Contents

The Offer

Capital One ShareBuilder is offering four bonuses in the form of cash for new customers who open and fund an individual retirement account (IRA) or nonretirement brokerage account with qualifying assets.

In our Fidelity brokerage bonus roundup, we discussed the importance of choosing a quality broker before pursuing a brokerage bonus. While ShareBuilder may be overshadowed by Fidelity’s research tools and investment product selection, ShareBuilder also offers some advantages that may suit your investor profile.

- ShareBuilder offers slightly lower commissions and fees for online trades than Fidelity, at $6.95 per trade (compared with Fidelity’s $7.95 per trade).

- ShareBuilder requires no minimum deposit to open a brokerage account (compared with Fidelity’s $2,500 minimum).

- ShareBuilder accounts offer a linkage with Capital One 360 accounts to enable ease of account monitoring and asset transfer. This potentially makes ShareBuilder an appealing option for existing Capital One 360 customers.

- The financial barriers to entry for these ShareBuilder brokerage bonuses are significantly lower than for the comparable Fidelity brokerage bonuses, making these bonuses more accessible to beginner investors without investment of hefty assets.

Master List of Bonuses

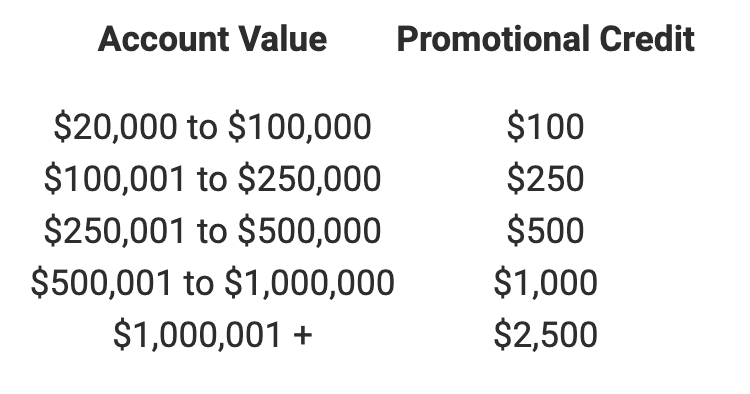

|

Bonus |

Deposit |

Receive |

Return on Investment (pre-tax guideline) |

| Deposit Bonus up to $600 |

$5,000+ |

$50 |

1% |

|

$10,000+ |

$100 |

1 % |

|

|

$25,000+ |

$200 |

.8% |

|

|

$50,000+ |

$300 |

.6% |

|

|

$100,000+ |

$600 |

.6% |

|

| $50 Deposit Bonus |

$5,000+ |

$50 |

1% |

| $50 Gift Bonus for Custodial Accounts |

None required. Execute 1 trade. |

$50 |

Variable depending on trade value |

Individual Bonuses

Deposit Bonus up to $600

There are three links to this promotion, varying only in the promotion code to be used to participate:

To receive this bonus you must do the following:

- Open a new ShareBuilder IRA or Individual, Joint, or Custodial account using a valid promotion codes instructed by one the above three links.

- Make a qualifying net deposit, transfer, and/or rollover that posts to your new account within 90 days of opening the account.

Rules:

- Offer expires 12/31/2015.

- You must have a U.S. Social Security number to open a ShareBuilder account

- Net qualifying assets are total deposits and transfers minus withdrawals. The qualifying asset amount is not affected by changes in securities value after they were deposited.

- Transfers from existing ShareBuilder accounts, or from a Capital One 360 IRA to a ShareBuilder IRA, are not eligible.

- The bonus will be added to your account within 4–6 weeks following the 90-day period.

- You may not withdraw the bonus for 180 days after it is awarded to your account.

- Qualifying assets must stay in your account for at least 9 months after the end of the 90-day period.

- Limit one ShareBuilder bonus per customer or custodial beneficiary

- Offer is nontransferable

- Offer is not valid for ESAs

- May not be combined with other offers

- You will need to pay any taxes resulting from this cash bonus.

$50 Deposit Bonus

To receive this bonus you must do the following:

- Open a new ShareBuilder IRA or Individual, Joint, or Custodial account using the promotion code MC505KIRA.

- Make a deposit of $5,000+ by 1/29/16.

Rules:

- Offer expires 12/31/2015.

- You must have a U.S. Social Security number to open a ShareBuilder account

- Transfers from a Capital One 360 IRA are not eligible.

- The bonus will be added to your account within 4–6 weeks after you complete your deposit.

- You may not withdraw the bonus for 180 days after it is awarded to your account.

- Qualifying assets must stay in your account for at least 9 months after 1/29/16.

- Limit one ShareBuilder bonus per customer

- Offer is nontransferable

- May not be combined with other offers

- You will need to pay any taxes resulting from this cash bonus.

$50 Gift Bonus for Custodial Accounts

To receive this bonus you must do the following:

- Open a new ShareBuilder Custodial account using the promotion code GIFTSTOCK14.

- Execute at least 1 online trade by 7/31/2015.

Rules:

- Offer expires 6/30/2015

- You must have a U.S. Social Security number to open a ShareBuilder account.

- Offer not valid with IRAs, ESAs, Individual and Joint accounts.

- The $50 bonus will be added to your new account within 7 days of your first executed trade order.

- You may not withdraw the bonus for 120 days after it is awarded to your account.

- Limit one ShareBuilder bonus per custodial beneficiary

- Offer is nontransferable

- May not be combined with other offers

- You will need to pay any taxes resulting from this cash bonus.

The Verdict

While the Capital One ShareBuilder cash bonuses offer a lower maximum bonus potential than the Fidelity offer, the qualifying bonus thresholds are significantly lower for the ShareBuilder offer, and for these lower deposit tiers, the ShareBuilder offer is more generous than the Fidelity offer. If you are inclined to invest with ShareBuilder but want to test the waters before wading in, opening deposits of as low as $5,000 can earn you a ShareBuilder bonus, whereas for Fidelity, deposits below $50,000 do not qualify for any of their bonuses.

The $50 bonus explicitly for Custodial accounts also provides a unique offering to help propel a young person toward developing his or her own financial savvy. It also requires no deposit commitment on the part of the adult custodian – only a single trade execution.

Quick cash goals are not the intent of these bonuses as all of the three offers prevent bonus withdrawals before 120-180 days have passed since the award date. Your decision to pursue this offer should ultimately come down to your investment strategy and broker needs. To research the investments offered by ShareBuilder, you can utilize their Investment Screener to better examine the selection of stocks, ETFs, and mutual funds.

Capital One ShareBuilder does not offer the SEP or SIMPLE IRAs, which have grown popular as retirement vehicles for small business owners/employees to grow tax-deferred earnings. If you know that you will require one of these retirement accounts, another broker (such as Fidelity which offers both types) would be more appropriate.

Note from Capital One Sharebuilder site: “Effective in January 2015, Capital One ShareBuilder, Inc. will change its name to Capital One Investing, LLC. In addition, Capital One Investment Services LLC will become part of Capital One Investing, LLC. […] What does this mean for you? Soon you’ll start seeing our new name on our website. If you have an IRA, the custodian’s name will simply change from Capital One ShareBuilder, Inc. to Capital One Investing, LLC – even though the custodian itself will stay the same …”