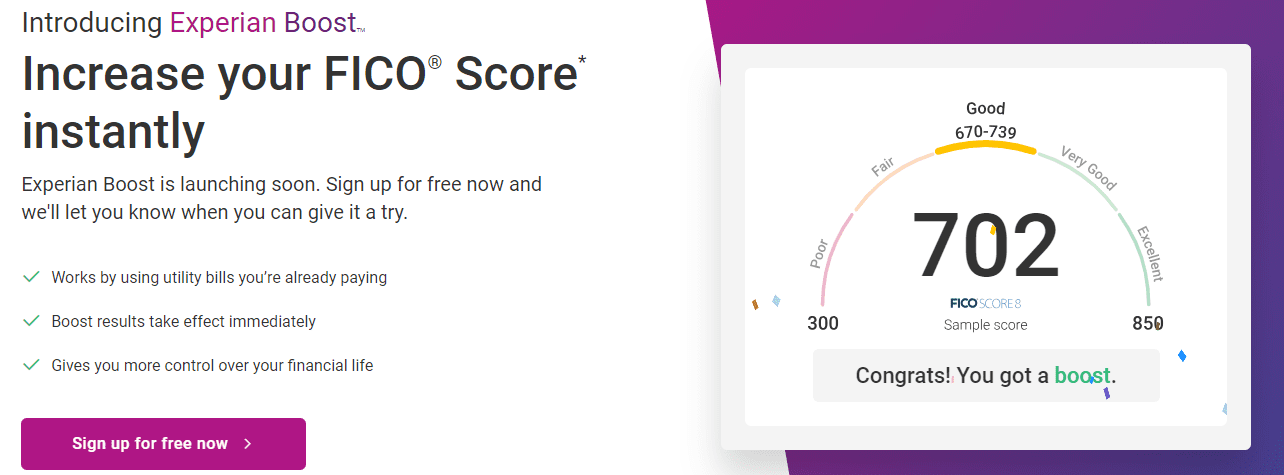

It really depends on what you mean by accurate, they do provide a real TransUnion VantageScore 3.0 credit score, but this isn’t a score most lenders use. The most commonly used scores are calculated using a FICO scoring model (over 90% of marketshare in the credit score space).

[Read: How To Get Your Free FICO Score]

In the past when I’ve compared my scores (between FICO & VantageScore, using the same credit bureau) I’ve noticed a difference of around ~50 points. That’s quite significant as it could put me into a score range that doesn’t receive the best APR advertised.

[Read: FICO Score Vs VantageScore]

That being said free credit monitoring sites can be a useful guide to see how your credit is tracking (e.g improving or not).

Free Credit Report

One of the nice things about WalletHub is that the credit report they provide you (also a TransUnion report) is a full report, whereas other credit monitoring sites only give you a partial report. This can be useful if you’re in the process of repairing your credit and want to check what items have been removed/updated as you can only receive one free report from each bureau every twelve months. The report is also updated daily with no usage requirements.

Credit Monitoring

In addition to the updated full credit report, they provide credit monitoring and notify you whenever there has been a major change to your report (e.g new account inquiry or late payment).

[Read: What’s The Best & Cheapest Way To Monitor Your Credit?]

Financial Recommendations

Update: WalletHub claims that unbiased recommendations only relate to personalized alerts that appear in a users account inbox and not in their basic comparison tools. I haven’t verified if that’s the case or not, so make sure you double check any personalized alerts and let me know in the comments below.

As mentioned in the introduction, one of the benefits that WalletHub tout is that they provide unbias recommendations. Here is what their Communications Manager had to say:

The Financial Fitness tool is unique because it provides data updates on a daily basis, even without daily user interaction. Credit Karma’s credit score estimator offers data that’s updated weekly, if the user logs in. Furthermore our product’s recommendations are based on user savings, not advertiser status. Credit Karma also only recommends products from its sponsors, and in order of their most lucrative partnerships. WalletHub, however, is completely agnostic with its offers. If an issuer we’re not partnered with offers a better deal than one who is an affiliate, we will offer you that better deal regardless.

I always like to test these claims, so headed over to their credit card selection tool. First thing I noticed is that selections are sorted by ‘featured’ (I assume this means the links pay) not a good start. I then selected the following:

- General consumer

- Excellent credit

- Rewards > cash back

- No annual fee

- All payment networks

- Banks only

- Sort by base earn

The top result was Capital One Quicksilver Cash, that earns 1.5% cash back on all purchases. Unfortunately that is a big fail, Citi Double Cash & Fidelity Visa both earn 2% cash back on all purchases. I did a few other searches and that card made a frequent appearance, surprise given it’s not a great card.

I didn’t bother checking what their search was like for other financial products, because I don’t have as much expertise in those fields to spot something obviously wrong.

Our Verdict

I’d never recommend using any of these free credit score/monitoring sites to help you select what financial products you should/shouldn’t sign up for, they are free for a reason and that’s to drive customers to their profitable sections. Wallet Hub does have an advantage over other sites like Credit Karma in that they update daily and don’t have any log in requirements, but I’d still prefer Credit Karma over them as they track two bureaus (Equifax & TransUnion).

Personally I’ll be giving this site a pass. Let me know what your thoughts are about WalletHub in the comments.

My actual FICO score is about 70+ points BELOW what Credit Karma reports, fwiw.

I don’t know If this is coincidence or not, but I signed up with Wallethub this morning and this afternoon I received an email from a collections agency. I’ve never received an email from a collections agency before so to me it appears that Wallethub may be profiting by sharing subscribers contact information. Or, it was just a coincidence that on the day I sign up I also happen to receive an email from a collection agency to the email address that I signed up with. I have about 6 email addresses that I use on a consistent basis. Hmmm…

Coincidence. Collection agencies don’t work that quickly, so they likely got your info from elsewhere.

i have credit.com, credit karma, my bank rate, Quizze, (which now updates every three months) and credit sesame these are all free sites, and show vantage 3.0 I also have capital one which now uses credit wise(also vantage 3.0) my only fico score i have is through my American express all my vantage scores are over 700., my fico from am ex is only 642. but because i have recently had a new mortgage finally being reported even though the loan was opened in Nov 2015, and i recently got some tires so i think the scores will rise soon but as far as the free sites they are good to keep track of your accounts and for alerts and for keeping track of your different scores

Is credit.com the only site that will show Experian inquiries for free?

I signed up for wallethub to do a comparison to credi karma which was due for its weekly update. the transunion scores had only a 1 point difference. I think credit karma also uses vantage 3.0.

Yes, they do. So this one seems to only be offering the extra benefit of daily updates instead of weekly ones with CK. Nothing interesting for me.

Be nice if one of these monitoring sites would get away from TU and partner with Experian. I apply for about 12 cards a year, so does wife, across all issuers. I would say 95% of the those hard pulls show up only on Experian, at least as of last year. When I use Credit Sesame or Credit Karma who use TU and minimally Equifax, they show only 1 hard pull and give me an A. It’s pretty funny.

Credit.com is not as good as Credit Karma (no full report and overall less info), but it does get it’s information from Experian, and the number of hard pulls is accurate. I’m in the same boat as you–double digit inquiries with Experian and only 1-2 with the others.

Nice. Thanks for the tip. Haven’t checked out credit.com

Is Credit.com free to use?

Yes.

For me, the most important benefits of these for profit sites are;

1. The number of hard pulls and institutions named in a 2 year period.

2. The listing of your debt with last statement balances reported plus the percentage of your Debt to CL ratio. Though these are not exactly accurate, they do show enough to recognize potential problems to address.

Thought I should point out that the report from Credit Karma is also a full report