Extended to 3/31/26

Extended to 12/31/2025

Extended to 9/30/2025

Extended to 6/30/2025

Update 1/3/25: Extended through 3/31/25

The Offer

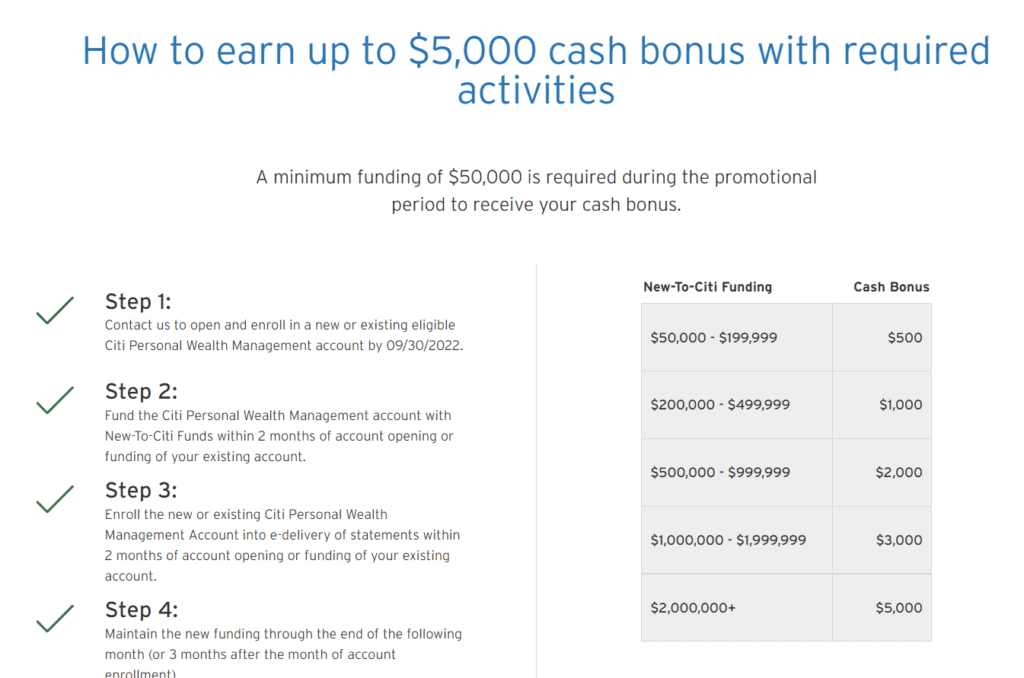

- Citi is offering a bonus of up to $3,500 when you open and enroll in a new Citi Personal Wealth Management account. The bonus you receive depends on the amount of funds you fund the account with within two months of account opening, the funds must remain there for three months after account opening and you must enroll in eDelivery of statements. The bonus tiers are as follows:

- Fund $50,000 – $199,999 and get a $500 bonus

- Fund $200,000 – $499,999 and get a $1,000 bonus

- Fund $500,000 – $999,999 and get a

$1,500$2,000 bonus - Fund $1,000,000 – $1,999,999 and get a

$2,500$3,000 bonus - Fund 2,000,000+ and get a

$3,500$5,000 bonus

The Fine Print

- To qualify to earn a cash bonus reward, accounts must be funded in cash or securities and the account enrolled in e-delivery of statements within 2 months of account opening and the balance of the account must be maintained through the end of the month shown in the chart below. For example, an account opened in October must fund their account and enroll in e-delivery of statements between 10/1/20 and 12/31/20, then must maintain funds until 1/31/21.

- Offer valid for clients who are 18 years or older who fund a new individual or joint Citi Personal Wealth Management account between October 1, 2020 and December 31, 2020. Account and asset eligibility requirements are explained below. Citi Personal Wealth Management reserves the right to change or cancel this offer at any time.

