Chase offers two no annual fee rewards cards, Chase Freedom & Chase Freedom Unlimited. Often when you no longer want one of their Chase branded rewards cards with an annual fee (e.g Chase Sapphire Preferred or Chase Sapphire Reserve) your best option is to downgrade it to one of these Freedom cards.

What’s The Difference Between The Two?

The cards are basically identical (e.g they share the same guide to benefits & fees). The only real difference is in the rewards structure:

- Chase Freedom Unlimited earns 1.5 Chase Ultimate Rewards points per $1 spent on all purchases

- Chase Freedom earns 5 Chase Ultimate Rewards points per $1 spent on rotating categories that change quarterly (cap of $1,500 in spend per quarter) and 1 Ultimate Rewards points on all other purchases

The sign up bonus on both cards is typically the same as well (e.g standard offer is 15,000 points after $500 in spend but you do see targeted offers of up to 30,000 points).

What Card Is Better?

To determine what card is better you need first decide how much you value Chase Ultimate Rewards points. Points are worth 1¢ each towards statement credit, but they can be transferred to Chase’s travel partners if you have one of the following Chase branded card with an annual fee:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Ink Preferred (Business)

- Chase Ink Plus (Business, discontinued)

- Chase Ink Bold (Business, discontinued)

If you don’t have one of those cards then the Freedom Unlimited will be of little use as it’s basically just a 1.5% cash back card (poor compared to other options) and the 5% on rotating categories that the regular Freedom offers would be much more useful. If you do have one of those cards then you can transfer to the following travel partners:

| Chase Travel Partners (All Transfer 1:1) | ||

|---|---|---|

| Airlines | ||

| British Airways Executive Club | Singapore Airlines KrisFlyer | Virgin Atlantic Flying Club |

| Flying Blue AIR FRANCE KLM | Southwest Airlines Rapid Rewards | Aer Lingus |

| United MileagePlus | Iberia Plus | Emirates |

| Air Canada Aeroplan | ||

| Hotels | ||

| Hyatt Gold Passport | Marriott Rewards | |

| IHG Rewards Club |

You also need to look at what credit cards that earn at a high rate on all spend you have available to you. We need this so we can use it as a bench mark to compare the Chase Freedom Unlimited to.

- If you have a 2% card, then you need to value Ultimate Rewards points at over 1.34¢ per point otherwise you’d never use the Unlimited.

- If you have a 2.5% card then you need to value Ultimate Rewards points at over 1.67¢ per point otherwise you’d never use the Unlimited

- If you have a 3% card then you need to value Ultimate Rewards points at over 2¢ per point otherwise you’d never use the Unlimited

If you don’t value them above those rates then the Chase Freedom will be better (even if you just spend $1 on a 5% category) as you’d never want to use the Unlimited card.

Once you’ve done that you need to work out how much spend you would put in the Chase Freedom categories. Here is a list of what they currently offer and have offered in the past:

| Q1 | Q2 | Q3 | Q4 | |

|---|---|---|---|---|

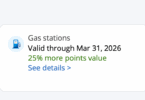

| 2017 | Gas Stations, Local Commuter Transportation | Grocery Stores & Drugstores | Restaurants & Movie Theaters | Walmart & Department Stores |

| 2016 | Gas and local commuter transportation | Grocery Stores & Wholesale Clubs | Restaurants & Wholesale Clubs | Drugstores, Department Stores & Wholesale Clubs |

| 2015 | Grocery Stores, Movie Theatres And Starbucks stores | Restaurants, Overstock.com, H&M, Bed Bath & Beyond | Gas stations, Kohl's | Amazon.com, Audible.com, Zappos.com, Diapers.com |

| 2014 | Gas stations, Movie Theaters, Starbucks Stores | Restaurants, Lowe’s home improvement stores | Gas stations, Kohl’s | Amazon, Zappos & select department stores |

| 2013 | Restaurants & Movies | Home improvement stores | Gas stations | Online shopping |

| 2012 | Gas stations,Amazon.com | Grocery Stores, Movie Theaters | Gas Stations, Restaurants | Hotels, Airlines, Best Buy, Kohls |

| 2011 | Grocery Stores, Drug Stores | Home Improvement, Lawn & Garden, Home Furnishings | Gas, Hotels, Airlines | Dining, Department Stores, Movies, Charity |

For example let’s say you max out the 5% categories each year (unlikely for most people) you’d spend a total of $6,000 and earn 30,000 Chase UR points. To earn the same amount of points on the Chase Freedom Unlimited card you’d need to spend $20,000. I think that helps illustrate the value proposition the regular Chase Freedom provides over the Unlimited card. Another illustration is that on every day spend the Unlimited earns 0.5 point more whereas on the 5% categories the regular Freedom earns 4 points more.

Final Thoughts

For the majority of readers the regular Chase Freedom is the better card. I can think of a few exceptions:

- You spend a lot of money on things that’s difficult/impossible to get a category bonus on (and I’m not just talking about the categories the Freedom offers).

- You already have a regular Chase Freedom/won’t be able to spend much on the 5% rotating categories.

Even then you still need to value Chase UR points at a significantly high rate and have a premium Chase card to allow for point transfers. I think in general the Unlimited card is overrated, especially with more cards offering 2%+ cash back on all purchases. For some people the card is obviously fantastic and can provide a lot of super sized value but as mentioned for the majority of people the regular Freedom makes more sense.