Update 9/13/18: Temporary workaround for another few weeks, details here.

Update 09/10/18: Unfortunately all referral links and pre-approved offers are now showing the 48 month language instead of 24 months. Hat tip to pfdpfd

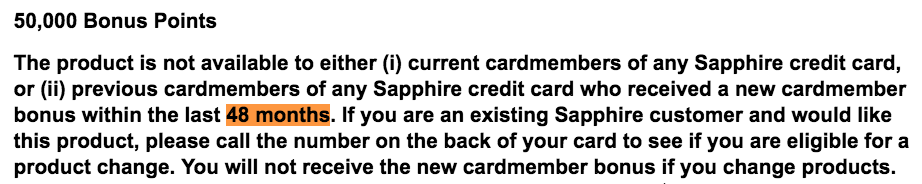

The Chase Sapphire Preferred and Sapphire Reserve cards have updated their signup bonus limitation from being once every 24 months to once every 48 months (hat tip to Uscreditcardguide).The Sapphire ‘family rule‘ limitation is in place as before whereby all Sapphire cards are counted as one to limit you further in getting more bonuses.

Other Chase cards like Freedom still show the 24 months language. It may only be a matter of time until that changes as well. The Sapphire changes were probably all part of streamlining and advancing the Sapphire brand with today’s Sapphire Banking launch.

Many of us can’t apply for most Chase cards due to 5/24. This added limitation just makes it less interesting to try getting yourself under 5/24, IMO.

Workaround

I noticed that Sapphire referrals are still showing the 24-month rule, not the updated 48 month terms. It’s probably not a mistake: they likely can’t switch those in mid-offer. They’ll probably be updated at some later date.

We’ll post a Sapphire Reserve and Preferred referral thread shortly.

Not sure who is still following this post, but I have a question about the Sapphire card.. I have read about “double dipping” on the $300 annual travel credit before canceling the card. I’m just curious, because I got the Sapphire card for the first time last year. So say for example, I got the card on June 15, 2019. Would the annual fee come around June 15, 2020? I read that Chase gives us 60 days to call to cancel the card to have the annual fee refunded? First of all, is that still true?

Also, would the timeline to maximize the travel credits in this example look like this (let me know if it’s wrong)?

June 15 2019 – got the card

did the $300 travel credit sometime in 2019

around June 15, 2020 (earlier?) the annual fee gets charged

after June 15, 2020 I can get the second $300 travel credit?

do I have until August 15, 2020 to cancel the card and still have the annual fee refunded without any penalty?

Thanks for any help with this question. Just trying to be prepared. Thank you

So, the 48-month rule is for sign-up bonuses. Will an application get denied if it’s within 48 months, or just not receive the bonus? My wife got a CSP last summer and cancelled this summer. I’d like to get her the CSR now, and know that she definitely won’t be eligible for the sign up bonus, but I’m curious if she could receive the card at all. For reference, I’m AD military, and subject to the MLA fee waiver on chase cards opened after last September. I also currently hold a CSR in my name.

So I was insta approved for a Sapphire preferred, in branch pre approval. Will you get denied if you are under 48 months, or just do not get the bonus?

checked my pre-approved offers from chase last night and still had the 24-month language for the CSP

When did chase change the term? I just got the csp early August ( last csp bonus was 3 yrs ago) and my first statement just closed 2 days ago and i notice i didn’t get the bonus. I was a bit puzzled and now read this term change I’m really worried. Does any one else in this situation or know the answer? Thanks!

If they approved you, you will get the bonus.. there have been delay in bonus posting recently.. Also if you meet the minimum spend requirements close to statement closure, you will get the points after next statement closure.. Check in UR page if you see the points pending..

I met my spending very early on ( i had them overnight the card to meet my home and auto insurance payment due date) and also checked in the UR page, there was no points pending. But i hope you are right about they are just running late. I will wait another cycle before calling them. Thanks for the response!

You were right about the delay. Now i see 56k showing as next statement earning (1k from recent chase pay offer at best buy). Huge relief!

I wonder if they are going to change the 24 month rule to 48 months for the ink cards. In Feb I will be under 5/24 and I was going to pick up the new ink card. If they switch to the 48 months for the ink cards then I see no reason to wait to get under 5/24. As it is I am considering giving up on chase and picking up other cards,

very unfortunate

As a datapoint, I had a email referral for CSR that is with 24 months language, (last bonus was 36 months ago). I applied just now got approved and verified that bonus is attached to the signup. Sadly I had referral for CSP but I just have the link (forgot to ask for email referral, link shows 48 months 🙁 )

I got the CSP in Feb 2014. In 2016 when the Reserve came out, due to reasons I was not approved, however was able to product change from CSP to CSR. Still have the CSR today, as well as the Freedom, Freedom Unlim, and United Explorer.

What do I need to do to obtain another Sapphire 50K bonus? I believe I am around 1/24 right now.

Cancel any CSP/CSR you have and apply for the CSP.

I have a referral link received last week with the 24 month language that says to apply by October 3. Likely it will be honored given the end date and 24 month language within the referral link?

If you click it, does it still show 24 month language. The landing page you end up on may have altered the language…

I did a product downgrade from CSR to the plain Sapphire a few months ago (and had not gotten the signup bonus due to 5/24 so I did a product change to get the CSR). I need to change that to the 1.5% Freedom card, I guess. Not that I plan to reapply for CSR anytime soon since I don’t have any current need for their features to make it worth paying $150/year (of course the bonus would make it worth it, but given the new 4 year rule I may as well wait until I actually need it).

This is terrible timing for me as I’m ready to re-apply for the chase sapphire preferred. Thankfully the refer-a-friend should still work for now (fingers crossed). Can anyone confirm that if I am an authorized user on someone else’s chase sapphire preferred account that I will not be approved for one in my name? I have never thought about this but saw a comment once that this could be the case.

Not sure what company/card this was about, but I remember seeing a comment somewhere on DoC earlier this year that you can usually successfully recon if you are denied based on cards that are on your report but you’re only an AU on. Seems like companies often don’t bother to distinguish between primary and AU cards until you ask them to.