As long as you have a Citi ThankYou earning credit card you should be eligible for this bonus. If you’re worried about not receiving the points, you can always call up and apply over the phone – making sure you confirm your eligible first (and getting a reference number).

We have posted about this bonus before, but there have been some changes so we thought a new post was necessary.

Offer at a glance

- Maximum bonus amount: 40,000 ThankYou points

- Availability: Nationwide, must have a credit card that earns Citi ThankYou points open

- Direct deposit required: No

- Hard/soft pull: Soft

- Credit card funding: Yes, $100,000 limit (be wary of cash advance fees, click that link to see what has/hasn’t been a cash advance and set your cash advance limits appropriately).

- Monthly fees: $10-$30, avoidable

- Early account termination fee: $0

- Expiration date: September 30th, 2015

The Offer

Direct link to offer (promotional code is 4YQY4RMDTT, this is not unique).

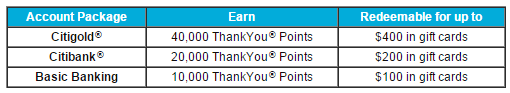

Regardless of which account you open, the requirements to trigger the bonus are all the same. All you need is one qualifying bill payment during a calendar month and during the following calendar month. The amount of points you’ll receive depends on the account you open:

- Open a Citigold account and receive 40,000 ThankYou points

- Open a Citibank account and receive 20,000 ThankYou points

- Open a Basic Banking account and receive 10,000 ThankYou points

The Fine Print

If you want to view the fine print yourself in full you can, just click “promotion disclosures” on the left hand side.

- Offers for new consumer checking customers only

- Qualifying bill payments are those using Citibank® Online, Citi Mobile® or CitiPhone Banking®. A bill that is paid by making a transfer between linked accounts and/or transfer payments made to accounts within Citibank or to accounts with Citibank affiliates does not qualify as a bill payment for this offer

- Points will be deposited into your ThankYou Member Account within 90 days from the end of the statement period in which you complete all of the requirements

- Offer is available to Citi card members who receive this communication and who have an existing ThankYou® Member Account associated with their Citi credit card. As mentioned previously has not been enforced in the past.

Avoiding Fees

Citigold Account Package $30 Monthly Fee

To avoid the $30 monthly fee you need to complete one of the following:

- $50,000 in combined link deposit or retirement accounts

- $100,000 in all linked deposit, retirement, credit or investment accounts (excluding a first mortgage with citibank)

- $250,000 including linked Citibank mortgages

- Hold a CitiBusiness® Preferred Banking account (minimum of $15,000 to keep fee free)

Citibank account Package $20 Monthly Fee

To avoid the $20 monthly fee you need to have a combined average balance of $15,000 or more

Basic Banking $10 Monthly Fee

Make a direct deposit (the following methods count as direct deposit, click to view) and 1 bill payment each month or keep an average balance of at least $1,500 in the previous calendar month to avoid the monthly fee.

Early Account Termination Fee $0

We couldn’t find any mention of any EATF in the product disclosures and haven’t heard of anybody being hit with a fee. Your account does need to be open for the miles to post though.

Our Verdict

Let’s break it down, you’ll need to keep this account open for at least 5 months to receive the bonus (two months to complete the qualifying bill pays and then another three months to receive the sign up bonus). Citi waives the first two months of fees, so you basically have two options for the top bonus:

- Pay $90 in fees

- Deposit $50,000 for three months

If we put that $50,000 into a 1% cash back account for three months, we’d earn ~$125. Considering Citi pays virtually no interest on these accounts we’d be better off paying the $90 in fees. You’re probably going to end up having to have the account open for a total of 6 months, so expect to pay about $120 in fees.

40,000 ThankYou points for $120 in fees, two bill pays and a ChexSystems inquiry is a pretty good bank bonus, especially considering you’re usually not paying taxes on this bonus unlike all other checking bonuses. Another advantage of having a Citi Gold account is that you can get the annual fee on the Citi Prestige reduced to $350 from $450 (even if you’ve already applied for the Prestige, they’ll process a refund as long as you link the accounts).

