Chime Checkbook

Chime just rolled out a new feature called Checkbook which allows you to write checks fee-free from your Chime account to pay businesses or individuals.

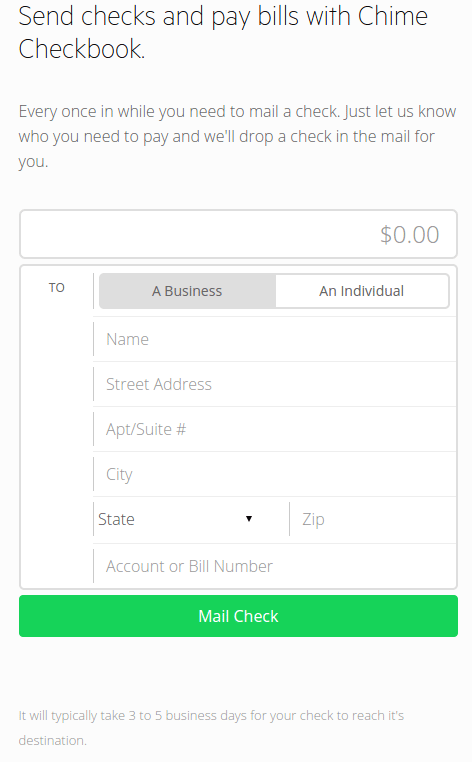

Here’s a look at the feature:

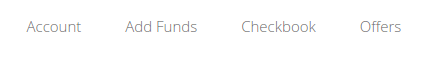

You can access it at the top-right of the home-page, in between the “Add Funds” tab and the “Offers” tab.

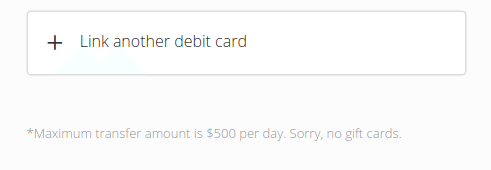

Chime allows loads of up to $500 per day from a debit card.

It used to be only $200, but it was quietly raised a few months ago. [UPDATE: Mileswhip tells me that his account is still limited to $200 per day. This is also what it says in Chime Support. And from the comments to this post, it seems that everyone besides me has the $200 limit. Let us know if your account has a $500 limit or a $200 limit.]

If you have a debit card that earns points, you can load up your Chime card and then unload by writing a check to pay, for example, your mortgage or a credit card bill.

Frequently Asked Questions

Here are some more details from Chime from Chime support (go to support and search ‘Checkbook’):

- Max check amount is $2500.

- No fee for using Checkbook.

- Funds are removed from account immediately.

- Typically takes 3-5 business days for check to reach destination.

- If check isn’t cashed, funds will be returned to your account after 180 days.

- You can cancel a check by calling 1-844-244-6363. Funds become available the next day.

The Old

It has long been possible to manufacture debit card spend with Chime. But it wan’t especially useful ever since they added a 3% fee to load your Chime account with an ‘irregular’ debit card. For example, gift cards, Paypal debit cards and presumably Buxx, all have a 3% load fee. However there are some debit cards which earn rewards and don’t have a fee on Chime. For example, the UFB Direct card can be used to load Chime with no fee and will probably earn rewards. Same for the Suntrust debit card which is probably fee-free on Chime and hopefully earns rewards. [UPDATE: Reader Sergey reports that Suntrust does not earn points on Chime.]

It was always possible to manufacture debit card spend with Chime using a rewards debit card, but you still had the hassle of then unloading the Chime card. You could do it at the ATM ($2.50 for $500, besides the ATM surcharge fee) or you could use it to buy money orders or load Bluebird/Serve.

Since the rewards on debit cards are usually lackluster, it wasn’t necessarily worth the hassle of unloading in order to accrue the ‘meh’-points.

The New

With the new Checkbook feature, the hassle is much less. All it takes is loading $500 per day and then unloading by writing a check from Checkbook. All while in your PJs. This could make it more of an option to use for racking up debit card rewards without the hassle of unloading.

To be clear, there’s nothing game-changing here, since it’s only an option for the few reward debit cards out there. But it’s a new, interesting option and I think that some people would find it worthwhile.

It’s also now a much more attractive option for the use of meeting a transaction threshold – some bank accounts require a certain number of debit card transaction to remain fee-free. Since Chime has a $25 minimum load amount via debit card, you’d end up with a nice amount of money in your Chime account which would have to then be unloaded. With the new feature, you can just pay a bill with Checkbook, making it a viable option. (See more option in this post.)

Caution

Just a couple of things to remember:

- We don’t know how sensitive Chime is to constant load and unload. I’ve never heard that they made any problems, but the limits used to be just $200 and it was more recently upped to $500, so it is a possibility.

- We don’t know if they’ll have special sensitivity to unloading via check. They write: “every once in while you need to mail a check”. My guess is that they’re just trying to be 21st century and not make a big deal out of checks, but they do say that “every once in a while” terminology.

- The easiest way of using Checkbook would be to write a check to yourself and deposit it in your regular checking account. (Better yet, deposit into your Suntrust/UFB/whatever rewards checking account.) But it’s possible that they won’t like people writing checks to themselves.

- If you’re paying a bill with Chime, it makes sense to start small and make sure that the check is sent properly. They do say that they’ll write the account/bill number on the check, but this is unchartered territory and extra caution would be prudent.

- Of course, we always have to beware of any sensitivities that the debit card may have. If you’d do $500 per day, it would be around $15,000 per month and it’s always possibile that they won’t be happy.

Final Thoughts

It’s interesting to see them add this Checkbook feature; seems they’re trying to become a real checking-alternative, similar to what AmEx is trying to do with Serve and co.

Personally I don’t have Suntrust or UFB Direct debit cards, but I have a card from my local bank which gives around .4% rewards for signature purchases. Of course I don’t use it for ordinary purchases since I could earn five time that by paying with a 2% cashback credit card. But it’s still useful for an occasional debit-only transaction. For example, it earns points for sending money with Square Cash.

Anyway, it was never worth my while to manufacture debit card spend with Chime at .4% profit, but with this added Checkbook feature I’m now considering it.

Let us know in the comments if you’ll be using Checkbook.