Update 9/22/19: This was due to be live 9/23/19, but it looks like it has gone live early. Hat tip to leetommy

Update 9/18/19: Miles Talk is reporting this as confirmed. Reddit user bspok3 is also saying this is confirmed by a Citi insider. Few things to note:

- Chairman, Prestige, or Premier cardholders will be able to transfer to all travel partners at a 1:1 rate

- If you don’t have one of those cards, you’ll be able to transfer to JetBlue at a 1:0.8 rate

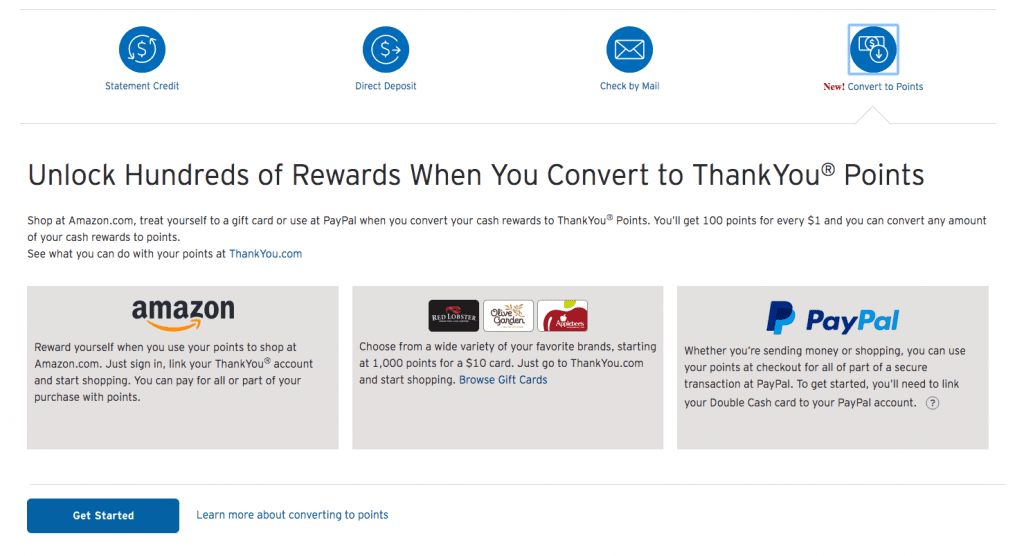

Update 9/13/19: A reddit user was told that Citi Double Cash Rewards will be convertible at a $1:100 rate (e.g 2% back = 2 Citi ThankYou points) starting 9/23. This would be a massive game changer.

Original post: In their most recent statement reader David G reports seeing an account message stating that in Fall 2019 Citi Double Cash rewards will be convertible to Citi ThankYou Points. Unfortunately it doesn’t say what the conversion rate will be, keep in mind this card earns 2% cash back on all purchases (1% when you make the purchase and another 1% when you pay on time). I can see three main options:

- 2% cash back = 1 Citi ThankYou point

- 2% cash back = 1.5 Citi ThankYou points

- 2% cash back = 2 Citi ThankYou points

The first option is not useful at all, the second option is comparable to something like the Chase Freedom Unlimited and the third option would be a game changer. I suspect we will see something like the middle option, but who knows with Citi.

“From 03/25/2022 through 03/28/2022, rewards access will be unavailable as we update our systems.”

Says you can still redeem for cash so I guess really not much has changed as far as card value.

DoC posted about this last month: https://www.doctorofcredit.com/citi-double-cash-card-will-offer-rewards-as-thankyou-points-remove-25-redemption-minimum/

(But as you said, it doesn’t seem to reduce the value, though there’s a risk that they’ll make the TYP redemption rates worse in the future.)

Can someone help me? what makes thankyou points so valuable?

Citi has posted a video on how to convert points her: https://www.youtube.com/watch?v=ftsDAH7aHAw. The public comments about why this is worthless (because “cash is king”) are priceless.

Has anyone converted an existing ThankYou points earning card (Prestige, Premier, Preferred, or Rewards+) to the Citi Double Cash card and successfully maintained their existing thank you points such that they will continue to not expire for the life of the card similar to how downgrading or upgrading an existing thank you card works? I would like to convert my prestige to the double cash since the annual fee is coming up but don’t want to lose my existing points earned or have them expire in 60 days since I don’t have any specific redemptions planned out yet.

Thanks in advance for the assistance.

I know for sure you can product change your card to the Double Cash. They pushed it pretty hard last time I had the Premier. I opted for the Dividend – probably not my best move.

However, I think you lose your points if you do not have another T/Y point card to shift them to. So, it’s better to just downgrade the card to a non AF card in that family. The other reason that is suggested is because I believe getting a different card out of family resets your 24 month counter, because now you have closed a card in that family, so you are extending the time that you can churn by about 13 months. So, instead, if you convert to a non-AF T/Y card, now you should be able to do the Premier/Prestige in 12 more months.

When I did Premier to Dividend P/C, my credit history was maintained on my credit reports, but the CC number did change.

