Update 3/17/24: They are now offering their Novus checking with 6.00% APY for 6 months on up to $50,000. Requires direct deposit of $1200 within 60 days of opening. A monthly $1,200+ direct deposit is required to keep the 6% boost; otherwise you’ll get the base rate of 4%.(ht to reader PaulinTexas)

Update 6/9/23: Seems Primis went and froze everyone’s some peoples accounts, no one really knows what’s going on. Readers suggest filing CFPB, FDIC and BBB complaints against them to spur some action.

Update 2/17/23: They are now sending out an official email confirming that the 5.03% rate will remain (at this time) for those who got the account while that rate was being advertised.

Update 2/16/23: Rate has been cut to 4.35% for both accounts. Find higher APY accounts here. For now the reps are saying that this change only applies to new accounts, and existing customers will continue to get the 5.03% rate.

Contents

The Offer

Primis Checking | Primis Savings

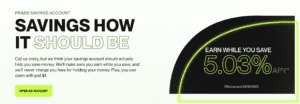

- Primis is offering a 5.03% APY on their fee-free checking account with no minimums and no requirements.

- Primis is also offering a 5.03% APY on their fee-free savings account with no minimums and no requirements.

Primis Bank is FDIC insured.

Our Verdict

The 5.03% savings rate tops all rates on regular savings accounts and even tops all CD rates, at the time of this writing. What I find even more remarkable is the 5.03% rate on a checking account – those rarely offer any interest at all. (See this outdated post from a few years ago.)

I don’t know much about Primis Bank but thought it worth creating a dedicated thread for discussion and reader reviews. Both of these accounts are fairly new to us (though it’s possible they’ve been around for a while and under the radar). Feel free to share your experiences. The biggest question mark is whether they’ll maintain a high rate in the long run, relative to the market.

Hat tip to reader CO

for folks who already bank with primis, are you able to open additional novus checking still (or is it discontinued)? i have a savings with them but they took down novus before i had a chance to open one, wondering what the process is/if they’ll honor it for existing customers still

nope

Novus has been gone for everyone including existing customers since the end of November last year.

Does anyone know what is the default rate for Primis Novus checking after the 6% 6 month promo is over and also for funds that are in excess of $100k while the promotion is on? I called them twice and keep getting different answers. First guy said 5% and I was like no way please check again, then it became 4.20. Second call they told me 4 which seems more realistic to me.

So it seems to be better to open a new simple savings account at 4.35% rather than going over 100k in Novus account, right?

Hello 🙂 I was going to tag you in my question but then thought let me not bother you too much. Thank you and I hope you are back to running around.

Im going to try open a Savings account tonight with Chex frozen. With everything else going down, 4.35% seems pretty competitive.

Let me know how the opening process has changed. Good Luck 🙂

Tried myself online and there is no option of opening a new account while logged in

And from outside, it showed me 2 options and noting for existing customers

I AM A NEW CUSTOMER

I’VE ALREADY STARTED AN APPLICATION

Looks like something has changed since I last tried this. Earlier there was a separate logon for account application website and I just did all my accounts through that. When I try now and log in, it just says you have no pending applications and then takes me back to the above 2 options.

So I just called in, first lady said you have too many accounts let me check if you can open more so I just hung up on her 🙂

Second one took the info for the digital team, I asked her to add beneficiary as well, lets see what happens

they’ll prob make you thaw chex- i applied for savings with it frozen around this time last year and they made me thaw before opening

Just got an email from them

If the account requirements are met during the preferred rate period, and your daily balance is $100,000.00 or less, the interest rate paid on the entire balance will be 5.84% with an annual percentage yield (APY) of 6.00%.

If the account qualifications are met during the preferred rate period, a variable interest rate of 4.41% will be paid only for that portion of your daily balance that is greater than $100,000. The account APY will range from 4.50% to 6.00%, depending on the balance in the account.

