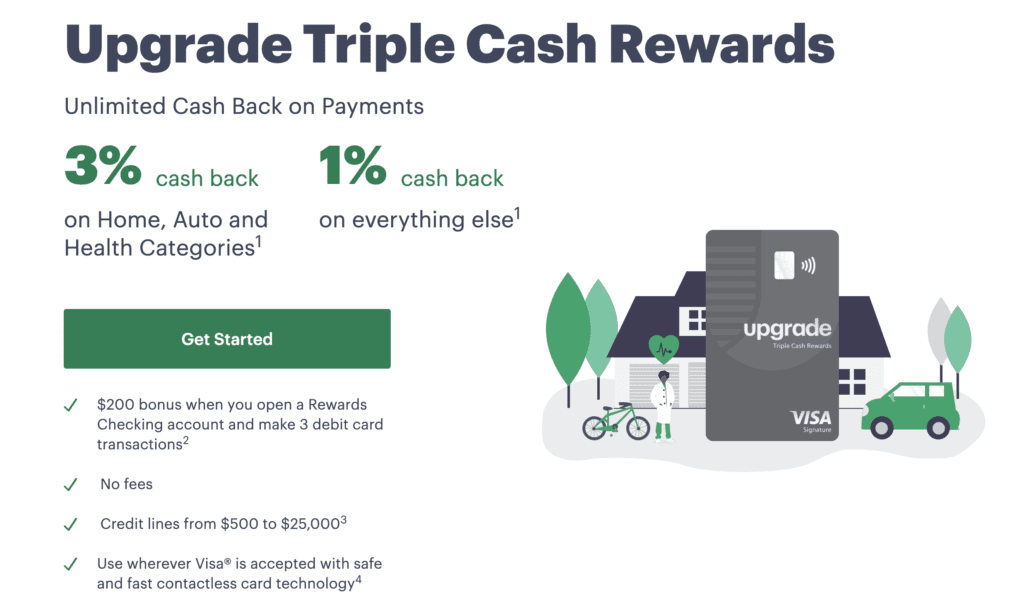

Upgrade Triple Cash Rewards

- The Upgrade Triple Cash Rewards card/line-of-credit has no annual fee and offers 3% cashback on the Home, Auto, and Health categories and 1% cashback on all other purchases.

You can see the full list of eligible categories for 3% cashback at this link. It specifically mentions Home Depot, Lowe’s, Menards, Wayfair, IKEA; Walgreens, CVS; and many other categories such as contractors, car leasing, doctors, hospitals and more. The card is issued by Sutton Bank.

Signup Bonus

- Get a $200 bonus for opening the Upgrade Rewards checking account and making 3 debit purchases.

We’ve posted about a similar deal to open the Upgrade rewards checking account and getting a $400 bonus with 3 debit purchases, via the Credit Karma link. Hopefully you can do the Karma deal and then open the Triple Cash Rewards card and link it to the checking account.

Our Verdict

This card is pretty interesting as it gives a 3% cashback rate on categories which typically go unbonused. There are many people who spend a lot on their homes (renovations, etc), cars (truckers, hobbyists, etc), and some people have high healthcare costs. The 3% on drugstores can be had with the Freedom Flex card, but to get 3% on all doctor and hospital payments, Home Depot, contractors, and auto shops could be useful for those who spend a lot in these categories. Or even to buy or lease car with the card, if the dealer allows cards, and earn 3% back.

The card is confusing: I’m unsure if you need the checking account first and the ‘card’ is just a line of credit on the checking account (more a debit card than a credit card) or if it’s a standalone credit card. Nerdwallet describes it as “a credit card/personal loan hybrid product that earns cash-back rewards.” If it’s more like a LOC then it might not count against your 5/24.

Regardless, best scenario here would probably be to open the Upgrade rewards checking account with the $400 bonus and then attach the card/LOC to that account. Hopefully that works, let us know if you try.

IMPORTANT UPDATE: Readers have verified that interest begins accruing immediately from the time of purchase. Thus, using this card/LOC only makes sense if you pay off the bills immediately, likely more of a hassle than it’s worth.

Hat tip to reader El_Acey via Nerdwallet