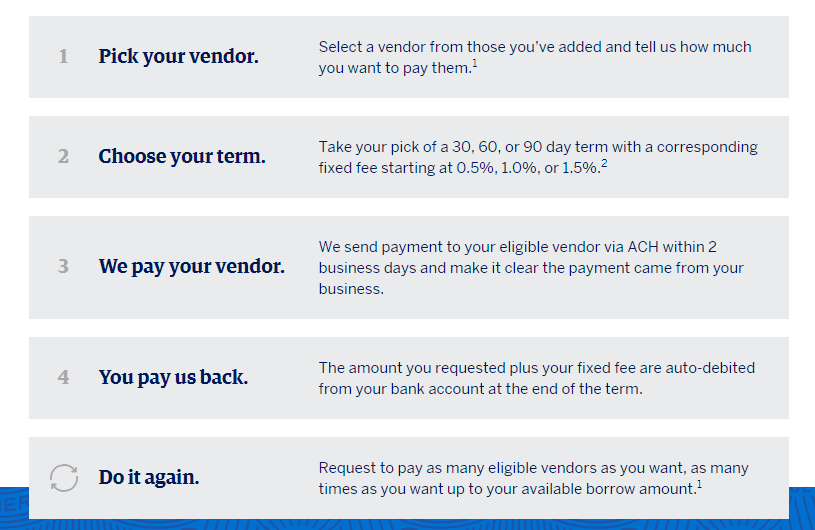

I’m not sure if this is new but American Express is offering some of their business credit cardholders access to working capital. Basically if a vendor you work with doesn’t accept credit cards (or American Express credit cards) they will pay the vendor on your behalf and then you pay a fixed flat fee. Fee structure is as follows:

- 30 days: 0.5%-1.75% fixed fee

- 60 days: 1%-3% fixed fee

- 90 days: 1.5%-5.25% fixed fee

American Express is making more of an effort to cross sell credit card customers on other auxiliary products so I’m not surprised to see them targeted high value business clients with this. It’s part of the reason Chase was able to lose money on acquiring Chase Sapphire Reserve customers initially, as they predicted they would be able to convert those customers to investment and home loans at a later date (although that still needs to be proven).

I used their 0% offer for 90 days to pay my attorney for a real estate transaction which allowed me to float the money.

They currently have the following promotion too: Limited Time Offer: Earn a 0% Fee 30-Day Loan for Each New Vendor You Add in July

Simply add new vendors in July. If the first loan you take related to a new vendor is a 30-day loan, that loan will have a 0% fee. Qualifying loans must be taken prior to August 31, 2018. Terms Apply

“We send payment to your eligible vendor via ACH”

Who’s an “eligible vendor,” and does this count as a direct deposit?

Does the CC holder receive points/rewards for this?

No

Some vendor offer cash discount. Usually you can offset borrowing cost by negotiating discount from vendor.

This is an ongoing program that is offered to ~10% of cardholders on a rolling trial. You cannt currently request to be part of it, you have to be targetted. I do have an internal rep at American Express who helps me with my accounts and spending more that that has given details if folks are curious of a specific question, happy to get answered.

What’s the point? You get to delay payment for up to 2 months longer than a charge card, but pay a fee and get no purchase protection or MR points?

It’s for merchants that don’t accept CC.

Lol it’s like the opposite of a credit card — I have to pay the fee instead of the vendor. No thank you, try again

Many merchants (vendors) are cognizant of their card processing costs and will offer an additional discount for large purchases paid in a way like this.

I just sent $15K to our consultants this way (using 30-day, no-fee promo) and they gave us an additional $450 discount

They’ve been doing this for a while. I got a targeted email offering to waive the fee about a year ago.

Ditto

Interesting, never seen this before!