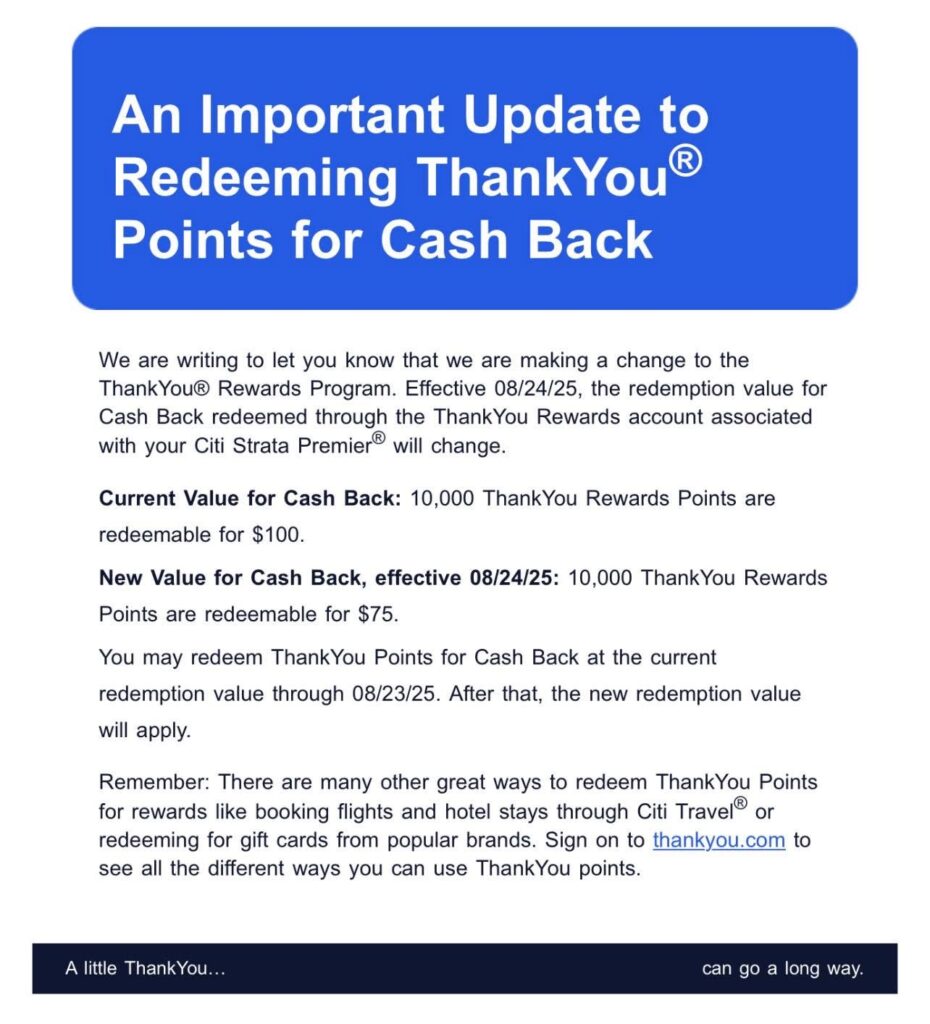

Citi has sent out an e-mail to Citi Strata Premier cardholders informing them that the rate when converting Citi ThankYou points to cash. You currently receive $100 when redeeming 10,000 points, that will reduce to $75 when redeeming 10,000 points on 8/24/25. Currently this doesn’t affect the Citi Double Cash card or Custom cash card so you could transfer to those cards then cashout if you hold them.

Most people prefer to transfer to Citi travel partners anyway, especially when Citi transfer bonuses are offered but it’s always nice to have this as a fall back option and 25% is a significant devaluation.

just Citi being shitty

Taking a page from the US bank playbook

This kind of stinks, i have the trifecta cards and use them for cashback because my lifestyle changed 🙁

I don’t think I’ve ever redeemed points for actual cash, it’s always been a credit to card balance. If I get a direct deposit from points, is that taxable?

Many banks word card balance transfers as a type of “cash” rewards, but it’s unclear whether that’s what Citi means for Strata Premier in this case.

So, unfortunately, the wording shown above is unclear to me whether it only applies to “truer” cash back like direct deposit, or also “equivalent to” cash back like card balance.

And since it’s not going to go into effect for a few months (August), I don’t know whether Strata Premier members can find out anything clearer about this on the Citi website now, or whether you’ll have to wait.

I no longer have a Citi Strata Premier card, so I can’t check that myself.

I think it’s for any cash redemption. On the Thank You site, cash redemption is grouped together and you can select direct deposit, statement credit or mailed check. The points value is shown at the top of the screen, and then you just choose the method you want to receive it in.

Short answer: no it won’t be taxed

Long answer: I asked my tax accountant why it was that I had to pay taxes on some bank bonuses and not others, and I vaguely remember that the answer had to do with a loophole, where if the cashback is considered a rebate for spending, it isn’t taxable. So cashback cards, points earning, or even subs that required a purchase of some kind are all part of this. But if you earned points or cash for just signing up or by referring someone else, it can’t be considered a rebate. So those have to be considered income.

Citi closed two cards I had forever in the past two months, a Citi Professional & Double Cash (product changed from a Premier), even though I was putting small charges on each every few months. A bit of a bummer because because they factored into my average credit age. Has me wondering if Citi did this because they want to overhaul their TYP.

How does the transfer between cards work? I thought they were all collected in one thank you points account. I recall having two of them and needing to call in to have them merged. Of course I don’t have strata now but may in the future (currently DC and R+)

First, Citi doesn’t default to being collected in one Thank You account. I had to merge them to make the be all one collection, about a year ago.

But once they’re merged, you still choose which card you’re using it for in the Citi user interface. So presumably they may have it act differently if you choose Strata Premier as the card versus if you choose something else as the card.

But again, without detailed T&Cs of this change, we can’t know for sure how it will work.

Citi can distinguish different buckets of points, so presumably they would be able to set different redemption rates for points earned via the Strata Premier vs the other cash back cards. This would be similar to when they still gave out TY points for banking. Even if they were pooled into the same TY account as points from a Premier card, the points earned from banking could never be transferred to travel partners.

That’s a lot of assumptions about Shiti IT. You have a lot more confidence in their capabilities than I do

If they downgrade points on a “premium” card, it must be coming to other TYP cards. It will make many of citi cards basically useless.

The only reason I have this card is for the transfer partners. Last I checked, the Citi cards without an annual fee only allow transfers to JetBlue. I don’t care about cashing out, but if they devalue other partners like they did Emirates, I won’t be a happy camper.

This sucks. Booking through their portal to get 10x points back then paying for the trip with statement credits at 1:1 has been great.

Fortunately for me, I will get my promotional bonus (75k points) in mid-June, well before this change goes into effect.