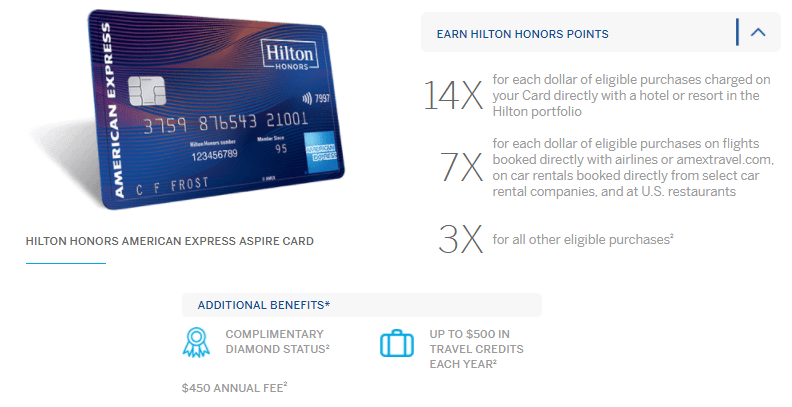

As mentioned earlier American Express is launching a new premium co-branded card with Hilton officially called ‘Hilton Honors American Express Aspire Card’. In this post we will take a look at the card in more detail including some of the card benefits such as a $250 resort credit. This card will officially launch on January 18th, 2018.

Contents

Quick Overview

- Annual fee of $450

- Sign up bonus of 100,000 points after $4,000 in spend within the first four months

- Card earns at the following rates:

- 14X Hilton Honors Bonus Points at hotels and resorts in the Hilton portfolio worldwide

- 7X Hilton Honors Bonus Points on flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and at U.S. restaurants

- 3X Hilton Honors Bonus Points on other purchases

- Complimentary Hilton Honors Diamond status for as long as you hold the card

- One weekend night at any hotel or resort in the Hilton portfolio (on account opening and on every account anniversary)

- A second weekend night at any hotel or resort in the Hilton portfolio after spending $60,000 on the card within a calendar year

- Priority Pass membership (unlimited access for you and up to two guests)

- $250 airline incidental fee statement credit (to work the same as the credits provided on Platinum & Gold cards)

- $250 Hilton resort statement credit

- $100 on property credit at Waldorf Astoria Hotels & Resorts and Conrad Hotels & Resorts when booking the exclusive Aspire Card package

- Authorized users can be added for no additional charge but don’t receive any of the benefits the primary cardholder does (they can use the $250 credits, but it’s a total of $250 in credits across all cards. They can also get access to the Waldorf Astoria/Conrad $100 benefit).

Card Benefits

As with any card with an annual fee of $450, you’d expect significant benefits to justify that fee. Let’s take a look at each of the benefits in more detail.

$250 Hilton Resort Credit

Every card member year you can receive up to $250 in statement credits for eligible purchases made directly at participating Hilton Resorts. Purchases made by both the primary cardholder and authorized users count towards this $250 total. Eligible purchases must be made directly with participating Hilton Resorts and charged to your Aspire card. Incidental charges (including charges made at restaurants, spas, and other establishments within the hotel property) must be charged to your room and paid for with your Hilton Honors American Express Aspire Card at checkout in order for them to be recognized as Hilton Resort purchases. This can be used on the room rate.

Only resorts listed at hilton.com/resorts are eligible.

Complimentary Hilton Honors Diamond Status

Diamond status is currently Hilton’s highest loyalty tier (although we’ve speculated this might not be the case for long). The primary cardholder will receive diamond status for as long as the card is open, if the card is closed for any reason you will lose your Diamond status. Diamond status normally requires 30 stays, 60 nights or 120,000 Hilton base points in a calendar year. This diamond status also counts towards lifetime Diamond status. It provides the following benefits:

- 50% Elite Status Bonus

- 48-hour Room Guarantee

- 5th Night Free (also available for Silver & Gold members)

- Guaranteed Discount: A discounted, changeable & refundable rate is exclusively available for Hilton HHonors members.

- Digital Check-In: choose your room, and customize your stay from your mobile device up to 24 hours in advance.

- Complimentary in-room and lobby Premium Internet access, during stays at Waldorf Astoria™ Hotels & Resorts, Conrad® Hotels & Resorts, Curio – A Collection by Hilton, Hilton Hotels & Resorts, DoubleTree by Hilton™, Canopy™ by Hilton, Embassy Suites Hotels™, Hilton Garden Inn®, Hampton Inn & Suites®, Homewood Suites by Hilton®, Home2 Suites by Hilton®, and Hilton Grand Vacations™. Premium speed Internet may not be available at all hotels.

