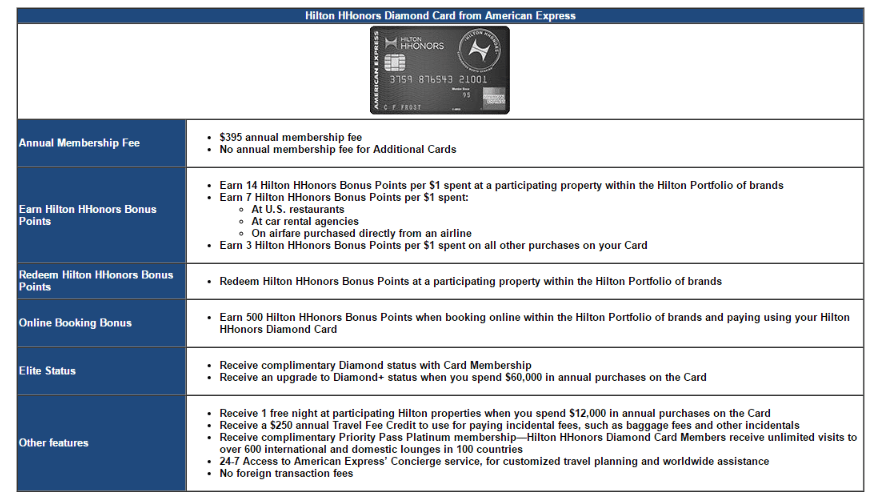

Hilton HHonors Diamond Card

American Express are considering a new card to their Hilton line up, called the Hilton HHonors Diamond Card. The idea is to better compete with the Ritz-Carlton offering from Chase. Here is what the details of the card would be:

It’s also interesting that it says this card would come with Diamond status and the ability to earn Diamond+ status (something that currently doesn’t exist as far as I know?).

No Annual Fee Card

They are also considering some changes to this card:

- 5x points on all purchases at U.S restaurants, supermarkets and gas stations (increased to 7x)

- $25 Hilton gift card with every $2,500 spent

- 50% certificate for meeting specific spend thresholds ($10,000 or $12,000)

Surpass Card

- Add priority pass basic membership

- Add priority pass basic membership + 10 free visits

- Add a travel credit of $75 or $100

- Change earning categories to higher levels

- Other random changes

Our Verdict

This information comes from a survey a reader took, obviously there is no guarantee that any of these changes will come to fruition but it’s somewhat strange they were presented with a fully thought out card in the Hilton Diamond card. It’s also weird to see mention of Diamond+ status. Obviously not all of the changes would be made to the Surpass and no annual fee card.

Hopefully American Express does launch a new Hilton card, as that means everybody would be eligible to get the card again as American Express limit you to one bonus per lifetime. What sort of sign up bonus would this card need to entice you? Would you consider keeping it long term? Let us know in the comments.

Thanks to reader Jordan C for sending through this information

Never liked Am EX, Visa is my choice. I’ll probably deal out of this change. I think someone is making a mistake. In this world of buying out and all the mumbo jumbo.. Stick with Visa………

CALLED IT.

Doc,

Any more word on this or other developments?

It would seem that this was truly in the works since AMEX was intent on securing all of Hilton’s business with its bid and the only way this card could fly were for AMEX to eliminate the Citi HHonors Reserve — which it did!

Many thanks!

Had

Haven’t heard anything yet unfortunately. Will update when I do.

Thanks.

If one can dispose of the travel incidentals like one can with the Platinum AMEX with various airlines, I might bite,

Any word on this? Also, can US citizens apply for the AMEX Ascend Credit Card in Canada? Wonder if one day, residency requirements can be eliminated and one can apply cross borders for a credit card in another country…what if? could a game changer…

I’m just about to ditch my AX Hilton Surpass card, because I find it totally useless since they charge forex charges and Citi’s card doesn’t. Just came back from 4 Hiltons stay in the UK. So I hardly use it; I use Citi’s Hilton card. If only they’d fix that part of the card, I’d be happy. I’d rather use Amex than Citibank.

