Update: Apparently this has been around for at least a year. I’d never seen any mention about the hard/soft pull stuff before which is why I posted. I’m keeping the post up because I still think it’s useful, but perhaps I’m giving Citi a bit too much credit recently. Thanks to everybody for correcting me in the comments, as always if you see something like this (even if it’s old) please let me know so I can post.

Asking for credit limit increases can be a pain, sometimes they result in a hard pull and sometimes a soft pull. Some card issuers will tell you what type of pull they’ll do but in the past Citi hasn’t always been upfront with their cardholders. It looks like this has now changed and they’ll let you know whether they are doing a hard or soft pull before you apply for an increase online.

Contents

How To Tell

You use the same link and then Citi will tell you before you apply if it’s a hard or soft pull. Pictures tell a thousand words, so let’s look at two of them:

Hard Pull

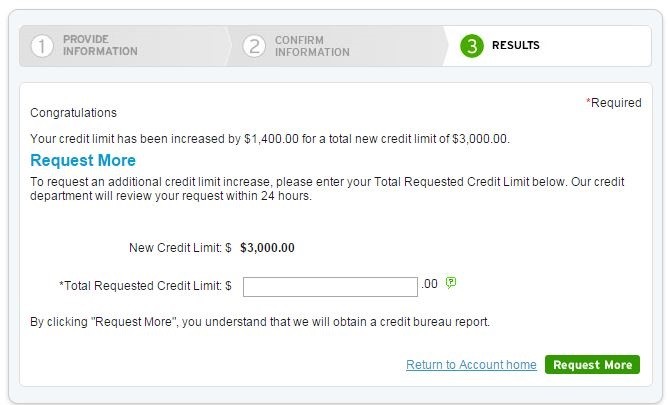

This is what the credit limit increase section will look like if Citi will do a hard pull. As you can see they state they will obtain a credit bureau report and it’ll take up to 24 hours. Thanks to @LukeTheSaint and Miles To Memories.

Soft Pull

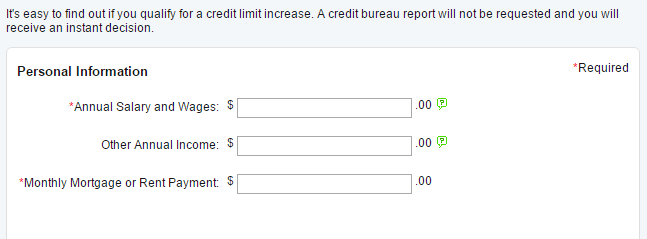

This is what the credit limit increase section will look like if Citi will do a soft pull. As you can see it says a credit bureau report will not be used and you’ll receive an instant decision. You’re also not allowed to request the limit increase you’d like to receive. Thanks to reader Adam for making me aware.

After you’ve been approved you’ll see the following:

Limits

If you’re approved for a soft credit limit increase, you’ll usually not be able to for a period of six months (unless you see the screen above). If you try to request it more often than that you’ll see the following error that reader Adam received when trying to increase the limit on his Double Cash card.

Why Request A Credit Limit Increase?

There are a number of reasons as to why somebody might want to request a credit limit increase:

- Want to make a purchase larger than their current credit limit

- Want to decrease their credit utilization to help improve their FICO score

- Want to avoid having to cycle through their credit limit multiple times per month

Final Thoughts

Citi is on a rampage recently to make their products more attractive, they’ve been adding transfer partners to Citi ThankYou, increasing the sign up bonuses on both the Premier & Prestige, introducing new credit cards like Double Cash & AT&T Access More and also adding a $100 Global Entry rebate on the Citi American Airlines Executive.

I love small changes like this, it doesn’t really cost anything for Citi to do it (apart from the programming expense) and it’s much more transparent for their cardholders. If you haven’t already, read our post on 13 things everybody should know about Citi.

We’ve also updated our page on Which Credit Card Companies Do A Hard Pull For A Credit Limit Increase?.