Many readers report (1, 2, 3, 4, 5) having funds debited on their Chase Business checking account as the bank is withholding 24% of their bonus to cover the estimated IRS taxes. As an example, those who did the $500 Chase Business... Read More →

Tag - taxes

How To Find Form 1099-INT From Treasury Direct (I Bond Taxes)

Reposting 1/26/25 as the 2024 tax forms are now available Original Post 2/22/24: Your Form 1099-INT for interest earned from I Bonds must be downloaded directly on the Treasury Direct website and is not sent in the mail. The process... Read More →

Two IRS Tax Payment Tips

I recently mentioned a couple of tax tips to a friend which he found useful so I thought to share them here as well. As always, do your own research or consult with a tax advisor before implementing any changes. Withhold Taxes From... Read More →

Which Banks Send Out Tax Form 1099? (Discussion Post for 2024 Tax Forms)

January and the ensuing months are Form 1099 season! Each year there are interesting developments that happen with regards to banks issuing form 1099s for interest, bank bonuses, referral bonuses, etc. Remember that time when Chase... Read More →

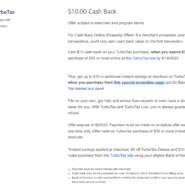

Chase Offers/BofA: TurboTax, Get $20 Cashback With $39 Purchase

Check your Chase Offers and other banks: Earn $10 cash back on your TurboTax purchase, when you spend $35+ by 4/18/2022. Plus, get $10 instant savings Read More →

IRS Announces Delay On New $600 Form 1099-K Rule (2023, 2024, 2025, 2026 Details)

Update 12/4/24: The IRS recently released updated guidance indicating $2,500 as the 2025 threshold and $600 as the 2026 threshold. Updated below. Original Post 11/21/23: The IRS has announced a delay on implementation of the law... Read More →

Claiming Your State Tax Deduction From Treasury Money Market Funds

I’ve written before about how money market funds are my preferred ‘savings account’. Personally I’ve been using Vanguard’s default money market fund (VMFXX) and their treasury fund (VUSXX). There are... Read More →

Upcoming Tax-Free Holiday In Select States (August 2024)

Many states offer a few days/weeks during which their state sales tax is waived, typically in advance of an upcoming school year. There are typically more details on limits and eligible items so be sure to research the details of your... Read More →

Which Banks Send Out Tax Form 1099? (Discussion Post for 2023 Tax Forms)

January and the ensuing months are Form 1099 season! Each year there are interesting developments that happen with regards to banks issuing form 1099s for interest, bank bonuses, referral bonuses, etc. Remember that time when Chase... Read More →

(Update) Chase & Amex Promote Paying Taxes With A Credit Card

Update 9/9/23: Just adding this Reddit report from a CFPB response confirming that tax payments with Amex do count toward rewards AND count toward minimum spend requirements. Update 5/12/23: Reddit use refarch88 found that Amex promotes... Read More →

New Jersey Can Apply & Get Up To $1,500 Checks For Property Tax Relief

Update 8/18/23: Back for 2023 (ht HarryTheFirstHarry) Reader HarryTheFirstHarry sent in a tip that most New Jersey residents can get a cash payment for property tax relief. The payment amount is $1,500 if you are a homeowner or $450 in... Read More →

Reminder: You Can Get $7,500 In Tax Credits With Electric Vehicle Purchase

Reader Danno reminds us of the Inflation Reduction Act of 2022 which enacted a potential $7,500 tax rebate for purchasers of an electric vehicle. That comes as a full refund on your taxes; essentially a $7,500 discount on the car price... Read More →

(Update) TurboTax To Pay Out $141M To Customers Who Used Their ‘Free’ Tax Filing Service

(Update 5/10/23: Checks are soon going out, per CNN) TurboTax from Intuit has agreed to pay out $141 million to millions of customers who used the ‘free’ filing service, yet ended up having to pay for the service. The... Read More →

Which Banks Send Out Tax Form 1099? (Discussion Post for 2022 Tax Forms)

[Update 3/28/23: Added a bunch of things below. Reposting now since Public sent out corrected form 1099s now with the bonus included there, along with some other minor (for me) changes. You can find it here.] January and the ensuing... Read More →

Capital One Counts Global Entry Credit On Form 1099-MISC

Viewfromthewing heard in a statement from Capital One that they count TSA Precheck/Global Entry credits in your form 1099-MISC toward the $600 threshold. Here was the official statement: Required reportable payments include certain... Read More →