Contents

- 1 1. Pay all of your accounts on time

- 2 2. Obtain A Copy Of Your Credit Reports And Check For Inaccurate/Incorrect Information

- 3 3. Pay off all of your credit cards each month in full, apart from one. The one account not fully paid should carry a balance no more of 10%

- 4 4. Don’t close credit accounts unnecessarily

- 5 5. Have a mixture of revolving and installment credit accounts

- 6 6. Don’t apply for new accounts

1. Pay all of your accounts on time

Payment history makes up 35% of your FICO score. By paying all of your accounts on time your score will slowly increase. Negative items (such as paying late or not at all) will stay on your credit report for a period of 7 years (bankruptcies and tax liens stay for a period of 10 years). So it’s important to remember patient whilst these items fall off your report. It’s also another reason why it’s so important to ensure these non payments don’t show up in the first place!

You can ensure you never pay an account late again by setting up automatic billing. For example most utility companies allow you to have your credit card automatically billed at it’s due date. Similarly credit card issuers will allow you to have your bank account automatically debited.

2. Obtain A Copy Of Your Credit Reports And Check For Inaccurate/Incorrect Information

There is nothing worse than having your credit score tank because a creditor reported incorrect information. That’s why you should get a copy of all three of your credit reports (one from each of the credit bureaus: TransUnion, Equifax & Experian) and make sure that every credit item on each of the reports is correct. Under FCRA/FACTA individuals are entitled to a copy of their credit report from each of the three bureaus once every twelve months. We’ve detailed the process here, or you can go directly to annualcreditreport.com.

If an item is incorrect it’s necessary to dispute it to have it removed from the credit report. If the items appears across multiple credit reports then you should report the incorrect item to all of the bureaus displaying it. Whilst the creditor who provided the incorrect item should notify all of the other bureaus once it’s been brought to their attention, this is a drawn out process which is often not done correctly. It’s much quicker and safer to notify all of the bureaus yourself.

These credit bureaus have 30 days (45 days if you’re disputing information found in one of your annual free credit reports) to remove incorrect items according to FCRA/FACTA.

A lot of credit repair guides will suggest you dispute every item that is negative. For example if you have a bankruptcy on your credit history you can’t just dispute it because you’d like it removed.

Making sure only negative items that are true appear on your credit report ensures that your credit score isn’t damaged by false information.

3. Pay off all of your credit cards each month in full, apart from one. The one account not fully paid should carry a balance no more of 10%

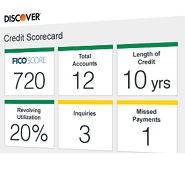

Credit utilization makes up 30% of a FICO score. Having a credit utilization score of over 30% negatively impacts your score dramatically. Anecdotal research has shown that it’s best to have all accounts with a balance of 0%, apart from one account which should carry a balance of 6-10% (the exact sweet spot depends on each individuals credit history, but most find that the 10% has the best impact on their score).

The above only applies to accounts with revolving credit (credit cards, store cards, etc). Installment loans (mortgages, auto loans) are treated differently and their credit utilization ratio counts very minimally to FICO scores. For best results pay down installment loans as much as possible, but don’t make it a priority.

4. Don’t close credit accounts unnecessarily

Credit history length accounts for 15% of a FICO score. The longer your credit history, the better. The FICO scoring model looks at the following in relation to credit history:

- Age of newest account

- Age of oldest account

- Average age of all accounts

By keeping credit accounts open, you can increase the average age of all your accounts – you may also increase the age of your oldest account. If having an account open costs you money it’s probably best to close this account – unless you are expecting to be applying for a major loan in the near future (e.g a mortgage).

5. Have a mixture of revolving and installment credit accounts

Types of credit used makes up 10% of a FICO score. Consumers should make sure they have a mixture of both revolving (credit cards, store accounts, etc.) and installment (mortgages, auto loans, etc.) credit to maximise this category.

It’s obviously not worth applying for an auto loan purely to add in another type of credit – but it’s something to keep in mind when trying to improve your score.

6. Don’t apply for new accounts

“Recent searches for new credit” is approximately 10% of a FICO score. Although FICO have stated that they put more weight into this category for people with thin credit histories. Whenever you apply for new account, you’ll notice that your score drops.

After approximately six months this drop will be almost unnoticeable and these items are removed from your credit report after a period of two years.

Applying for new accounts will also lower the age of your newest account and the average age of your accounts.

Does adding an authorized user to my business credit card (excellent history) increase their credit score or it has to be on a personal credit card only?

Won’t work with most business cards since they don’t report to the personal credit bureaus https://www.doctorofcredit.com/which-business-credit-cards-report/

Great article, — One of The Best ways to raise your credit scores fast is to get added to existing credit accounts. Once added the payment history, credit limit and age of account is placed on your credit files giving you an instant credit score boost.

One of my credit cards has offered to increase my credit limit. Will that increase or decrease my credit score? I am planning to apply for a new card soon with a zero percent intro rate on balance transfers and pay it off but I want to have the best credit score when I apply so I can get the best card.

It will most probably lower your credit utilization which will result to increase your credit score. Also a higher credit limit from one bank will also give you a better chance of the new bank matching that. So my advice is you go ahead with that increase.

what happens if I request to lower my credit limit? Does this affect my FICO?

thanks..

It could affect your FICO by increasing your utilization.