- Cash or securities must come from an external, non-Citi, source through a standard transfer method (e.g., a standard Transfer of Assets form, check, electronic funds transfer, ADM deposit). “New-to-Citi Funds” are 1) funds deposited from external accounts or payees other than Citibank, N.A. and 2) must be deposited using domestic ACH transfer, Direct Deposit, checks drawn on banks other than Citibank, N.A., wire transfer, trustee to trustee transfer, or ACAT securities transfers.. Cash deposits, Citi Global Transfers, international ACH transfers, and person-to-person transfer services such as Apple Pay, PayPal®, Venmo, and Zelle®, do not qualify as New-to-Citi Funds. New-To-Citi funds may be deposited into a Citibank retail account and transferred to the new CPWM account during the account funding period outlined in the chart below. However, transfers of existing funds from a Citibank retail account are not considered New-To-Citi funds for the purpose of this promotion.

- To qualify to earn a cash bonus reward, accounts must be funded in cash or securities and the account enrolled in e-delivery of statements within 2 months of account opening and the balance of the account must be maintained through the end of the month shown in the chart below. For example, an account opened in July must fund their account and enroll in e-delivery of statements between 7/1/20 and 9/30/20, then must maintain funds until 10/31/20.

- The total funding for purposes of determining the bonus level funding considered for the promotion is defined as the total amount of eligible cash or securities received in the account minus withdrawals and transfers of securities out of the account as of the deadline to fund the account based on the month of account opening. Distributions, interest, and dividends from investments will not be counted. Market fluctuation will not impact eligibility for a particular bonus level.

- The amount of the cash bonus reward is based on the funding received during the promotional period. The cash bonus will be credited to the Citi Personal Wealth Management account for customers who were enrolled in the promotion and have met the qualifying requirements stated in the offer based on the date the account was opened.

- Limit one bonus per customer. If multiple accounts are opened or funded by a customer, the offer will apply to the eligible account with the highest balance. Multiple account balances in the name of the same beneficial owner will not be aggregated for purposes of this offer, except if one account is a non-managed brokerage account and the other account is a managed account, in which case the eligible funding from these two accounts may be aggregated for bonus qualification purposes. Any additional accounts opened during the promotional period will not be eligible for bonus eligibility. Citi Wealth Builder accounts are excluded from eligibility for this bonus. This offer cannot be combined with any other offer. All requirements of the offer, including the dates in the above chart, pertain to both the eligible managed account and brokerage account.

- For purposes of this offer only, the primary owner of a joint account will be considered the customer. All accounts are subject to approval and applicable terms and fees. Account must be open and in good standing at the time the bonus is credited to receive the bonus.

- The promotion is only available for certain account types, including individual and joint accounts. Accounts not eligible for this promotion include but are not limited to corporate and other business/entity accounts, trust accounts (except Living Revocable Trusts and Family Revocable Trusts which are eligible), retirement plan accounts other than IRAs and SEPs (e.g., 401(k), money purchase pension plan, profit sharing plan, and other ERISA plan account), estate accounts, UGMA/UTMA accounts, 529 college savings plan accounts, robo-advisory accounts under the Citi Wealth Builder Program, and insurance products (including annuities). For questions about eligibility, please speak to a Citi Personal Wealth Management representative.

Our Verdict

This looks to be a good brokerage bonus as the cash/securities only need to be in the account for roughly a month (e.g fund at the end of the second month and keep the funds in there for a month after that). Knowing Citi there might be a gotcha that I’m missing here.

According to the comments this works for self directed accounts, but the set up process is extremely slow due to it all being manual.

Hat tip to reader EW

Post history:

- extended through 12/31/24

- Extended to 9/30/2024

- Update 4/2/24: Extended to 6/31

- Update 1/16/24: Extended to 3/31

- Update 10/2/23: Extended to 12/31/2023

- Update 7/5/23: extended to 9/30/23

- Update 5/17/23: extended 6/30

- Update 11/1/22: Deal is back and valid until 12/31/22.

- Update 7/5/22: Extended until 09/30/2022. Deal is better on the higher tiers. Hat tip to Mawney

- Update 4/6/22: Extended until 06/30/2022

- Update 1/2/22: Extended until 03/31/2022.

- Update 1/4/2021: Deal is back and valid until 6/30/21. Hat tip to reader savingwizard

- Update 10/11/20: Deal is back until 12/31/20.