Update 11/5/21: Card now has a $200 sign up bonus. ($200 bonus is on the personal version of this card as well.) Hat tip to reader Tsarinax

Original Post:

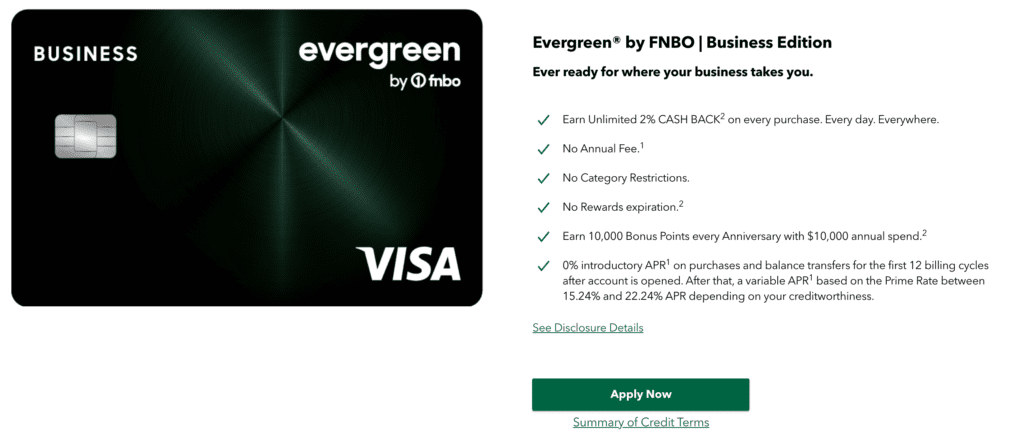

FNBO has various 2% cards which we’ve written about before. Reader Julian reaches out to let us know about another FNBO option called the Evergreen Business Rewards Visa card. The card has no annual fee and earns 2% back on all purchases.

FNBO does not report their business cards to personal credit bureaus, so some might find this 2% useful.

Even more interesting, the card offers an annual bonus of 10,000 points if you spend $10,000 during the year. That ends up at 3% earning rate on your first $10,000 spend and makes the card a little more interesting than a standard 2% card.

Also has 6 months of 0%APR, which in this banking era increases the value of the bonus. Used dummy zip, have prior relationship with personal cards, and got this message: “Thanks for applying.

Your application has been submitted. You should receive written status of your application in 2-4 weeks.”

any lucks?

DP: tried applying using a dummy zip, pending after application. got email saying decision is made, system could not find the application info yesterday, waited till today and check, declined. So, didn’t work for my case. Also could not find the pre-qualification page for the biz card either. too bad.

Denied. Letter said out of service area. No HP

Chicago area apparently

same here. didn’t work. too bad

It’s $200 bonus for spending $3000. not worth it.

2nd Biz card approved! Got personal+biz visa last year, appears I’m out of footprint this year but used snailrock’s tip below and input a nearby zip into the prequalification tool. Tool said approved, finished app and approved for exactly the amount tool stated. EQ pulled

I just got an offer in the mail same 200/1000 and it is for the personal card. I dont think I can put 10k on this card in a year. Was looking for a general 2% card anyways, so just going to apply for the personal one

Has anyone tried applying using a qualifying zip code for this card, but then their own on the application? It doesn’t give an error when using your real zip (outside of where they issue this card) during the pre-qual step… Tempted to see if I’d get approved, but worried it might be a hard pull for nothing.

Note that it appears this is now being issued as a World MasterCard Elite (according to picture here: https://www.fnbo.com/small-business/credit-cards/evergreen/), but they’ve restricted geography on applications. I asked to change my Visa Card to a MasterCard, but they declined. Relevant for Plastiq purposes because MasterCard can be used for some categories other issuers can’t.

anyone got the 10k spend extra 100 bonus yet? or need to wait for the 12th statement to see it??

so far still didn’t see the extra 100 bonus. i guess will wait till end of the year and check again.

DP: 10k points received today, exact 1 yr from date of opening.

I feel this post is a bit misleading and should be updated. This card isn’t a 3% cash back card if you spend $10,000 in one year to get the bonus. It is only a 3% cash back card if you spent exactly $50,000 over five years and exactly $10,000 in each of those five years. This is due to the fact the card’s “cash back” earned can only be redeemed to cash in $25 increments. If you stick with it 5 years and that all works out for you, then that’s fine. However, cashback cards have certainly changed rates and terms in the past: and FNBO cards change terms every 2-3 years it seems. Please update “That ends up at 3% earning rate on your first $10,000 spend” to something like “That ends up at 3% earning rate on your first $10,000 spend if you do this in each of five years (due to the $25 cash redemption increments)” instead.

I don’t know why you’re talking about 5 years. If you spend $10,000 in the first year, you’d get 50,000 points (10,000*2 + 20,000 signup bonus + 10,000 bonus for spending $10k). 50,000 is a multiple of 2,500 so you could redeem all of the points, and it would be like you got 3% on the $10k of spending, plus the $200 signup bonus.

If you were talking about future years (where you wouldn’t get the signup bonus), spending $10,000 would give 30,000 points, which is also a multiple of 2,500. If it was some other situation where your total number of points wasn’t a multiple of 2,500 I would probably treat it as giving a little less than 3%, rather than spending on it for 5 years to try to get exactly 3% (though, I don’t see how this scenario would even happen; each year that you spend $10,000 would increase your points by a multiple of 2,500).

OOS DP: Applied online as an existing cardholder (Getaway via a targeted mail offer) by putting a dummy ZIP code in the prequalification tool. Got the “You will get a decision by mail” message, approval email the next day. Glad to avoid the call

For other info: 4k projected biz income, put under 1k for checking account balance, relatively low personal income. Pulled Experian.