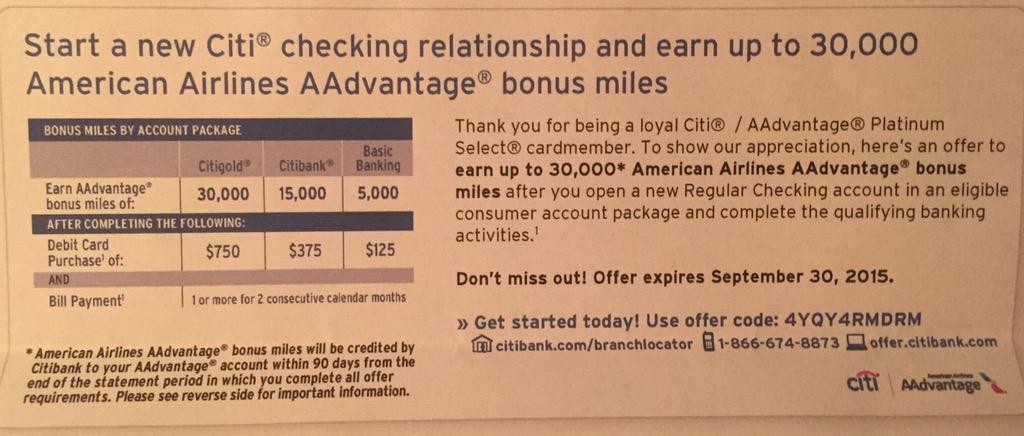

We just posted about the return of the Citibank 40,000 ThankYou point checking bonus and gave you four reasons to sign up, we have some additional good news. The 30,000 American Airlines Citibank checking bonus has also returned. The promotional code that you need to use is as follows: 4YQY4RMDRM. I’d recommend reading our full detailed post on this bonus, which should answer any and all of the questions you have regarding the bonus.

If you need any further encouragement on why you should sign up for this account, read this post or the quick outline below:

- You can initially fund up to $100,000 with a credit card

- You don’t need to pay taxes on this bonus

- There is no direct deposit required

- There is no hard pull

You can view a full list of all current bank bonuses here and a list of the ones we recommend here.

Hat tip to reader Justin B on Twitter

Any difference using a BOA Business Alaska card to fund? Still code as purchase? Thought I read somewhere that it might not.

Thanks!

I have a challenging situation which combines several situations: I am sure I used the code for 40k typ to apply for a new checking account in June. Just to be sure about my bonus on the card, I sent a message and got the response in a letter that I qualify for the aa 50k bonus if I do two bill payments and $1000 debit purchases. Oh, well, There is thank you point shown under the citi checking account. And it is bad that I do not have a citi aa card open when I applied the checking account in June. So any idea about how to solve the puzzle?

I opened a new account for the bonus miles and received my application package to fax in. I plan on funding my account with a Barclay’s Aviator card. My CL is 21k, and I have my cash advance set at $1. I was thinking of going with 15k to fund the account. Or, should I go with 10k just to be on the safe side. Also, is there a possibility that when they run the card I will get a fraud alert?

data point: I used 23600 out of 24000 on my boa Alaska card to fund the checking account. It went through and there was no phone call from boa.

I set my CA limit on my BOA AA Business Card and the $8000 purchase was declined. I called BOA and they said that Citi submitted the charge as a cash advance. I then called Citi back and they said they submit the charges as a purchase but BOA saw it was coming from a bank and changed it to a cash advance.

@June – Did you notify BOA ahead of time of an upcoming large purchase? Did you set your cash advance limit to $0?

Sorry for the rookie question, but I assume the credit card funding of the account can go towards minimum spend. Is that right? That would be so convenient right about now!

Yea, if it’s not a cash advance then it would work for minimum spend.

I did this offer a few months ago. However, since I had miscalculat d and had opened a citi aa less than 18 mths from closing one, didn’t get the bonus on that, the. Did this checking promo, using he promo code, but didn’t get the bonus on that either. When I asked why, they kept asking me for the email where I got the offer. Of course, I didn’t have it, and they just never gave me the bonus on the other the checking account or the card. Super annoying, and waste of pulls and min spends.

Would I be eligible for this if I had a Citibank checking account about 1-2 years ago, but was then forced to switch it to BB&T when they sold off their branches here in Texas? I wasn’t happy about the change. BB&T doesn’t really meet my needs and also I didn’t have a choice in the matter regarding my checking account changing over.

No idea, sorry. I don’t think so, but maybe I’m wrong.

Can someone please let me know if a bill pay to amex or discover credit cards meet the requirements of bill pay

HI I didn’t realize you need a Citi AA card in order to for this checking promo. I applied the citi gold checking in June.

if I applied a AA citi credit card, can I still get the 30K miles from the Citi Gold checking?? I only have a Barclay Aviator card….

Please advise and help!

thanks!!

I mean if I apply the citi AA credit card now…will I still get the 30K miles? and is it any Citi AA credit cards?

Can fund up to 100k by credit card? yikes. So what’s the advisable approach to that? Is there a risk of it being marked a cash advance or triggering some manual review? I can’t say I’ve ever attempted a 30k charge before but it’s certainly tempting here.

You can mitigate the chances of it posting as a cash advance by lowering or CA limit on the cars you intend to use to $0 or $1 as allowed. Typically Barclays cards are the most successful in posting as a purchase. Unfortunately I can’t advise on if $100k (or even $30k) is a good idea. Depends on your personal credit limit (and income to some extent). Many reports of successful funding between $15k-$25k.

lowering your CA limit on the card*

I stopped looking at these Citi checking deals a couple years ago because I thought they were issuing 1099 for “interest” earned on the bonus miles. Is that not the case anymore?

Great post though…

That is not the case anymore, or at least it hasn’t been for the past several years. I signed up for one of these in 2012 and again in 2014 — no 1099 either time.

Not the case anymore, if you read the individual dedicated posts we linked, we cover this in some detail. You basically need to earn more than 60,000 points from checking promotions before they’ll sent out a 1099-INT.

With taxes you are required by the IRS to report ALL of your income. It doesn’t matter whether it is selling items on eBay, checking bonuses, or $11 of earned interest. I don’t understand the misinformation in the blog and other sites and forums on the Internet which ADVISE people NOT to add their bonus to their taxes. To be clear, IT DOES NOT MATTER whether you get a 1099 or not. It’s part of your earned income / interest and it is REQUIRED by U.S law to report on your taxes.

Considering the 2 citi offers the TYP looks better but will kill the eligibility for the AA offer for life, hard choice, willing to help!

Not necessarily, the terms on both change some what regularly so you should be able to get the AA offer in the future with the two year wording.