People often have a lot of questions about how authorized users affect credit scores and credit reports. We decided to answer some of the most common questions out there.

If I add somebody as an authorized user to my card, will their credit be affected?

Authorized users are only supposed to be reported to credit bureaus (and thus affect credit) if they are your spouse, this is because a few years ago somebody had the bright idea of offering a service where they add you as an authorized user to help increase your credit score.

If the authorized user is your spouse and the credit card issuer is not reporting this information to the credit bureau then call the card issuer first to inform them the authorized user is your spouse. This should get it added to their credit report. If it’s still not added, call the credit bureaus as well.

That being said, it is possible to make an authorized user appear as a spouse and thus get it to show on their credit report. To do so the primary card holder and authorized user should:

- Have the same surname

- Live at the same address

- Be of opposite sexes

Equifax is known for removing authorized user data when they believe the authorized user is not the spouse of the primary card holder.

Which Banks Report Non-Spousal Authorized Users To Credit Bureaus?

Somebody banks will report non-spousal authorized user accounts to the credit bureau, below is a list of banks who do so:

- BofA

- Barclays

- CapOne

- Chase

- Citi (reports to all three credit bureaus)

- Credit One

- Discover (reports to all three credit bureaus)

- Firestone (you must call and request the form to fill out)

- GECRB

- Macy’s

- NFCU

- Walmart (GECRB)

- WFNNB

- Zales

Which Banks Don’t Report Non-Spousal Authorized Users To The Credit Bureaus?

- Amazon.com

- HSBC (Before CapOne takeover)

- Jared

- Kays

- Lexus

- RBS

- UMB

[Neither of these lists contain American Express, that’s because American Express & authorized users are much more complicated. We will be adding a dedicated post about this in the next week or two]

If I Add Somebody As An Authorized User, Will Their Score Go Up?

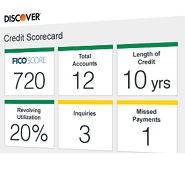

If you have a good credit history on that card (pay the credit card statement on time, have a low credit utilization and it’s an old card) then it will be beneficial. The opposite is also true though, if you have bad history (never pay on time, have a high credit utilization ratio and it’s a new card) then it will be detrimental to their credit. If you’re unable to be somebody and have them count as an authorized user, then it’s best for them to get a secured credit card to help build their credit history. This is true for the FICO score only, vantageScore doesn’t include authorized user data in their scoring process.

If I am removed as an authorized user, what will happen?

When you are removed as an authorized from an account, the card issuer should notify the credit bureaus and the bureaus should remove all data relating to this account from your credit report. If they fail to do so, you can file a dispute to have these removed.

Does being an authorized user affect your ability to earn a credit card sign up bonus?

No, if you’re added as an authorized user you can still apply for the same card yourself and receive the sign up bonus. For example, the chase sapphire preferred currently gives you 5,000 additional points when you add an authorized user. You could add your wife as an authorized user and then she could sign up for her own chase sapphire preferred and still receive the 40,000 points when she spends $3,000. On the other hand, if you add somebody as a joint user they will not be able to receive the sign up bonus again.

Am I responsible for the main card holders debts if I am added as an authorized user?

No, you’d only be liable for that debt if you were made a joint-owner or co-signed for the credit card. On the other hand the primary card holder is responsible for all of the debt that an authorized user accrues. This is why it’s extremely important to only make people you trust completely an authorized user (e.g spouses). If you wouldn’t loan them the credit limit of the card, you shouldn’t be adding them as an authorized user.

Does being added as an authorized cause a hard inquiry on your credit report?

No, being added as an authorized user will not allow the lender to do a hard inquiry on your credit report. This is because the account holder is responsible for the debt that an authorized user generates.

Do I get all the benefits of the card if I am added as an authorized user (e.g free baggage, insurance etc?)

Usually the more premium benefits such as free baggage don’t transfer to authorized users, whilst items like insurance will transfer. As always check the product disclosure as this varies a lot card to card.

Other Advantages Of Adding Authorized Users

- To take advantage of American Express offers such as: small business Saturday, sync offers and twitter offers allow every card holder to take part (once per card) this includes authorized users. This means you can take advantage of such offers more times than you normally would be able to.

- You can manage somebody elses credit cards for them. My mom isn’t particularly interested in credit card sign up bonuses, despite seeing the rewards first hand. Now she just applies for the cards, adds me as an authorized user and I do the rest. I could’ve done something similar with other family members, but they prefer to manage it themselves.