- Quick reservations and check-ins based on your room preferences

- Late check-out2

- Express check-out

- 2nd Guest stays free3

- Complimentary access to fitness centers and health clubs4

- Two complimentary bottles of water per stay (at Waldorf Astoria™ Hotels & Resorts, Conrad® Hotels & Resorts, Curio – A Collection by Hilton, Hilton Hotels & Resorts, DoubleTree by Hilton™, Embassy Suites Hotels™, Hilton Garden Inn™ and Hilton Grand Vacations™ hotels)

- Full list of other benefits here

$250 Airline Fee Credit

Every calendar year you can receive up to $250 in statement credits toward incidental air travel fees. You must select one qualifying airline at www.americanexpress.com/airlinechoice and this can be changed once each year in January after it’s originally selected. This is the same benefit that is provided on the American Express Platinum cards.

Free Weekend Night(s)

This card gives you one free weekend night at any hotel or resort in the Hilton portfolio with your new card and each year of card membership. You can also receive a second free night certificate if you spend $60,000 or more on the card in a calendar year.

Weekend nights are issued as a redeemable code and sent to the e-mail address attached to your Hilton Honors account within 8-12 weeks of meeting the spend requirement and expire one year from issuance.. You must call Hilton Honors (1-800-446-6677) to redeem these weekend night rewards. Each weekend night certificate can be redeemed for one weekend night standard accommodation double occupancy subject to availability. It’s valid at all properties in the Hilton portfolio excluding those listed at HiltonHonors.com/weekendreward (currently errors out).

A weekend night is defined as Friday, Saturday or Sunday night. It includes all applicable taxes, but you must still pay mandatory resort fees if applicable. You can combine these free night certificates with other Hilton or Free night promotions. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of other cash equivalents.

Priority Pass Lounge Membership

This card gives you unlimited complimentary access to lounges in the Priority Pass network. The card also gives up to two guests complimentary access, additional guests can be brought into the lounge at a cost of $27 per guest.

$100 Property Credit At Waldorf Astoria Hotels & Resorts and Conrad Hotels & Resorts

When you book the ‘exclusive Aspire Card package’ at Waldorf Astoria Hotel & Resorts or Conrad Hotels & Resorts you will receive a $100 property credit. There will be a gated online booking portal that will be ready in January that card members will use to book the package. The $100 credit can be used for property expenses like golf, F&B, spa, etc. The stay requires a min 2 night stay. The credit will be taken off the guest’s folio at checkout. The credit is not used toward room rate.

Our Verdict

When evaluating a card I like to look at two different things:

- Immediate value

- Long term value

It’s hard to determine the immediate value currently because we don’t know if there will be a sign up bonus offered (or what that bonus would be) outside the free weekend night certificate. In terms of long term value the idea is to determine if keeping the card passed the first year makes sense and to do that we just look at the annual fee vs the benefits provided. I like to break down each individual benefit and give it a value (I generally ask myself how much I’d pay for that benefit in cash), obviously this is going to vary A LOT from person to person so make sure you’re doing your own calculations.

- $250 resort credit. I think this is something I need to investigate further to get a value on.

- $250 airline incidental credit. I personally don’t think these are worth anymore than 80% of their value, maybe even less. So I’d value this at $200.

- Annual free night certificate. $100-$150. I know I can get a lot more “value” out of the free night than this but I really don’t enjoy luxury hotel properties in most cases – especially when I’ve only got a single night to use them. If I had a partner that also had the card I might value this higher.

- Priority pass membership. $0, I already hold this with other cards and getting this won’t change my decision to keep those cards open.

- Complimentary Diamond status. Honestly not much, Maybe $5. I don’t really have paid stays at Hilton properties and don’t value status much in general.

- $100 property credit at Waldorf Astoria. $0. I can’t see myself ever using this.

- Earning rates. $0, I barely if ever book paid stays at Hilton and 7x on travel isn’t attractive at all. This also makes the $60,000 spend threshold for the second free night worthless to me.

Without taking into account the resort credit I’d be looking at $305-$355 in value for a $450 annual fee. As I previously stated everybody is going to value these benefits differently! Feel free to argue why my subjective opinion is wrong in the comments below. In all seriousness I think a lot of people fall into a trap of overvaluing benefits and they end up paying a lot of money every year in annual fees without getting any massive benefit from it. I try to provide a counterpoint to that to invite a more robust discussion on benefits.

When this card launches I’ll almost certainly be signing up, but long term will be a different story. I’d love to hear how readers are valuing each of the benefits (and why) in the comments.