When account qualifications are not met and/or after the preferred rate period ends, the variable interest rate paid on the entire balance in your account will be 4.41% with an APY of 4.50%.

Determination of Rate At our discretion, we may change the interest rate on your account.

• Preferred Rate1 – If the account requirements are met during the preferred rate period, and your daily balance is $100,000.00 or less, the interest rate paid on the entire balance will be 5.84% with an annual percentage yield (APY) of 6.00%.

• Above Cap Rate1 – If the account qualifications are met during the preferred rate period, a variable interest rate of 3.93% will be paid only for that portion of your daily balance that is greater than $100,000. The account APY will range from 4.00% to 6.00%, depending on the balance in the account.

• Base Rate1 – When account qualifications are not met and/or after the preferred rate period ends, the variable interest rate paid on the entire balance in your account will be 3.93% with an APY of 4.00%.

My current Primis Savings account has a 4.4% APY. My plan on 5/16 (end of my promo period) is to move the funds from my three Novis accounts to the joint savings – if the Novus rate ends up being 4.5% APY I’ll move funds to a joint Novus account, but I’m not holding my breath.

At that point I’ll be in the market for another high yield savings account and will take a closer look at Evergreen Wealth – currently 5% APY, $25K. I also have the 4.6% APY Wells Fargo Savings that I’ve kept around & will be good until August or unless I decide to close it beforehand.

The thing is that even if I have it in writing it does mean anything as it is a variable rate 🙂 And 4.5 seems too good to be true like you said.

So your 4.4 APY is the same savings account type that is available on their site now at 4.35 APY with you being grandfathered, or is it called something different?

Sounds like a good plan. Even though I absolutely hate Marcus, I keep on falling back to them as I keep getting referrals and the rate is a decent 4.75 including referrals.

Hi PaulinTexas Finally got someone decent today who helped me open the Savings account. She apologized for all the “variable” rates I was getting quoted and said she will try to get me 4.40% (grandfathered rate) for my new Savings and she did.

PaulinTexas Finally got someone decent today who helped me open the Savings account. She apologized for all the “variable” rates I was getting quoted and said she will try to get me 4.40% (grandfathered rate) for my new Savings and she did.

But as expected the base rate o Novus in 4.00 and not 4.50 🙂

Btw, have you looked into this

https://primisbank.com/extendedfdiccoverage/

Looks like we are already opted in by default but there is an option to opt out.

Yes, I have looked at the extended coverage but never plan on taking advantage of it. I don’t like the risk of keeping all your eggs in one basket, so I prefer to diversify.

I am wondering how much visibility they give you about the accounts at the other banks like do we get direct access to those other accounts like MaxMyInterest or is it all behind the scenes like Raisin. If it is the later, then no way I am going near it. If I find some more info on this, I will share with you

Are your Primis funds in the savings account?

I think I have a month or so more before the 6% ends. I have some tiny bit in the Savings (I just move the interest there and leave it there) but mostly in Marcus (4.75%). I think I saw an email about regarding your comment about Evergreen in the other thread, I marked it but havent read the details yet. My Roger is mostly empty right now, moved whatever I had moved there back to Marcus.

Hi PaulinTexas How are you? I have been out of loop for a while. Guess what, I moved out my primis earned interest on June 16th but totally forgot that was the day my 6% was ending. Just realized it today that the rate had changed. I should have at least moved the money internally to Primis savings which is paying 0.4% more than novus checking. Just did that today. Now reading your posts about Evergreen. Seems like they provide direct access to the account numbers which is great. May I ask how much are you trusting them with? I have more than 250k. I didnt see any post about beneficiaries so not sure if fdic insurance can be increased that way

PaulinTexas How are you? I have been out of loop for a while. Guess what, I moved out my primis earned interest on June 16th but totally forgot that was the day my 6% was ending. Just realized it today that the rate had changed. I should have at least moved the money internally to Primis savings which is paying 0.4% more than novus checking. Just did that today. Now reading your posts about Evergreen. Seems like they provide direct access to the account numbers which is great. May I ask how much are you trusting them with? I have more than 250k. I didnt see any post about beneficiaries so not sure if fdic insurance can be increased that way

For me currently Marcus is at 4.65 and so is Roger, so not that attractive, and the best Primis is 4.40

Also, did you look into this new Hustl thing, not sure how long will that rate last?

