[See updates on Amazon Local in our follow-up post: Amazon Local Register (update).]

There’s a lot of talk recently about a new payment-processing service which Amazon is rolling out, and its possible use for manufacturing spend.

Contents

Amazon Local Register

Amazon is offering to be the local cash-register of your business. Until now Amazon has only competed with Paypal and others for online payment processing, known as Amazon Payments. Many of us utilize Amazon Payments as a means to manufacture spend , but the main idea of the service is to process website payments, exactly like Paypal. Now Amazon wants to be part of the physical, local swiping.

Currently, Amazon Local does not integrate into your regular Amazon account. When you try to use your personal Amazon account info to sign up with Amazon Local, the system prompts you to use a different email address.

The entire Amazon Local seems to be app-based; even manual-keyed payments can only be done via the app. And the swipes can only be done via the Amazon Local Secure Card Reader which plugs into a tablet or smartphone; there doesn’t seem to be any non-mobile-based swiper available. The Card Reader sells on Amazon.com for $10, but Amazon promises to reimburse you the first $10 of processing fees, making the Card Reader essentially free.

The Battle of the Swipe

Square is the biggest mobile-payment processor, and more recently Paypal rolled out Paypal Here. Amazon’s entry into the foray increases the ever-expanding competition betweent the two giants.

Google is also competing for online payment-processing with their Google Wallet, but thus far they haven’t entered the regular swiping competition. Apple and Facebook are also reportedly very interested in being part of the mobile-payment battle. We’re seeing more-and-more expansions in the few major corporations who dominate commerce in the USA.

1.75% Fee

Amazon is offering an introductory fee of 1.75% processing fee for credit card swipes until the end of 2015. Beginning January 2016, the regular swipe-fee of 2.5% will be in effect. This rate is only available for those who sign up by the end of October 2014. The above rates are only for swiped payments; manually-keyed payments are 2.75%.

Amazon has a comparison chart showing how they compare with Paypal and Square.

The rate does seem very good and may even be a money-loser for Amazon, but their idea is to sign everyone up on their system and have them keep using it after the introductory rate expires. That being said, even the regular rates seem to be clear savings over Paypal and Square, especially for the manually-keyed option.

Manufacture-Spend Opportunity?

The talk in the miles-and-points community is about the possible application of Amazon Local as a means of manufacturing spend. The most basic idea would be to find a credit card which gives more value than 1.75% and just keep swiping away and profit the spread. For example, if someone has the Barclay Arrival card which earns 2.2% back on all purchases, he could swipe thousands of dollars with Amazon Local and he’ll earn around .45% with each swipe, or $4.50 per $1000 swipe.

That small profit may not sound too lucrative, but think about the possibility of using Amazon Local as a means of meeting spending thresholds for new credit card sign-ups.

Another possibility mentioned, which sounds enticing to me, is to purchase Amex gift cards through a shopping portal for additional cash-back. Add the portal cash-back to your credit card cash-back/points, and it can be quite profitable to buy up lots of Amex gift cards and unload them via Amazon Local. The portal idea is an old one, but until now we had to go out and figure out how to unload the Amex GC’s; with Amazon Local we wouldn’t have to leave the living room.

The big question is how tolerant Amazon will be; will they aggressively shut down people who use the system “abusively”? Thus far, we haven’t found anything explicit in the Terms & Conditions prohibiting such practice, but it’s probably against the credit card rules (even if it’s not against Amazon rules), and it’s understood that they have the right to suspend an account for such behavior.

There are already data-points of FlyerTalk members who successfully unloaded Amex GC’s via Amazon Local, but this is just a few swipes-worth; we still don’t know how they’ll react to high-dollar amounts.

With regard to the $1000 monthly Amazon Payments that so many people do, Amazon seems to have a pretty good tolerance rate, so hopefully this will be similar. On the other hand, Amazon Payments has a built-in limit of $1k per month, but the unlimited nature of Amazon Local may push them to be stricter.

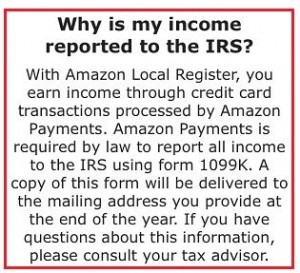

The Fear of Uncle Sam- 1099K

[See updates on this in our follow-up post: Amazon Local Restister (update).]

One highly-discussed issue is the the tax repercussions of using Amazon Local for manufacture-spend purposes. Since Amazon Local is meant for a business swiping their customers credit cards, the IRS will assume that a percentage of the “revenue” which you swiped is profit.

When you sign up for a Local Register account, Amazon states that they will file a 1099k for you. Many have pointed to the fact that Amazon writes clearly that they’ll only file a 1099k for those who (1) exceed 200 transactions, and (2) exceed $20,000 in gross payment volume. Accordingly, we’d be able to make use of Amazon Local – without tipping off the IRS – by keeping our totals under 200 transactions or under $20,000.

The above 1099k-statement from Amazon is made on their Amazon Payments page. (This is the same info that Amazon tells their sellers: if they sell more than 200 transactions and $20,000 then Amazon will file a 1099k.) For reasons which are unclear to me, Amazon seems to have separated their Amazon Payments department and their Amazon Local department; they’re separate sub-domains of the Amazon website. I find this very odd, but I guess they want to separate their online payment processing and their local payment processing. There’s a separate sign-up for each of the services. When you sign up for an Amazon Local account, Amazon doesn’t seem to say any such a limitation in their reporting; they seemingly indicate that everyone will get a 1099k.

As such, I’m not 100% convinced that both departments have the same rules. On the other hand, they do seem to be saying that Local Register is part of Amazon Payments, in which case it would make sense that it has the same rules of 200/$20,000.

The bottom line is that I really don’t know whether or not Amazon will file a 1099k for all Amazon Local “merchants”. As far as actual tax-liability goes, there’s obviously no issue here since there was no profit in the entire swipe amount. (There may be a tax-liability for the credit card points and the portal cash-back, but let’s leave that discussion for a different time.) The issue is that if Amazon files a 1099k for you, you’ll have to start explaining to your accountant, and possibly to Uncle Sam, how you swiped thousands of dollars of Amex GC’s, and how none of it was actual profit. Some people may not enjoy having that conversation.

Our Verdict

I signed up for a Local Register account, but I’m still undecided whether to use it or not. As such, I have not yet purchased the Card Reader. Since I already signed up for the account, I believe I’m locked in with the 1.75% rate, should I decide to go ahead with it. In any event, we have until Oct. 31 to lock in the rate.

If I was convinced that I would not get a 1099k by keeping under 200 transactions, I’d probably buy the Card Reader and use it moderately. I can’t imagine that swiping a couple thousand dollars a month in Amex GC’s will set off any red flags. As someone who buys on Amazon, sells on Amazon, and uses Amazon Payments, I value my relationship with Amazon and I’ll err-on-the-side-of-caution and keep away from anything which might get me shut down. Hopefully, within the next month or two we’ll get a clearer picture of how tolerant Amazon intends to be with this, and we’ll be able to decide better how to proceed.

What about you? Will you be signing up for Local Register?