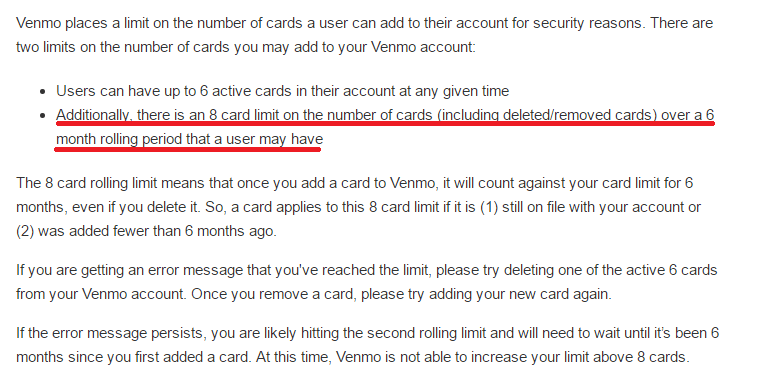

Venmo allows you to add credit cards (and prepaid Visa/Mastercard/American Express) to make transfers to friends & family. You’re allowed to have six active cards at any one time. Previously you were allowed 6 cards over a 6 month rolling period as well, but this has been increased to 8 cards.

Venmo isn’t terribly exciting for manufactured spending or meeting minimum spend requirements due to the 3% fee for credit card payments but some people like to use it as a last stop resort (paying 3% fee isn’t something I encourage) and this is something that might be helpful for those people to know. If you’re paying a bill or rent/mortgage you’ll be better off using Plastiq instead.

Thanks to reader Logan C for pointing this out.

Just ran into this limit, or something similar, that my account is limited to 4 cards added or deleted over a rolling 6-month period. They have a KB article about this, so it seems the 4-card limit applies to all accounts, rather than being specific to my account.

Is AGC still dead with Venmo?

I think they rolled back to 6.

Doc could you please check and confirm.

this kinda infuriates me that they went from 6 to 8 and then back to 6… for people like me that MS this method and therefore plan CC sign ups based on that, pretty unfortunate.

I wish I had never heard of Venmo or AGC. Venmo suspended me when I originally tried to load my first AGC card. After I sent them ID, they permanently suspended me. I was able to talk my way out of that since I had still not officially used their service.

However, I have tried repeatedly to use my AGC cards online with no success whatsoever. One card is now frozen with pending charges. The other card was just rejected and I can’t get the system to allow me to check my balance.

Question:

If you get banned from Venmo how long does it take to try again?

Any data points on this?

I was banned but haven’t tried again. Would be interested in hearing DPs as well.

I imagine you can open an unconfirmed account with the low weekly limits, but wonder if it’s possible to open a new confirmed account.

I am reading on other sites that Amex pulled the plug on Venmo. Do any of the other prepaid cards work?

Yeah, I think only AGC doesn’t work anymore

Using VGC or MC GC works on Venmo? What about fee?

I think it has the standard 2.9% fee

what is benefit of using it then by paying 2.9% fee? why would one use this option then unlike AGC which was fee free?

I’ve never used the option. Maybe some people use it if they literally have no other way of unloading the gift card.

Anyone having issues making Payment with Amex GC/DC? I tried and it says “Transaction failed, please correct card info and try again’.

This worked fine till yesterday.

https://www.reddit.com/r/churning/comments/6icck7/agc_venmo_may_be_dead/

Anyone having issues making payment with Amex GC? I am trying to send payment and it says ‘Transaction failed, correct card info and try again’.

The 6 card limit is still in effect, unfortunately. Their system isn’t letting me go past that.

Anyone managed to add a 7th card ?

Have you tried contacting support?

yep, they moved it back to 6 cards.

Can one only pay to other Venmo Account holders via their account or payment can also be made by other modes (mail checks/Bill Pay/Pay to Non venmo account people) just like Serve/BB/RB)?