I zeroed out all of my Primis checking accounts and Primis automatically closed them within a month. That made it easy! Now I only have the joint savings account.

I too have been out of the loop for a while. Right now, I only have $250K with them. That’s right, I’ve added beneficiaries in the past. That would be especially useful since they don’t offer joint accounts. I’ll contact them to find out the options and to verify additional beneficiaries are passed on to Coastal Community Bank in order to increase FDIC insurance. I’ll let you know what I find out. I put in a request and should hear from someone tomorrow.

I called them about beneficiaries today and the form that they sent me allows 5 on savings and 4 on checking (a bit weird)

I had the same question that you mentioned above i.e. if the beneficiary info is passed on to the actual bank for fdic insurance purposes. They said someone will reach out to me with an answer.

The other thing I noticed is that the beneficiary form had the account number for the savings. Should I try linking it with Customers or LCB to see if it is a real account number and has ACH access? 🙂

I am also thinking of waiting on Hustl, I think it might end up like OnPath or whatever that CU was which lasted only about a month and a half.

For those who have a Primis checking account from a few years back (the original 5.07% APY), what’s your APY today?

I opened their checking account when they first offered the product so I have a grandfathered rate of 4.4% APY. Slightly higher than their current advertised rate of 4.2% APY.

Gah, I actually used to have an account with them too years ago. I should’ve kept it open — rate for me was 5.07% back then. Re-opening would knock me down .20%. Not a huge deal I guess. Curious, is your savings rate different than the 4.35%?

I only opened their checking account, not their savings. Back then, both their checking and savings had the same APY. Now I see it’s 4.2% APY for the checking and 4.35% APY for the savings. So I do not know if they have a grandfathered rate for their savings and what that might be. Maybe someone else who does have one can chime in.

I have grandfathered checking and savings which were 5.07% when I opened years ago. Now they are both 4.4% APY.

What’s grandfathered about them if the rate went down?

They send email to me when they lower my grandfathered account rates. What I get is usually a little higher than on advertised Primis website rate. But their email will state what exact rate I get.

I guess their current savings is 4.35% APY so they are giving additional 0.05% for grandfathered making it 4.40%

Anyone use their high yield checking and have thoughts about it to share, positive or negative?

I use them as one of my two hubs.

Positives:

(1) Excellent, US-based, 24-hour CS. On the couple of occasions I had issues that regular CS could not solve, I was able to reach C-suite executives at the bank to get them resolved, Can you imagine being able to email execs at most banks and have them get back to you within a few hours?

(2) They reimburse wire transfer fees charged by other banks and pay you an additional $10 for incoming domestic wires. A very useful feature in this hobby that makes it easy to move large sums back to the hub when a particular bonus is finished. (Outgoing domestic wires are $5, which is mildly annoying but not the end of the world.) Obviously, this feature should not be abused or they will discontinue it — but a nice cherry on top a few times a month.

(3) Their APY for the checking account is consistently very good. Not the absolute tops, but good enough for a hub from which I move money out consistently to do bonuses.

Negatives:

(1) An annoying limit on outside linked accounts. You are allowed three outside accounts per Primis account per account owner. So, to use us as an example, I have a joint checking account with P2, and each of us also has an individual checking account. That allows us to link 6 + 3 + 3 = 12 different outside accounts between us. Probably fine for most users, but not enough in this hobby.

(2) Linking has to be done by Plaid, which I hate with a passion. So I usually link using my other hub, and then wire to Primis for the $10 moneymaker.

