Update 9/17/25: Reposting since all the changes went live. If you already spent $10k during this statement period, you’ll only earn 2% on purchases until your next statement begins. Note: since the change, the 4% is only reflected after your statement close; initially everything will show up for everyone as 2%. (Some readers who got the ‘Bad Nerf’ letter were initially seeing in their login ‘Good Nerf’ info with U.S. Bank apparently counting investments for the 4% qualifications. However, apparently that got updated today with the ‘Bad Nerf’ details.)

Update 8/1/25: Reposting as this has now been sent out via email as well. It appears confirmed that there are two groups of nerfs, one group who can still count their investment account and one group who can not. No one knows what causes someone to be in the ‘good nerf’ or ‘bad nerf’ group.

Update 7/27/25: Some cardholders have received letters that are actually different than what is listed below and actually requires a $100,000 balance in a checking account to earn the 4% (rather than $100,000 in checking, savings and investment). Hat tip to bogleheads

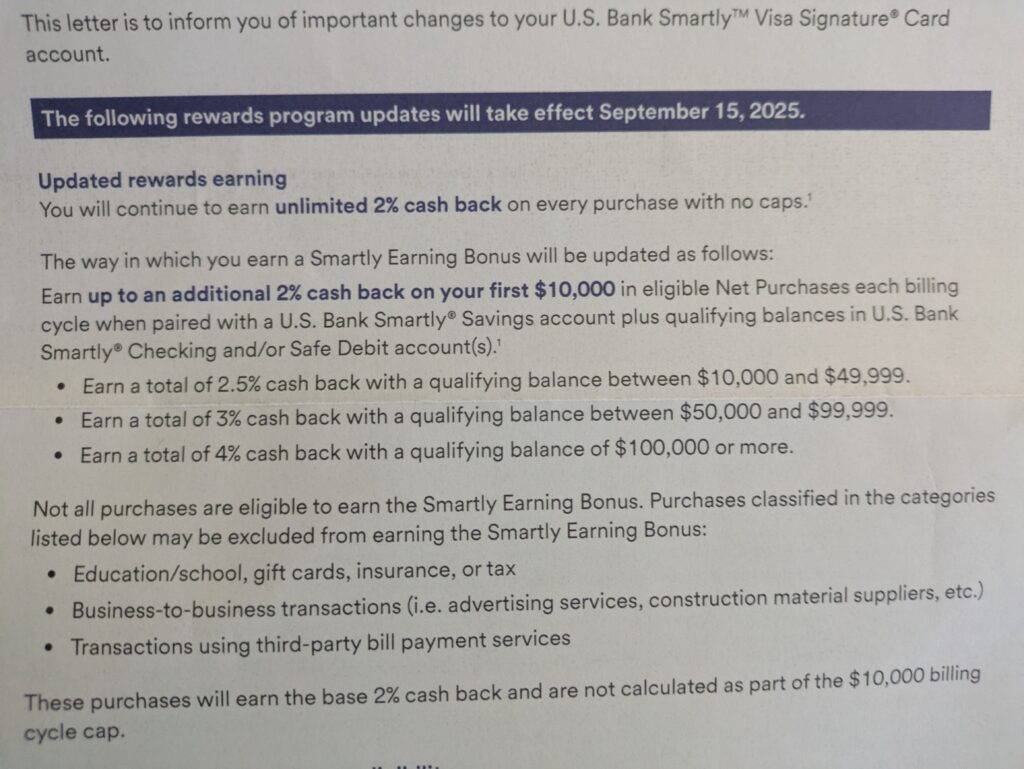

Original post: Earlier this year U.S. Bank made huge changes to the Smartly credit card, but the changes only applied to new applicants and existing cardholders were grand fathered in. Existing cardholders have now received a notice that this is changing, starting on 9/15/25:

- “earn unlimited 2% cash back on every purchase with no caps”

- “earn up to an additional 2% cash back [the “Smartly Earning Bonus”] on your first $10,000 in eligible Net Purchases each billing cycle when paired with a U.S. Bank Smartly Savings account and average daily combined qualifying balances in U.S. Bank deposit, trust or investment accounts” with $100K+ in qualifying balance required for a total of 4% cash back

- exclude* certain categories of purchases “from earning the Smartly Earning Bonus”: (1) “Education/school, gift cards, insurance, or tax”; (2) “Business-to-business transactions (i.e., advertising services, construction material suppliers, etc.)”; and (3) “Transactions using third-party bill payment services.” “These purchases will earn the base 2% cash back and are not calculated as part of the $10,000 billing cycle cap.”

Surprised they didn’t make these changes earlier in the year to be honest, this card was never sustainable.