Deal has ended, view more bank account bonuses by clicking here.

Offer at a glance

- Maximum bonus amount: $500

- Availability: AL, CA, IL, NJ, NY, TX, VA, WA. Must be opened in branch. [Branch locations]

- Direct deposit required: No

- Additional requirements: See below

- Hard/soft pull: Soft pull

- ChexSystems: Unknown, no longer sensitive (one person approved with lots of inquiries)

- Credit card funding: None

- Monthly fees: $15, avoidable

- Early account termination fee: Unknown

- Household limit: None

- Expiration date: September 30, 2021

Contents

The Offer

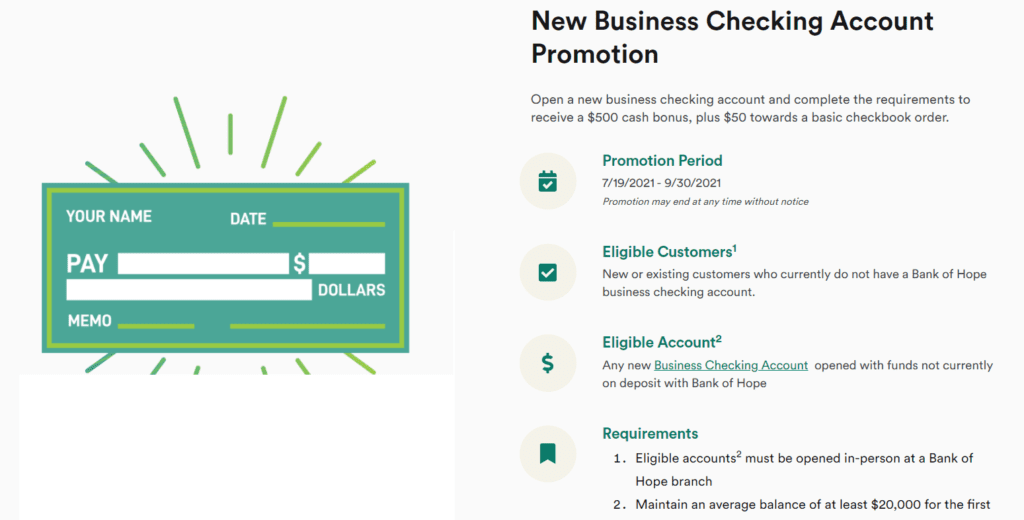

- Bank of Hope is offering a bonus of $500 when you open a new business checking account and complete the following requirements:

- Maintain an average balance of at least $20,000 for the first 4 months of account opening

- Complete the following requirements within 90 days of account opening:

- Request a debit card and make at least one debit card purchase or ATM deposit/withdrawal

- Register for Business Online Banking

- Enroll in e-Statements

- Complete one of the following two requirements:

- Make a bill payment using Bank of Hope Online Bill Pay or ACH debit payment

- Receive an ACH credit

The Fine Print

-

Eligible Customers” are (1) new or existing customers who do not currently have a Bank of Hope business checking account, (2) be at least 18 years old and (3) furnish or have a valid Form W-9 or Form W-8BEN on fi le with Bank of Hope and are not subject to backup withholding. Customer who currently has an existing business checking account(s) is not eligible. Eligible Customer must open a new checking account and enroll to participate in the Cash Bonus Offer at the time of account opening or within 30 days of account opening. By enrolling in the Cash Bonus Offer, customer agrees to be bound by these Terms and Conditions.

- “Eligible Account” must be a business checking account opened by Eligible Customer during the Promotion Period with new money. New money is defined as funds not currently on deposit with Bank of Hope. Only the first checking account opened during the Promotion Period is eligible for the offer. Subsequent checking account(s) opened under the same account ownership type and account title are not eligible. Limit one Cash Bonus per account. A new checking account opened after closing an existing checking account during the Promotion Period is not eligible for the promotion.

- Eligible Account must remain open, and in good standing from the account opening date of your Eligible Account until the Cash Bonus is paid. The Cash Bonus will be paid to your Eligible Account within six (6) months from the account opening date.

- IMPORTANT TAX INFORMATION ($500 Cash Bonus Offer): The Cash Bonus will be reported on IRS Form 1099-INT to the primary account holder on the account, in the year received, as required by applicable law. Customer is responsible for any applicable taxes. Consult your tax advisor. | All accounts subject to applicable terms including the Bank of Hope Deposit Account Agreement, fees, and charges. Terms, conditions, and fees for accounts, products, programs are subject to change. Fee may reduce earnings. Accounts subject to approval. Participation and enrollment in a promotional offer do not guarantee eligibility or fulfillment of the promotional offer. Speak to a banker for more details.

Avoiding Fees

Monthly Fees

The econo checking account has a $5 monthly fee. $2 is waived with one debit card purchase and $3 with eStatements.

The regular checking account has a $15 monthly fee. Monthly service charge can be waived if a minimum daily balance of $5,000 or average daily balance of $10,000 during each statement is maintained.

Early Account Termination Fee

Wasn’t able to find a fee schedule so unsure if there is any early account termination fee or not.

Our Verdict

Previously there was a $500 personal checking bonus, that bonus ended early. It seems like you should be able to do this bonus even if you did that previous bonus. We will add this to our list of the best bank account bonuses.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times