The Amex RAT team has been on an absolute rampage this year.

- They updated their terms to penalize those gaming the signup bonus system

- They may have begun cracking down on some kinds of minimum spend purchases for counting toward signup bonus spend, such as Simon Mall

- They added terms on the SPG and Hilton cards indicating rewards may begin coming with a 12-week delay starting November 1, 2017

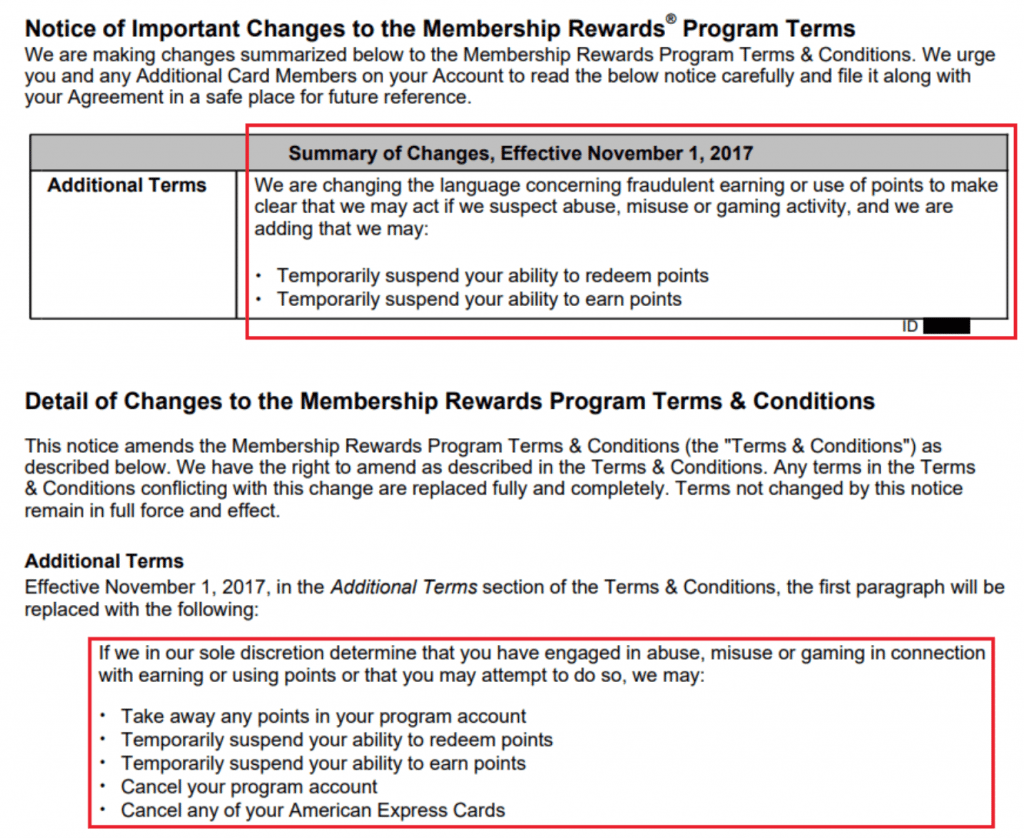

Now they’ve added terms to Membership Rewards-earning cards (thanks to Travelwithgrant):

- Beginning November 1, 2017, if American Express believes you are engaging in abuse, misuse or gaming in connection to earning or redeeming Membership Rewards points, they can temporarily suspend your ability to earn or redeem Membership Rewards points

They can now:

- Take away any points in your program account

- Temporarily suspend your ability to redeem points

- Temporarily suspend your ability to earn points

- Cancel your program account

- Cancel any of your American Express Cards

As Grant notes, they’ve already been freezing people’s accounts. They have their Financial Review process which freezes everything during the review, we’ve also seen other freezes without Financial Review as well. It’s fair to say that once it’s in the terms they’ll be quicker to apply such a freeze.

It’s interesting that on co-branded cards (SPG, Hilton) they added the 12-week clause and on MR cards they’re adding stronger terms. On their own cards they can write what they want. It’ll also be interesting to see if these terms get added to Blue Cash cards as well.

Does repeat purchase of $500 on MPX will alert the RAT team? Anybody has experience before?

