Card has been officially launched, read more about this here.

(Update 8/9/17) WSJ ran a piece on the card today. See more in this dedicated post.

A few details confirmed there:

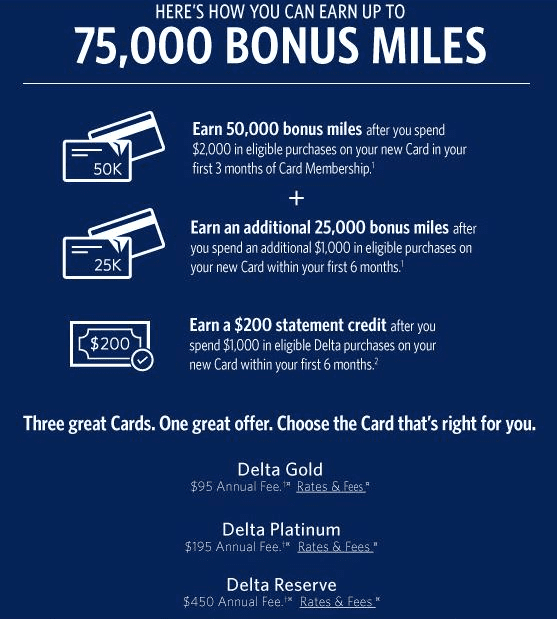

- 50k point signup bonus will have just $3k spend threshold

- The annual fee will be $95

- 1.5x everywhere and 2x on travel/dining; this stacks with Preferred Rewards

- It will roll out in September

- It will be a Visa card

- Not yet confirmed: Global Entry and travel credits

Reader SR17 just posted the below picture that looks to be Bank of America’s new premium credit card ironically called ‘Premium Rewards’.

Contents

Key Points

- Sign up bonus of 50,000 points

- Card earns at the following rates:

- 2x points per $1 spent on all travel and dining purchases

- 1.5x points per $1 spent on all other purchases

Our Verdict

This matches up with what other people were predicting, if that’s the case I’d also expect the following:

- $100 yearly travel credit

- $100 Global Entry/TSA PreCheck

- $95 annual fee

Pairing this with the Bank of America Preferred Rewards program would mean that it could earn up to 2.625x points on all purchases. This is the same as the current Travel Rewards card and apparently the points function the same as well (e.g must be redeemed against travel charges). It would also mean you’d be earning up to 3.5x points on restaurant and travel purchases. This would make it one of the best restaurant and every day credit cards when paired with the Preferred Rewards Platinum Honors status.

When it’s not paired with Preferred Rewards the card looks quite weak on the surface. At bare minimum it’ll be worth getting for the sign up bonus and then going from there based on whatever other benefits it might have. The reader that provided the image also confirmed a fall launch.

Here’s the cached site for this card. Credit to my fico site

http://webcache.googleusercontent.com/search?q=cache:https://www.bankofamerica.com/credit-cards/products/premium-rewards-credit-card/

If only you could redeem for more than just travel this card would be great. I do notice how “travel” is not in the name…here’s to hoping you can redeem for straight statement credit.

You can redeem for straight cash into a BofA account. Confirmed from an inside source.

Saw it on Reddit somewhere, can’t remember exactly. One of the daily threads.

Business Insider says that there will also be a $100 Application Credit for GE/TSA Precheck.

http://www.businessinsider.com/top-travel-reward-credit-cards-bank-of-america-vs-sapphire-reserve-2017-8/#1-bank-of-america-premium-rewards-1

Good catch. I’ll repost with this addition.

Iron Triangle – Amex Platinum, Chase Sapphire Reserve & US bank Altitude

there are many more metal cards than that so not sure what you mean.

Is it confirmed that the points can only be used for travel? Or can it be redeemed for cash?

Cash redemptions are severely discounted.

They still have inferior insurance offerings compared to Chase & Citi. It may be ok to use for dining, but I can’t fathom using it for anything else.

Let me get this straight, BOA is offering:

$500 Sign up bonus

2.625% CB unbonused spend

3.5% CB travel/dining

-$5/yr annual fee

This will last long…

The 2.6 and 3.5 is only for Preferred Rewards members. Also, it’s a $95 annual fee.

I expect it to last same as the Travel Rewards card since it helps them get loyal customers who move over real assets to the bank.

If the $100 travel credit is relatively easy to get (I.e. It works on EZPass and therefore is worth its full value) then the effective annual fee is -$5.

Also, since Merrill Edge generally offers nice transfer bonuses this could be an extra enticement to get someone to throw an IRA bone over to Merrill. I’ve considered it…no fees for 30 transactions a month is a great deal and reality is I only need like 4-8 transactions a month.

Travel Rewards PR has offered 2.625% unbonused spend since 2014, I’m sure they will keep it around.

So it’s more likely a CSP clone and not CSR clone.

I would like the $100 travel credit to offset the AF

Thank you for posting.

So, $500 cash at a minimum, and probably can churn for a bit, not a bad deal.

Cheers,

PedroNY

Yup, not sure why people are complaining. Not a long term keeper for most people but will happily take $500.

Why is everyone expecting GE and travel credits? The CSP doesn’t offer either and no one is complaining, I’d expect GE credit at most, no chance of a travel credit. Hopefully I’m wrong 🙂

It does offer a travel credit, confirmed in the WSJ image.