There is also a sign up bonus for up to 30,000 American Airline mines which might be preferable to some people (there was a rumor of a 50,000 AA mile offer starting April 30th, but that has not materialized). This bonus also requires debit card spend.

If you have somebody that you trust with a Citi Gold account and they are maintaining the $50,000 minimum balance you can get them added as a secondary signer to your account. By doing this, you will not need to meet the minimum balance requirement to keep it fee free. They will have access to your account, but you will not have access to theirs.

F.A.Q’s

Will I be charged taxes on these points?

Update: Some people that earned more than 60,000 in TYP were sent a 1099-MISC for 2014. Reader, Susan also had this to say:

I believe Citi sends out 1099-MISC based on the taxable value, which can’t be determined until you actually redeem the points. So for example, if you got 20K points for opening the account, and then you redeem it for $100 worth of cash, you’ve only received $100 worth of miscellaneous income, and you won’t get a 1099-MISC. But if you redeemed those same 20K points for a $200 airline ticket, then you’ve received $200 miscellaneous income (still less than $600, so you won’t get a 1099-MISC)

Now, let’s say you save up your points and you redeem for an airplane ticket that’s worth $700, including taxes and fees. All your points that you used were earned from the checking account. You’ll get a 1099-MISC because the total amount redeemed during the year is more than $600.

So the key to making sure you don’t get a 1099-MISC, is to only redeem $599.99 worth of points a year.

This also means that if you have the Citi Prestige, combined these points into your Citi Prestige and redeemed each point for 1.6¢ a point in AA/US Airways airfare you could run into trouble as you’d receive $640 in value from the 40,000 points you received from this checking bonus.

The fine print states that you’ll receive a 1099-MISC if the value is over $600 in value. In the past Citi has sent these forms out for these points checking bonuses, but the last two or so years they have not sent out these 1099 forms. Speak to a tax professional to work out if you’re still required to pay taxes on these points.

Can I transfer these points to travel partners?

Update/TL:DR: It seems like it’s not possible.

This is a point of contention, some people say you can and some say you can’t. If you look at the Citi TYP terms and conditions:

“Taxable Points” are Points received for a Citibank checking relationship, Points obtained through activity unrelated to purchases made with your eligible Card Account, as well as bonus Points that may be awarded with no spend requirement. Taxable Points and Points made unavailable for redemption due to signs of fraud, abuse or suspicious activity on your ThankYou Account or due to your failure to make the required minimum payment on the Card Account by the payment due date are not eligible for Points Transfer. (HT to Anthony)

This seems pretty clear that points cannot be transferred. Yet Kenny from Miles4More has this experience:

All of my points are combined, but when I transfer to another member it tells me I cannot transfer the last ~10K points. This matches the amount that was in my former Citigold checking account. No such restriction shows up if I go to transfer to AF or others, but I haven’t yet emptied my TYP account.

Seems I misunderstood Kenny from Miles4More and he hasn’t been able to transfer these points to travel partners:

When I go into my TYP account now, I cannot transfer points I had earned from checking. I have heard reports that state you can transfer those, but that’s not what I see online. Screenshot:

Reddit user Flymearoundthworld has this experience:

[When I try to transfer] It just shows that XXX amount is available for transfer, which is less than the total I have.

I’ve asked Citi for clarification regarding this matter and I’m yet to receive an answer that I feel confident in posting. My gut feeling is that these points don’t transfer to airline partners even when you’ve combined the points.

Can I use these points to pay for airfare?

Yes you can and if you have the Citi Prestige you’ll get 1.6¢ in value per point for American Airlines/US Airways flights. If you redeemed all 40,000 points for this you’d receive $640 in value which would put you over the $600 limit causing Citi to issue a 1099-MISC. This screenshot again supplied by Kenny from Miles4more shows he is able to use points earned from this bonus for that purpose.

Can I cancel my Citi Gold account after receiving the points?

Yes, there doesn’t look to be any early account termination fee in any of the fee schedules I’ve looked at. Make sure you combine the points into a Citi TYP account that is staying open before closing, unless you wanna lose your points.

What is an eligible bill pay?

Read the fine print section above to read Citi’s definition. It’s basically any bill pay to a company that is not Citi, e.g paying your Citi credit card will not work but paying Chase would.