Deal has expired, view more Southwest deals by clicking here

[4/3/19: Reposting as a reminder.]

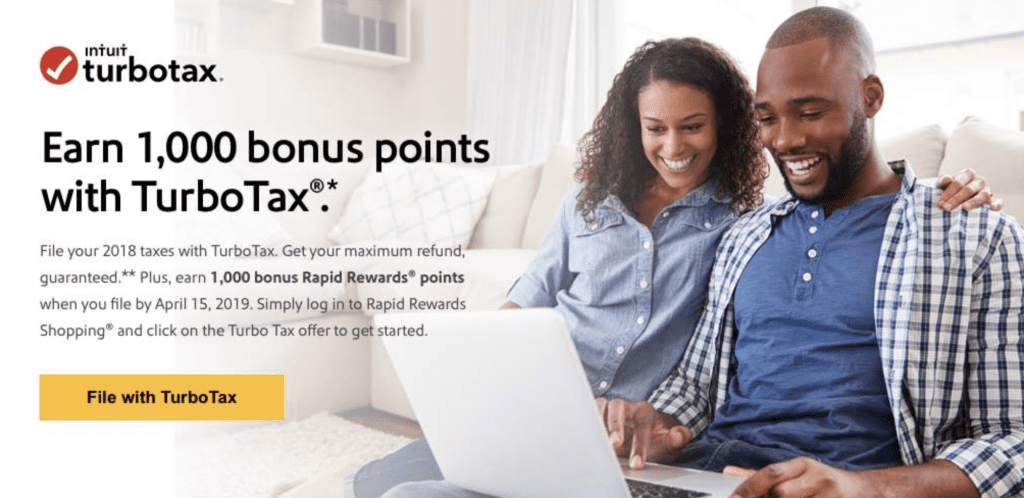

The Offer

- The Southwest shopping portal is offering 1,000 miles when you do your 2018 tax return via their link to Turbo Tax. The free version is also included.

The Fine Print

- The 1,000 Rapid Rewards® bonus points can only be earned by filing an online federal tax return

- Filing must be made between Wednesday, January 2, 2019, and Monday, April 15, 2019, after clicking through this offer on Rapid Rewards Shopping and logging in to be eligible.

- TurboTax Online Federal Products qualifying for 1,000 Rapid Rewards bonus points are the 2018 online version of TurboTax Free Edition, TurboTax Deluxe, TurboTax Premier, TurboTax Self-Employed, and TurboTax Live.

- This Rapid Rewards bonus points offer may not be combined with any other product or offer from TurboTax

- limit one (1) bonus redemption per Rapid Rewards account number.

- Eligible only after a tax year 2018 completed federal tax return is filed during the Bonus Period.

- Federal tax filings made using TurboTax CDs, TurboTax Free File Program, downloaded products, or in-app purchases are not eligible for the bonus offer.

- Please allow up to eight weeks from the date of your qualified federal tax filing for your Rapid Rewards account to be credited with 1,000 Rapid Rewards bonus points.

- Questions regarding the crediting of Rapid Rewards points can be submitted here.

- Rapid Rewards bonus points will not count towards A-List, A-List Preferred, or Companion Pass qualification.

- All Rapid Rewards rules and regulations apply and can be found at Southwest.com/rrterms. Southwest® reserves the right to amend, suspend, or change the Rapid Rewards program and/or Rapid Rewards program rules at any time without notice. Rapid Rewards Members do not acquire property rights in accrued points. The number of points needed for a particular Southwest® flight is set by Southwest and will vary depending on destination, time, day of travel, demand, fare type, point redemption rate, and other factors, and are subject to change at any time until the booking is confirmed.

Our Verdict

Pretty cool that they include the free TurboTax offering in the deal (that’s been the case in the past as well, as I recall). I guess they want you hooked into their ecosystem.

Irritated that the free version doesn’t allow 1099-INT or MISC… So went with Credit Karma and TopCashback thanks to DoC <3

You should add major exclusions for TurboTax this year:

You can’t itemize or file any of the new Schedules 1-6.

This year it’s only useful for people who don’t claim any deductions or credits except:

1. Standard deduction

2. Child tax credit.

3. Earned income tax credit

Hope this helps someone so that they don’t waste their time doing their tax on TT only to be hit by a paywall in the end.

BIG WARNING to DoC users: the free version won’t work if you have more than $1,500 in interest income. Perhaps you can add this to the post, William Charles?

William Charles?

I thought I’d try TurboTax this year due to this Southwest bonus. Entered all of my interest income from bank bonuses I discovered on this site and discovered I’d need the $60 Deluxe version to do my taxes. If you do a lot of the bank bonuses, the free TurboTax won’t work for you.

Back to Express1040 (FreeTaxUSA)…

Depends on how you arrived at the page. I have always gone thru IRS.gov freefile, which takes you to taxfreedom.com. Free for me, and I had well over $1500 interest, but all depends on your qualifications/income. Have no clue if I will end up with the points though, but not sweating it.

Does Credit karma free version cover HSA contribution and IRA contribution deduction?

I only found out about this deal AFTER I filed my taxes. Is there a way to go back and add my RR # so that I can get the points?

Just a little tip I stumbled on last year. I tried filing electronically last year but put the wrong identity pin so it was rejected. i still got the 1000 points and ended up filing by mail. I assume you could do this just for the points without actually using it to file a real return.

just a word of caution: i filed using free turbotax last year but never received the RR points. contacted RR and they asked for an e-receipt:

“The e-receipt contains all the order details that I am in need of to research the order for you such as the order number, the order date, the order amount, the merchant name, the items description, etc. ”

turns out turbotax doesn’t provide e-receipt for free tax filing. wasted a lot of time emailing back and forth.

Same: I apologize for any inconvenience that this matter may have caused. Allow to inform you that TurboTax has not credited your account with rewards, because they have deemed this purchase #xxxxxxxxxxx ineligible per their terms and conditions stated on the Rapid Rewards Shopping web site.

Reminder that Turbo Tax free only supports VERY simple tax Filings. H&R block free covers much more.

1000 points is a great deal if you qualify for the free version.

Chase offers is also giving away $20. Turbo tax is kind of a rip off but this might help make it a little more reasonable.

Chase offer is only for purchases over $100 according to my offer.

The Chase offer is $20 *if you spend $100*. Thanks but no thanks. (Also available at BofA..)

That is for purchases over $100

I’ve taken advantage of this for at least 2 years now.

But word of caution, they’re now requiring you to get the Deluxe version to claim student loan interest deductions. I’m sure they’re using the Schedule 1 as an excuse. But Credit Karma is a good alternative (already filed!).

Oh thats a bummer. Does credit karma charge extra for schedule Cs?

With FreeTaxUSA you can do schedule Cs, and everything else, without charging anything at all – sure you don’t get Southwest miles but it still seems to me to be the better offer…

CK is 100% free, but make sure they support all you need.