Digit.co has been getting a lot of buzz recently, mostly in the personal finance blogging circles. I’m a big fan of anything that encourages or helps consumers to save, so I thought I’d give this new site a thorough review to see if it’s actually worth using.

Contents

What Is It?

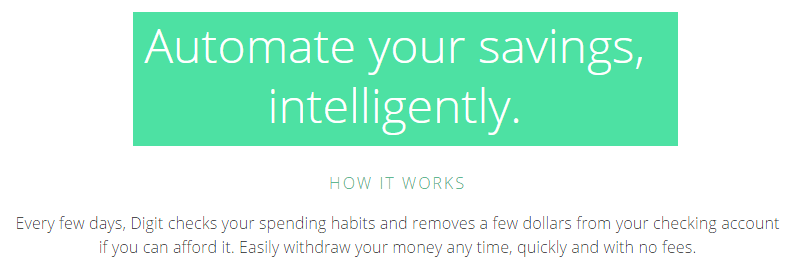

Basically Digit is an account (FDIC insured) that you link to your checking account, it then “studies your spending & income history to predict your cash flow”. It’ll then check your account every few days to see if there is any excess money that could be saved (these are usually small amounts of a few dollars, but can be as much as $50). If it finds any excess money that it thinks you won’t need, it’ll withdraw it to your Digit account.

Every week your sent a text with how much money you saved that month and how much money is in your digit account. You can withdraw money to your linked checking account by sending a text to digit. It takes a business day for those funds to then be released to your checking account. You can also watch their sleek video below:

Digit from Hello Digit on Vimeo.

Fees

Digit is a free service that does not currently charge any fees. If they overdraft your account, then they will pay the overdraft fee (although I assume they don’t pay the fee if you overdraft because they withdrew too much money).

How They Make Money

Digit make money by earning interesting on all of the funds in peoples Digit accounts. They do not offer any interest to users and as such they can earn interest on those funds.

Safety

Whenever somebody wants me to link a financial account, I am always cautious. They state that:

- They use 256 bit security

- They do not store your bank login information

- That all “personal information is anonymized, encrypted and securely stored”

They’ve also received a large amount of venture capital funding ($2.5 million) from some fairly big investors.

Why I Don’t Like Digit

There are two main reasons why I don’t like digit:

- The account does not earn any interest. In the long run compounded interest adds up quickly, consumers are missing out on at least 1% APY and even up to 5-6% APY if they used a rewards checking or prepaid account.

- It encourages consumers to be inactive in their spending, savings & budgeting decisions. I’m a big believer that the more aware a consumer is of their spending & saving decisions, the more likely they are to make good decisions. If you know you’re spending $300 a month on coffee, it’s much easier to cut back on those purchases. By automating the savings side of things it encourage peoples to only save what Digit thinks they can afford, without thinking about the big picture. This is why I think budgeting programs like “You Need A Budget” are better than automated services like “Mint”.

I think the first point is the most important and something I’d like to expand on a bit more. Let’s assume that Digit is able to find $50 in money that you could be saving every week, let’s also assume it does this for five years. Let’s look at how much money you’d have if you had that in your Digit account compared to an account that earns 1% APY, 2% APY or 5% APY.

| Digit | 1% APY | 2% APY | 5% APY |

| $13,000 | $13,329.17 | $13,669.46 | $14,761.30 |

As you can see, even when the interest rate is only 1% for 5 years, there is a difference of $329.17 – that might not sound a lot but it’s over six weeks of saving at $50/week. Obviously the higher the interest rate gets, the worse this gets. When you get to 5% APY, the difference is a staggering $1,761 or 35+ weeks of saving at $50 per week.

If you look at a longer term, things get even worse at compound interest really starts to take affect. Let’s look at the same numbers, but increase the term to 25 years.

| Digit | 1% APY | 2% APY | 5% APY |

| $65,000 | $73,838.58 | $84,313.16 | $129,388.86 |

Suddenly even the difference between digit and a 1% APY account is $8,000, an account with an APY or 5% is almost double that of digit. Now obviously some people will point out that you can simply withdraw money from digit at any time and put it into your savings account. My rebuttal is that Digit is relying on you not to do that, that’s how they plan to make money. Given that this is supposed to make things hands & think free, I imagine a lot of people will leave money in their Digit accounts for a long period of time.

As I also mentioned earlier, the more involved you are in the savings process the more likely you are to get a positive outcome. The more you understand about your finances the better. I’m not against automating your savings, in fact a portion of my pay check goes into a high interest checking account automatically.

Referral Program

Digit offers a pretty generous referral program. For every person you refer you will receive a $5 bonus once they link a bank account. In the past they’ve also offered a $5 bonus for person signing up, but this isn’t currently active. You can share your referral links in the comments, but you must retweet this tweet first. Make sure you link us to your tweet in the comments otherwise your referral link will be removed.

If you don’t use a referral link, you will be added to a waiting list and won’t be able to sign up immediately.

Final Thoughts

This is an interesting concept and I am sure some people will use it and love it, I personally will not use or recommend it. Spend some time working out where you’re currently spending your money, where you can cut back or reduce your spending and then focus on how much you can save on a paycheck basis, automatically get this sent to a high interest checking account and you’ll be in a lot better finance shape than you will be by trusting Digit.

For readers that have been unable to save in the past following this strategy, it might be worth giving Digit a try to see if there are ways it can curb your spending and increase your savings automatically. Hopefully after seeing the savings stack up the benefits will become more apparent and you can transfer those savings into a traditional interest bearing account.

Have you used Digit before? If so, let me know what your experiences are in the comments. Am I being too hard on this service? Why/why not?