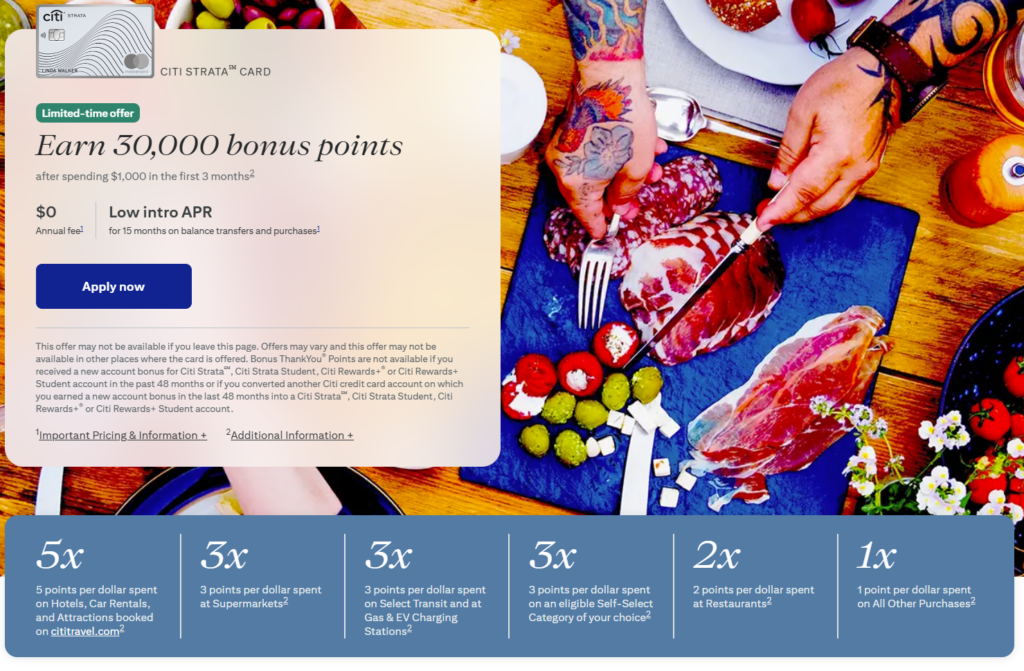

The Citi Strata no annual fee card is now live. This card replaces the Citi Rewards+. Card benefits are as follows:

- No annual fee

- 30,000 point sign up bonus after $1,000 in spend within the first 3 months

- Card earns at the following rates:

- 5 points per dollar spent on Hotels, Car Rentals, and Attractions booked on cititravel.com

- 3 points per dollar spent at Supermarkets

- 3 points per dollar spent on Select Transit and at Gas & EV Charging Stations

- 3 points per dollar spent on an eligible Self-Select Category of your choice

- 2 points per dollar spent at Restaurants

- 1 point per dollar spent on All Other Purchases

Not as useful as the rewards+ card as there is no 10% rebate on redeemed rewards.

Could someone please advise the cashback rate for points on this credit card? Is the 30,000 sign up bonus points worth $300 cashback or are they worth $225 or less? Thanks in advance.

It may depend on what other Citi TYP credit cards you have.

According to the AI report from Google Search, it’s only 0.5 if you are redeeming toward a Citi Strata balance, which implies that 30000 points would be only $150.

But if you combine your TYP points from different cards, and use the points from Citi Strata purchases toward another TYP card that gives 1.0 toward its balance (such as DoubleCash or Custom Cash), then you’ll get the full $300 cashback.

Though be aware that DoubleCash is not necessarily the best card to do big redemptions for. That’s because unlike other 2x cards, DoubleCash only earns 1x when you purchase and the other 1x when you pay. But if you wipe out most or all your DoubleCash statement amount with a points redemption, then you won’t get the 1x for paying the DoubleCash purchase.

Was able to convert Strata to DC

Was able to convert from Strata to DC

Does Citi allow product conversion from Citi Strata to Custom cash?

Among other things, it may depend on how many Custom Cash cards you already have. I already have two of them, and I’ve never yet heard of anyone having three of them to date.

And while initially I was thinking of converting, when I found out that it gives 3% back on certain streaming services, I decided to keep it as is for a while, given that I’m not sure what I can and would want to convert it to, because I already have, besides this card, a Citi Double Cash card and two Citi Custom Cash cards.

I have seen reddit posts of people holding 4 custom cash cards.

Can you combine points with the new premier card like Chase can with freedom and preferred cards?

Yes, you can combine all your TYP points cards into one points summary at the Citi site. If you can’t figure out how to do it online, you can call customer support during the week (to get a local customer support agent) to get it initiated.

If you did that while it was Rewards+, it stayed that way when Rewards+ changed to Strata (no AF).

Whether they’ve enabled that on the new Strata (no AF) card for those who haven’t done it before it became a Stata card, or are working on it, that I don’t know.

No thanks

The Self-Select 3% category defaults to Select Streaming Services. It can be changed once per quarter.

How to set the category on the Citi website:

How to set the category in the Citi app:

will this be 1 cent per point if redeemed for cash back? or .75 cents per point like the other strata

Also wondering this.. If so, can you transfer them to a double cash card and redeem at 1c?

Looks like no additional benefits such as extended warranty?

I didn’t see any. Supposedly Double Cash now offers a 24month warranty – so maybe product change into that?

Can you still transfer to partners with the citi strata?

yes, but at a worse rate than the Premier/Elite cards. Also you cannot transfer to AA but it works with other partners

(AA is 1000:700 with the plain Strata for 1:1 transfer partners, even more decreased values for non-1:1 partners like Emirates)