Don’t be afraid to call and see what the reps say. I can tell you this… if you call before 12 months, they will tell you that you have no product change options. They won’t tell you why. Just that they don’t see anything available. There is an invisible 12 month rule before you can PC. GL

Thank you Gadget 🕵️ !! Gadget, I didn’t know the Premier card could be pc to the DC. I just got off the phone and yep! The card has now been converted. Thank you so much for this information! I have 399 TY points, is there anything I can do with them or not really because I only redeem for cash? Can I give the TY points to someone else?

Gadget 🕵️ !! Gadget, I didn’t know the Premier card could be pc to the DC. I just got off the phone and yep! The card has now been converted. Thank you so much for this information! I have 399 TY points, is there anything I can do with them or not really because I only redeem for cash? Can I give the TY points to someone else?

Yes, you can give them away, but Citi calls it “sharing” with someone. The fine print is that they have 90 days to use them, which seems silly. And, you need their CC number or T/Y points number of course. https://www.thankyou.com/pointsSharingLanding.htm

I believe Citi takes about 50 days to fully PC a card usually… so, don’t expect it to be instant. I am sure they went over all that on the phone, but they usually say it could be sooner. In my case, it wasn’t. It’s probably shorter if staying in family and not being assigned a new number.

She said it was already converted and had a new account number. She said she’d FedEx it and I should get it within 24 to 48 hours. Here’s hoping for the best!

Maybe it depends on the product chosen for how long it takes? I had a very different experience. I tried to find my DP I posted somewhere, but I can’t find it. There are so many Citi posts.

DoubleCash is my go to card for bank account funding. Just lower the CA limit and go to town! If it happens, answer any fraud alert e-mail/phone calls and try again. Enjoy!

Have you ever had it post as a cash advance (and get rejected for that reason)? I got an email from FedEx saying I am getting something from Citibank on Friday.

Bank funding: With Citi, no. If your CA limit is $0, it cannot post if they process as a CA. (With BofA, it will actually try to pull from the $200 CA limit, but because the charge is bigger than $200, it doesn’t post as CA. Just scarier.)

It’s very possible Citi upped there conversion/product change game.

Finally found my DP Premier to Dividend: https://www.doctorofcredit.com/citi-annual-fee-refund-policy/#comment-748896

Thank you for the quick reply. I probably will convert to the rewards + instead as you suggested and convert my Citi Dividend to a Double Cash.

I PC the Premier to DC and was told the TY pts will expire in 60 days.

FWIW…I had to call in to Citi to get my newly created Double Cash Thank You acct properly merged with my existing ThankYou acct that is tied to my Prestige/Preferred cards. I’m aware that there is a “combine my accts” link on the ThankYou site, but I could never get it to work. After the Citi rep properly combined the accts, I was then able to use all points (including newly created points from converting DoubleCash “cash” to TYP) toward all 13 airline transfers.

Thanks to others who have posted here with recommendations on the proper Citi trifecta. My long term plan is to convert the Preferred to a Rewards + and downgrade my Prestige to a Premier just prior to my next AF. I believe at that point I’ll have the correct set of 3 cards to achieve 2.77% toward travel redemptions. Thanks also to those who posted warnings about booking hotels through the Citi travel portal…as always, comparison shopping with a 2nd/3rd site is the best way to ensure you’re not getting ripped on Citi hotel redemptions.

Same boat, I’m unable to combine my Double Cash TY account with my Prestige TY account. Will call them today to combine.

UPDATE: Was told today 9/26 all transfers are erroring for those who have combined accounts, expecting a fix in 7 business days or less.

Hi Big. Thank you for the DP.

Is it possible to points share from the double cash account to another person’s account? I see it under the faq of the DP card but a citi rep said otherwise. My plan is to give my parents the DP and transfer to me with the premier card to transfer to partners. Thanks!

Have you actually transferred DoubleCash converted ThankYou points to a non-Jet Blue travel partner, or are you just seeing it in an account where you suspect it can be transferred? I ask because I received conflicting info from phone and chat representatives at Citi, and want to make sure it is possible before I make this move.

I already have a DoubleCash card and I am contemplating getting a Premier and a Rewards+ card to give me this option. But I don’t want to waste two 5/24 spots if the airline transfers are not going to be possible.

Thanks!

How did you calculate 2.77%? Is it Premier + DC + Rewards+?

Meh. They are cutting travel benefits. Citi is dead in the water.

Gaah, thwarted by minimum redemption thresholds!

“You must have at least $1 in Cash rewards to convert to points.”

I only use Citi DC for $0.50 Amzn reload twice a year (to keep active), so I’ll never reach this threshold. Woe is me!

I believe these TY points converted from cash back can only be used as checking account TY points which is NOT transferable to airlines.

I have bank accounts, DC, and Prestige. It only allows me to combine points for DC and checking account.

Can’t they just create an optional $95 AF Double Cash card to allow transfers to all partners? Why force me to sign-up for two accounts–Double Cash ($0 AF) and Premier ($95 AF)–just to access all the partners?

Just make a new product and keep it simple! Don’t make me open two new accounts.

I see the option to convert but get an error every time I try. I can see a TYP number associated with my DC card when logging in at ThankYou.com but no luck in moving the rewards thus far. But again, typical Citi fashion…roll something out that doesn’t work…oh, and I’m losing all of my benefits today….yay Citi!