(3) A couple of years ago, they had a security incident that resulted in many people’s accounts being frozen for several days. You can read about this in the comments below from June 2023. This was before my time, but caused some people to swear off Primis.

I read from someone here on the new banking platform they no longer limit to only 3 external accounts, though maybe it doesn’t apply to older accounts and only to new ones?

But apparently a lot of other institutions have trouble recognizing Primis. And plaid only linking kills a hub imo, way too restrictive without a old fashioned backup

I’m just curious, what is the 2nd hub that you use?

And you can also do intra-bank transfers to family member accounts by phone (this is also true of Primis). Banks like Capital One and Discover do not allow this, which is super annoying.

Now you made me feel bad about closing my CIBC Savings account years ago. 🙁

Do you mind sharing the positive and negatives on CIBC as a hub as I’m 99% sure that you have knowledge of it?

Last time I checked, the hold time after the new-account probationary period ends was 3 business days, which is better than CIT’s, of course. If your account is new, the hold time is considerably longer, unless that policy changed. I do not remember how long they consider an account to be new, but hopefully it’s not the excessive 90-days Roger forces.

So, for the most part, I have nothing negative to report about CIBC as a Hub Bank.

I just checked and the account is currently at 4.21%. That’s decent but still lower than LCB. I have the following questions.

#1. Do they credit interest for deposits initiated on their website right away like LCB, PenFed and LOB does?

#2. Do they offer next day pushes? If so, are the funds removed immediately like with LCB or not until the next day like AAB?

#3. midas89 mentioned their monthly limit. What is their daily and weekly transfer limits?

#4. Any negatives that bother either of you?

(1) No, interest is not credited until the money arrives. Annoying, but I am usually moving small enough amounts by ACH that it’s not a lot of lost interest. Large amounts get moved directly by wire.

(2) Funds are removed when the push starts. I have not paid attention to see whether they are always next day, but they usually are.

(3) $125k daily, no weekly, $250k monthly.

(4) The issues you flagged in (1) and (2) are the most annoying, but there is no perfect hub.

You are certainly right about there being no perfect hub. However, I doubt that will stop midas89 and me for looking for one. 😉

midas89 and me for looking for one. 😉

How do you send wires from CIBC Agility? I can’t find a way online.

TIA!

Curious, if you were starting today, would you choose Primis or CIBC if you were only picking one?

I actually have used both Primis and CIBC extensively over the past couple of years.

CIBC is a much better hub because of higher transfer limits, allows you to link accounts via trial deposits, and more external account connections. Primis only allows you to connect to accounts through their buggy Plaid system, no trial deposit option.

The main advantage Primis had a couple of years ago was it’s APY was significantly higher than CIBC, however, now that gap has narrowed (4.35% APY for Primis Savings vs 4.21% APY for CIBC). If I had to choose between the two today, I’d pick CIBC as a hub if you plan on doing a lot of transfers with many linked external accounts.

Is it true that CIBC offers free outgoing wires? Also, maybe CIBC being bigger and more established might remain competitive long-term whereas we’re not sure what Primis will eventually do?

There’s a $200 bonus for their checking account. I wonder if it offers atm refunds.

Thanks! What is agility anyway? Their online only division?

Agility is the online HYSA.

One more question if you don’t mind. Last one I promise. How’s the mobile app? Easy to use?

I have never used their mobile app. Hard to believe, I know, but I am from a generation that came of age before smartphones, and, while I use them, I prefer laptops and desktops.

However, I will say that CIBC’s website is rather clunky and old-fashioned. So I would be surprised if their app was particularly slick.

I’ve never sent a wire transfer from CIBC. However doing a quick search, it looks like the outgoing wire fee is $30-$80 depending on the amount being sent. I actually don’t see any option to send a wire in my CIBC online banking portal, so perhaps the others that mentioned free wires know something that I don’t.

