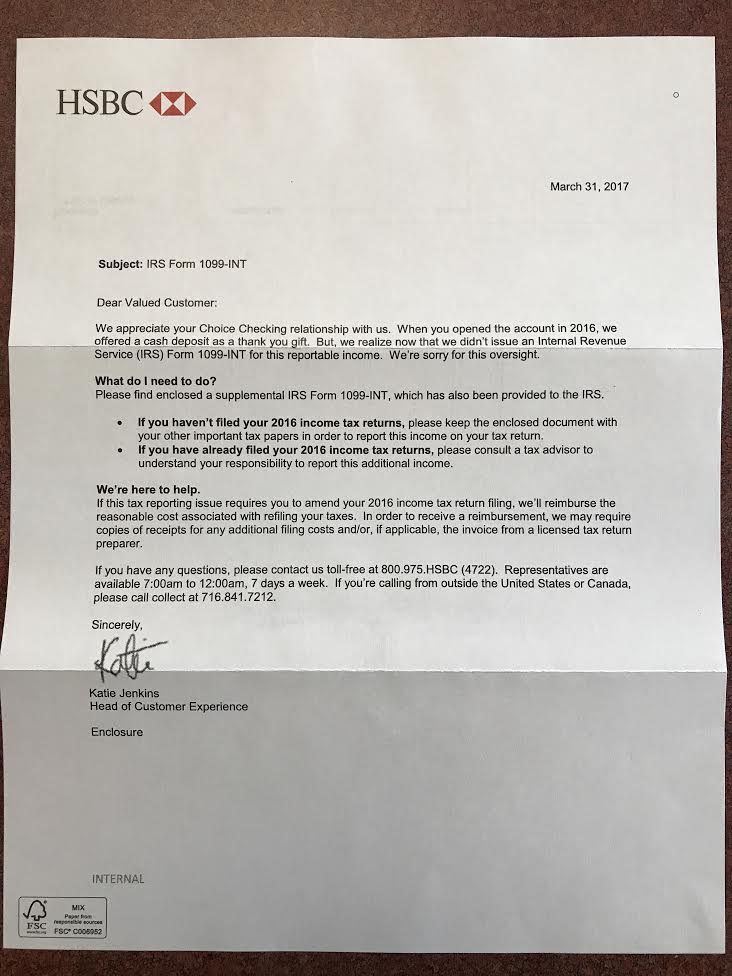

Last year HSBC offered a popular $350 checking bonus, yesterday a lot of readers reported receiving a 1099-INT form for this bonus. You can view the full letter below:

1099-INT forms are supposed to be sent and post marked by January 31st, 2017 for amounts over $10 ($600 requirement is for 1099-MISC). Regardless of whether you receive any 1099 form, I always recommend treating bank account bonuses as interest and paying taxes on them. What’s interesting is that some readers are receiving this 1099-INT for 2016 even though they received the bonus in 2017.

HSBC are offering to reimburse reasonable costs related to this error. I’m not an accountant or lawyer, so please don’t ask me what reasonable costs are. You can read Chuck’s thoughts on paying taxes for bank account bonuses, credit card rewards here. Please make sure to seek advice from a licensed professional.

Hat tip to /r/churning & reader Phil