Yesterday I received my new Amex Delta Plat Biz by UPS, as well as a letter by US Mail saying that Amex is unable to approve my request for the card: “The reason for our decision is that you have reached the maximum number and type of Cards that we will approve within the period of a few months. Please know that your prior application(s) has been approved and your Card has been sent to you.” I applied for the Ameriprise plat the same day, was automatically approved for that and approved for the Delta via an email two hours after I applied (got 14 days message). My previous Amex apps were the leaked 100K Plat on 11/23/16, and an SPG biz in 3/16 (canceled 4/17). I actually called Amex on Monday to ask them to expedite my Delta biz. The woman looked at the account and said she would. (The letter was generated on Sunday, the day I applied.) I have confirmed the card and set up online access. So… should I call? Chat? Purchase a Delta GC and see if I get reimbursed? And has anyone else encountered this? Thanks!

I guess my question is, I have added a bunch of amex comcast offers, spend 100/receive 1000 MR points and I am wondering if I should go ahead and do it. I have comcast and so do my folks so it’s an easy MR boost, but now I am afraid they will shut down mine or my wife’s account. Any thoughts?

amex offers are not the primary target yet. altho they will be. i would say go balls deep while staying DL as much as possible for now. AMEX CC will be a wasteland soon just like USB.

What is wrong in doing an offer that Amex advertised and offered to you in first place?. Am i missing something here?.

this pretty much signals then end. RIP.

thinking about this some more, AMEX is the new USB. organic or face clawback or shut down or FR or everything combined.

lol, the problem is.. if you claim a claim for those warranty protection, it will probably trigger a human looking/reviewing your account and then they see you either MS or abuse (whatever their term is) their bonus, then you are dead too.

When AMEX isn’t trying to crack down on MR abuse, they’re sending FRs. I’m probably limiting my AMEX spend to items that I want to have strong return/warranty protection or AMEX offers. Although I’m sure they’ll figure out a way to make those weaker too.

Got a call yesterday from AM3X, they were offering me 5K MR for $500 spend for each AU on my personal Plat (Gold cards) with I accepted it (my first AU with AM3X lol), anyways she ended up telling me about the new rules against “People who play the System in order to get reward points”, so here is her definition of this:

1- People who add AUs to get bonus and cancel the cards right after the bonus posted.

2- People who add AUs that don’t exist. (She mentioned that they know that people add pets and then because there is not SSN attached they have to cancel the card).

3- And the ones that just simple apply just for the bonus, then never use the card for the entire year and cancel them after that.

She never mentioned anything about MS, everything was around the 3 points I mentioned above, just people that abuse the reward points applying just for the bonus, I do MS and all that she said was, I can see that you have high spends and no AUs in any of your cards, also she told me, I’ve seen customers with 8 AM3X cards with 4 AUs each and they know that those are playing the system because AM3X only offers bonus on the first 4 AUs per cards.

Based on what she told me, I think they are (AM3X) after Churners and not those who MS, of course MS is/will be included at some point but there was not conversation about HIGH spenders, just Churners.

Makes sense. In the terms for one of their prepaid cards (Bluebird) they prohibit “manufacture spend” specifically by name, but don’t mention it in the terms for their regular credit and charge cards that I’ve seen.

Thanks for the dp! With the huge influx of churners from the CSR 100k bonus and the number of ppl asking how long before their bonus post, it comes as no surprise ppl are gaming and sock drawing the card after. Why do you think Fairmont, Hyatt, and Hilton (from citi) all discontinued their free night bonuses last year to a point bonus now?

hire a team of ppl to look down the charges on someone’s statement and determine whether those are purely for sign up bonus or gaming the rules/system for cash back/points/rewards. Their transaction cost must be very high

this sucks. i just went past 5/24 and figured i could MS the hell out of amex for a while. wishful thinking i suppose

Depend, I think they are trying to crack down MSR bonus because that’s where they lose money. I don’t think they are targeting regular non-MSR MS because they don’t really lose money on them. They still earn the credit card % fee.

they definitely lose out on BCP and OBC MS, perhaps SPG too? Then there are games you can play with Amex offers too

@artgriego. They aren’t losing out on regular spend on SPG. Amex isn’t paying anywhere near 2c/point.

yea, not SPG. But they gotta be losing on OBC. But the 50k cap limit their losses.

Any new datapoints to suggest s1m0n m4LLs are working for MS again with am3x?

at this point, everything is YMMV until the real ban hammer gets implemented via algo. anything u see now is temp. proceed at ur own risk.