As for your second question, CIBC is definitely a bigger bank than Primis. I’ve had many issues with trying to link Primis to other banks and vice versa through Plaid and I think a lot of this has to do with Primis being a smaller bank and other institutions not recognizing them.

Wires are only free if sending from the Agility account — but that’s the account everyone here would have anyway because that’s the HYSA. I’ve done many free wires, so am 100% sure this is true.

Wires have to be done by phone. No online option.

Thanks for letting me know! Yes, I have the Agility account from back when they offered their promotion at the end of 2023. This is a big plus and something I’ll keep in mind going forward.

They work well together because CIBC has free outgoing wires and high ACH limits, and Primis reimburses wire transfer fees for incoming wires. Neither is enough by itself.

I’ve been using Primis and CIBC together as well for the past couple of years.

Just applied for an account at Roger which is currently under review. I know they have really low transfer limits, however at 5% APY, I’m willing to just push in funds using external accounts and use them strictly as a savings account with minimal withdrawals and transactions.

If I don’t get approved for Roger, I do have the elevated 4.5% APY with CIT savings as I’m currently doing their savings promotion. However, I have a grandfathered 4.4% APY rate with my Primis Checking so not sure if it’s worth me transferring everything over just for a 0.1% APY gain.

My general MO is to not let funds sit at the hub for more than a month or two between bonuses, so I don’t feel like I need to squeeze every last basis point in interest out of the hub. I care more about customer service and being able to do what I need to do — and the Primis + CIBC combo has worked well enough for me.

Ah ok! Bummer! Appreciate the information.

Does anyone know if Primis provides the ability to locking/freezing the debit card?

At first I didnt activate it, thinking I will do that when needed. But if you dont they cancel it without any notice.

I called them and the agent told me there is an option right next to the + icon at the bottom of the home screen in the app. I see that icon, it looks like a card but when you touch it, it just provides the “Contact Us” info which is a bit weird.

Thanks. I meant the one right next to the + circle in green, towards right of it. The icon looks like a card but below the icon it says Contact Us. The agent told me thats where all the options to control your debit card are.

After my card got cancelled, I ordered a new one just to have one handy and I activated it on Friday. The agent was also saying to give it some time in case the system hasnt realized that I now have an active debit card but it still is the same

Thats cool. I ask you so many stupid questions that you have already answered 🙂

No, we couldnt find it anywhere on the app or the website so far.

I called them on Friday at around 1 AM and this agent was also the curious type and kept looking and looking as her documentation said they have this functionality, then she called me back at close to 2 AM as I told her I would be up for a while and said this is where it should be. I am guessing this is where it would be and that they havent implemented it yet and it is just a place holder.

I was wondering if the old interface (which I never saw) had it, like the ability to add beneficiaries, etc.

Just FYI, make sure to activate your debit card as soon as you get it. This morning got a bunch of debit card cancelled emails as I had kept them aside and didnt bother to activate them

What is the current rate for the Novus Checking accounts that has been past the 6-month promo?

TIA.

you mean 4.41% Rate. It’s very nice that it is actually higher than all current checking and savings they offers!

Sorry fat fingers – Yes – 4.41% APR

Their current 6% preferred rate is still in effect for those of us still in the 6-month promotion window…at least for now.

Thanks! You’re awesome PaulinTexas

PaulinTexas

Curious, what are your rates now?

Effective 1/10: Premium Checking rate reduced to 4.31% / 4.4% APY.

Sorry, missed your message earlier. I searched through this whole thread when I was setting mine up and saw DPs about these working

Schwab, Treasury Direct (both already mentioned by Paul), Fidelity brokerage or CMA and Chase. If I were you, I would use Chase as the last option but Bulba recently confirmed again that it works

People who have done the novus promotion, how long did it take to update the APY to 6% on the app/website after DD? Thanks.

Thanks! it did today