The Diamond card sounds OK, but unless they change it so you can buy airline tickets with it, I feel that $250 credit is just annoying (signing up for specific airline, and then buying seat upgrades or airline gift cards sucks). They are just hoping a lot of people won’t bother … at least they won’t have Forex charges.

Where do you get this survey? Is it from those survey for miles or points, like those from Survey Sampling International LLC?

Hopefully they will also entice existing card members to upgrade with upgrade offers.

I’m going to have to side with abby on this one. MS is the reason why we can’t have nice things. The categories on this card are more evidence that American Express has clearly decided to clamp down on the small number of users who are gaming their system, although all the crying about points that got clawed back make me think AmEx has already been successful on that front.

Comparing this card to the Ritz Carlton card has one huge flaw: the Ritz card does not have the Marriott name on it. If AmEx really wants to rake in the cash from people looking for bling, they need to cut a deal to put the Waldorf-Astoria name on the card. If you don’t think there are a bunch of people who would spend $400 just to have a card with the Waldorf name on it, look at all the fools who beg AmEx to let them have a Centurion card.

RC technically has its own reward program. WA does not.

Damn, I love the Waldorf’s. Just stayed at the Caledonian in Edinburgh; what a lovely hotel… I want that card!!! 😀 Can sit right next to my Mercedes Benz Plat card! 😀

I’m just being silly, but the Waldorf Astoria name would up the card status a bit. Maybe they could even make it a metal card. Silly me.

I think there is a chance rumors of AMEX new trademarked “Tier 1” have to do with this possible upcoming card. Just occurred to me when I received an unrelated promotional email from Hilton about and saw them referring to their status program levels as “Tier”.

As someone who does not MS, the changes to the no annual fee card of 7 points at supermarkets could make this my go to card for that relatively minor spend for me ~ 2.8 cents/$1.00 spent is not bad at all.

Since I have Diamond thru 3/31/2018 as a result of the most recent status match, I would not consider this card until early 2018 or so — especially since sign up bonus would likely be once per lifetime.

Not going to put $60K on the card, that is for sure. But as a non-MS-er,if the carry cost is $150/year for Diamond status, I might consider the card as it would be nice to have guaranteed lounge access for the annual free night and points accumulated thru the Citi Reserve as one only wants to use those at the best places anyway where the lounge is key and prices can be high = London, etc.

Will wait and see for the Diamond card, but looking forward to revamped no fee card.

Partner and I were both targeted for the free AMEX HHonors night like Citi Reserve, but for only $1,000 spend.

AMEX needs to do something as it is being ditched by many households, including mine. Those who retain, either know the sweet spots of MRs — and are willing to live with non-US redemption partners — or are dinosaurs who still think that Platinum AMEX signifies your are an elite — like my dad. They will never learn.

In any event, I think the jury is out with SPG — they just signed a contract and I think they are playing nice with Marriott hoping Marriott does a AAdvantage like it did with Citi and Barclay’s — How else do you explain AMEX not offering 30,000 point semi-annual increase of the SPG cards, which would currently translate into 90,000 Marriott points, eclipsing Chase’s own offerings currently at 80,000?

I think that AMEX is hoping to influence Marriott to have 2 card issuers in the future — not sure it will work, but since AMEX signed up for presumably a multi-year deal with SPG, I expect that AMEX could be around for some time — hence the rumors of a Chase SPG card, as well.

Even though Hilton has a deal with Citi, AMEX’s US travel partners are really Hilton and Delta, with a minor player being Choice and that’s it!

Since HHonors has to now deal with the changed SPG/Marriott landscape and AMEX has to deal with Chase and Citi eating into their market share for high end cards, AMEX and Hilton are perfectly placed to offer a compelling card to the masses — who don’t MS.

We’ll see if they really step up to the plate.

This about sums it up:

http://blogs.barrons.com/stockstowatchtoday/2016/10/06/american-express-no-business-is-not-getting-better/

” In a digital era in which the transparency of reward values is high, and many consumers are increasing savings amid lackluster income growth, many investors have expressed concern that American Express’ high annual fee and low reward value products are no longer right for the times.”

Main problem with AMEX is they painted themselves into a corner of relying on high annual fees and very wealthy consumers spending a ton. Their MR points are now much less useful compared to Chase/Citi.