This is the first post in our series that compares different credit scores. In today’s issue we are going to compare FICO scores & PLUS scores. We’re going to look at the scoring factors that causes them to be different, their ranges, who uses the score and where to get the scores from.

Comparison Table

| FICO Score | PLUS Score | |

|---|---|---|

| Minimum Score | 300 | 330 |

| Maximum Score | 850 | 830 |

| Median Score | 723 | 724 |

| Available to Individuals | Yes | Yes |

| Acessible for Free | Yes | Yes |

| Used by Lenders | Yes | No |

| Scoring Criteria | ||

| Payment History | 35.00% | Not public |

| Credit Utilization | 30.00% | Not public |

| Length of Credit History | 15.00% | Not public |

| Types of Credit used | 10.00% | Not public |

| Recent Searches for New Credit | 10.00% | Not public |

Unfortunately the PLUS scoring team doesn’t make their scoring criteria public, but have stated numerous times that it’s “remarkably similar to the FICO score” so we can only assume they use similar scoring metrics.

Both scores are available for free, when you sign up for a credit monitoring program and cancel before the trial period ends. We suggest using myFICO’s “Score Watch” for your free FICO score and freecreditscore.com if you want a PLUS score.

The biggest difference between the two is that the FICO score is used by lenders and the PLUS score isn’t. We’ve said this numerous times but it’s worth repeating, FICO is used in 90% of lending decisions.

If you just want a broad idea of how your credit is (e.g poor, good, excellent etc) then the PLUS score should be able to do the job. If you’re applying for credit and want to see a score similar to that of what a lender will see (there are 49 different FICO scores after all) then we suggest looking at your FICO.

How Do The Scores Compare?

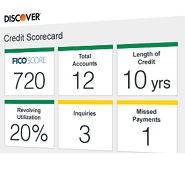

I decided to compare my scores between the companies so you’d have a real example of how they differ. Because the PLUS score is based on Experian data, I decided to find out what my Experian FICO score was. The only Experian FICO score currently available to consumers is the 2004 classic score, also called EX-04 FICO or Experian, FICO Risk Model V3. This is available from myFICO.com and I picked up my copy for $15.95 by using a promo code “E1311BDY20FST” (click here for up to date promo codes). If I didn’t care about the credit bureau then I could’ve used the Score Watch product and got it for free.

I then headed over to https://www.freecreditscore.com to get my PLUS score. Below are the results:

| FICO | PLUS | |

|---|---|---|

| My Score | 821 | 799 |

As you can see, there is a score difference of 22 points. A lot of forum posters have higher PLUS scores than FICO, one of the reasons mine might be the inverse is because of how high my score is and that the PLUS’ top score is 830 whilst FICO is 850.

If you know both your PLUS score & your FICO, let us know what they are in the comments.

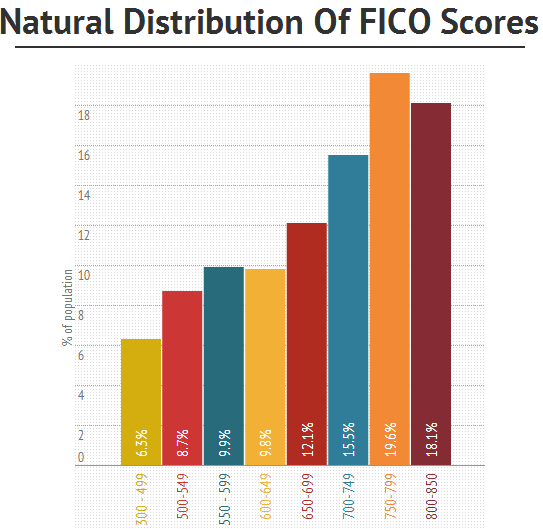

Graphs of natural distributions of both of the scores below for the graph lovers out there.