Citibank offers large sign up bonuses on their checking accounts, at the moment there are three bonuses on the Citigold accounts ($400 in cash, 40k ThankYou points or 30k American Airline miles). Something most people don’t know is that they also offer on going ThankYou point (TYP) bonuses on these accounts as well.

I’ve posted about this before but the amount of points that you earn was dramatically cut back in December of 2014. I thought it was worth having a look at the new program to see if there is still value to be had or not.

Contents

Banking With Rewards

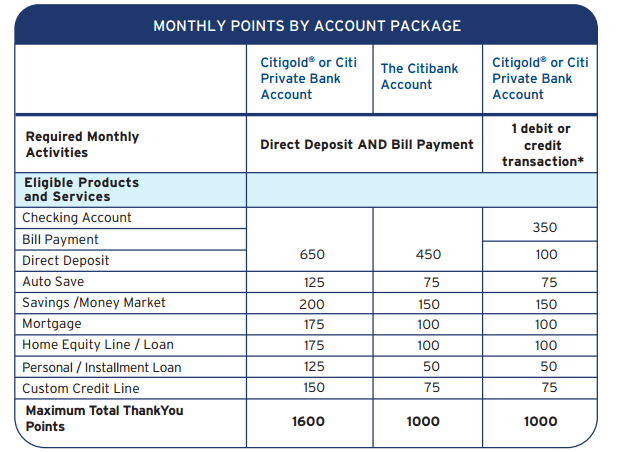

Banking With Rewards is the official name given to this program. Basically there are two different tiers you can qualify under:

- Citigold/Citi Private Bank Account. This is the highest tier and receives the most ThankYou points.

- Citibank Account. This is the lowest tier and receives the least ThankYou points.

Obviously the Citigold/Private bank account is much harder to keep fee free than the regular Citibank account. The number of TYP’s you earn not only depends in what tier you’re in, but also what requirements you meet.

These requirements must be met on a statement period basis, not on a calendar month. It’s easy to request what your statement is by calling Citibank directly. I thought it would be a good idea to have a look at each of these products and which ones do and don’t make sense doing.

Bill Payment

The great thing about paying bills is most companies don’t mind if you split payment, as long as they receive the total eventually. This means you can simply pay a small amount with your Citibank account to trigger the bonus and then use something like Evolve Money for the rest of the bill. It also means if you’re doing other bank bonuses that require bill payments you won’t run out of bills to pay. The fine print on this offer says:

A bill that is paid by making a transfer between linked accounts and/or transfer payments made to accounts within Citibank or to accounts with Citibank affiliates does not qualify as a bill payment

Verdict: Easy & free to meet this requirement, worth doing.

Direct Deposit

When banks are talking about direct deposit, they are usually talking about the deposit of your paycheck or government benefit. In the fine print it even says:

Qualifying direct deposits are Automated Clearing House (ACH) credits, which may include payroll, pension or government payments (such as Social Security) by your employer or an outside agency

Thankfully there is a work around, generally an ACH transfer will trigger this requirement. You can see a list of data points on what Citibank has considered a direct deposit in the past here.

Verdict: Worth doing, you should be able to set up a small recurring payment from an existing checking account to trigger this part of the bonus.

Auto Save

An auto save is basically a recurring transfer from your Citi checking account to your Citi savings account. It’s fairly easy to set this up, just follow these instructions:

- Open a savings account with CitiBank (fee free), this should automatically link with your checking account. If it doesn’t, call Citibank and they will link it for you

- Click “Payments & Transfers”

- Click “Transfer between linked accounts”

- Click “Set up a recurring transfer”

- Set up a transfer from your checking account to your savings account

There doesn’t look to be a minimum requirement, so you could potentially just set up an automatic transfer of $1 a month. The one downside is that you’ll need to have $500 in your account to keep it fee free which means you’d be missing out on around $5 annually in interest (when compared to a 1% account).

Verdict: Worth doing, this is a set and forget type of thing. Just transfer a very small amount over as the rates that Citi offer are quite low compared to the competition.

Savings / Money Market

Presumably if you already have the savings account open for Auto Save then you’d automatically receive this bonus as well. The same fees apply.

Verdict: Worth doing, especially when combined with the Auto Save bonus.

Mortgage

You can view Citibank’s rates here. These are constantly in flux, whenever I have rate shopped Citi has not been offering the best rates though.

Verdict: Not worth doing unless Citi is offering the best rate on mortgages, which they rarely if ever do.

Home Equity Line / Loan

You can view the rates for home equity lines here. This is the same as Mortgage’s, make sure you rate shop first.

Verdict: Not worth doing unless Citi is offering the best rate.

Personal / Installment Loans / Custom Credit Line

These rates can be viewed here. These rates seem exceptionally high.

Verdict: Not worth doing unless Citi offers the best rate

Enrolling

To enroll in this program, you need to use this link. Which was found on this page. You might also be able to contact Citi by phone to get enrolled in this program, remember that it’s called Banking With Rewards.

Final thoughts

None of the credit products (e.g mortgage, home equity line or any of the personal loans) are worth doing for the minuscule amount of points they offer. This leaves us with the bill payment, direct deposit, auto save and savings / money market bonuses. Assuming you did all of these, this is how many points you’d earn per month / year.

- Citigold / Citi Private Bank: 975 / 11,700

- Citibank Account: 675 / 8,100

That’s quite a small amount of points when you consider everything you actually need to do each month and that’s before even thinking about the requirements to keep these accounts fee free. If we assume Citi TYP’s are worth 1¢:

For example: The Citigold has a $50,000 requirement to keep it free free. You would earn $500 per year if you held this money in a high interest checking account earning 1%. At most you’d be getting $117 in ThankYou points and $50 in interest (this account currently has an interest rate of 0.1%). This means you’d be making a net loss of $333 per year.

Another example: The Citibank account has a $15,000 requirement to keep it fee free. You would earn $150 in interest if this was kept in a high interest checking account earning 1%. At most you’d be getting 8,100 points ($81) without credit products and then an additional $1.5 in interest (0.01%) which means you’d actually be loosing $54 per year.

I didn’t think this was a great product before Citibank gutted it, now I think it’s even worse. The only thing I can think of to make it work is if you are able to earn these additional points whilst doing the big sign up bonuses. My guess is that enrolling in this offer would make you forfeit any sign up bonus attached to your account. Update: it is possible to get this while doing sign up bonuses.