This page was last updated on 18th, February, 2014. It’s next due to be updated on 18th, August, 2014.

Any plans for an update to this post? Has been about 10 years. Would love to know if the lists in the post are still accurate.

For what it’s worth, a couple years ago I added an AU to my Amex Cash Back Everyday card, opposite gender using my address, and it showed up on his credit report and helped his score.

Planning to add a same-gender AU soon to a couple cards, can report back those DPs.

Are you able to add non US citizens as authorized users? We have personnel in Central America and it’s incredibly annoying drafting notarized papers for them to be able to use my card. I’ve long wanted to add a few of them as authorized users but they don’t have US addresses or social security numbers, but I can I use my address and social for them?

I don’t know the answer to your question but I suspect a credit card company would not allow you to use the same social security number for multiple people. I suspect they would see that as fraud.

Does anyone know if adding an authorized user during credit card APPLICATIONs affects approval odds? (I’ll add the user anyways, just want to minimize the waiting time to get the authorized cards).

Thanks!

I am an authorized user from my bfs chase card. In this case, does 5/24 count to me or him?

To Him, but you may need to call them and tell them you are an AU and they will then not count that card against you.

This is a question regarding the Chase 5/24 rule and being added as an authorized user on very old credit card accounts. I have been RECENTLY added to 2 of my husbands accounts that are 20+ year old. (and by the way- this power jumped my score to over 800 points!)

I get the point about authorized user for accounts younger than 2 years old counts toward the 5/24 for the AU…but what about adding them to accounts much OLDER than 2 years old, or even to to an INK account? Will this get around the problem? I want to apply for more Chase Cards but I need to know- Will these 2 AU accounts that are cards that were opened before year 2000 push me to the 5/24 limit ? Will they count against the 5/24?

I have this same question, did you ever find an answer?

Sorry but even a AU from accounts that are younger then two years old do not count towards 5/24. if you get declined just call reconsideration and tell them to check and see that you are only a AU. They will then approve you.

Hello, My mother added me to her Barclays and Old Navy visa card as an AU. Her RCI barclays card asked for my information such as DOB, address, etc. But not my social. Her old navy’s visa(synchrony) just asked for my first and last name. How do I get for her Barclays and Visa to attach to my credit profile?

You have to call and ask them to add the social

Without my knowledge my exhusband added me as authorized user on his first credit card. He took off and didn’t pay on it and now it’s on MY credit report sent to collection agency!!! I never signed or authorized to be added as a user! Now I’m stuck trying to get HIS debt off MY credit! Can’t blv how easily they let him add me! Any advice ? I’m calling this card tday but I doubt they even CAN help me now! I thought my permission would be required for that! So sad now

File a complaint with the credit card issuer, if they don’t remove it from your report file a complaint with each of the nationwide consumer reporting agencies.

You could also file a complaint with the Consumer Financial Protection Bureau

http://www.consumerfinance.gov/

Financial Institutions respond very quickly to complaints submitted thru the CFPB. They are scarred of not responding and getting in trouble.

My capital one card is almost maxed out and have not been paying bills lost job and my husband is AU but I did remove him on the account will it still show up on his credit report and if so how can I remove it and does the card need to be close first.

Just call the bank and ask to speak to the credit reporting department. Then go ahead and ask them to remove it. it is usually is not a big deal.

I could not figure out why my Trans Union credit score was 100 points less than my Equifax score.

After about 6 months of this situation, I looked at my Trans Union account and it said I was using 99% of available credit on one of my credit cards, which I know was not true… as I pay off my cc’s every month. I figured out that my daughter had put me on as an authorized user on a credit card that she had just gotten …. six months previously… AND that she had MAXED OUT and was using 99% of her available credit on. I immediately told her to REMOVE me as an authorized user.

Within 2 weeks my Trans Union credit score was raised 85 points.

SO, …. YES, EVEN IF YOU ARE JUST AN AUTHORIZED USER, THE PERSONS CREDIT USE CAN AFFECT YOUR SCORE !!

I am not interested in having an authorized user’s info reported to the bureaus. I just want them to have access to assist me when needed (I am handicapped). What would be the best bank or store cards to acquire that will not report their info to the credit bureaus? Thanks

I know this is an old question but just wanted to comment that in the post above there is a list of credit card companies that don’t report authorized user info to the credit bureaus unless the authorized user is a spouse. To make it clear, you could tell those credit card companies that the authorized user is not a member of your family, or something like that.