Update 5/1/20: The annual fee is no longer waived the first year. Hat tip to reader Alex

[Update: You can use this link to get the same offer with the $59 annual fee. Discussion here.]

The Offer

Direct Link to offer (go incognito if you don’t see it or try this link)

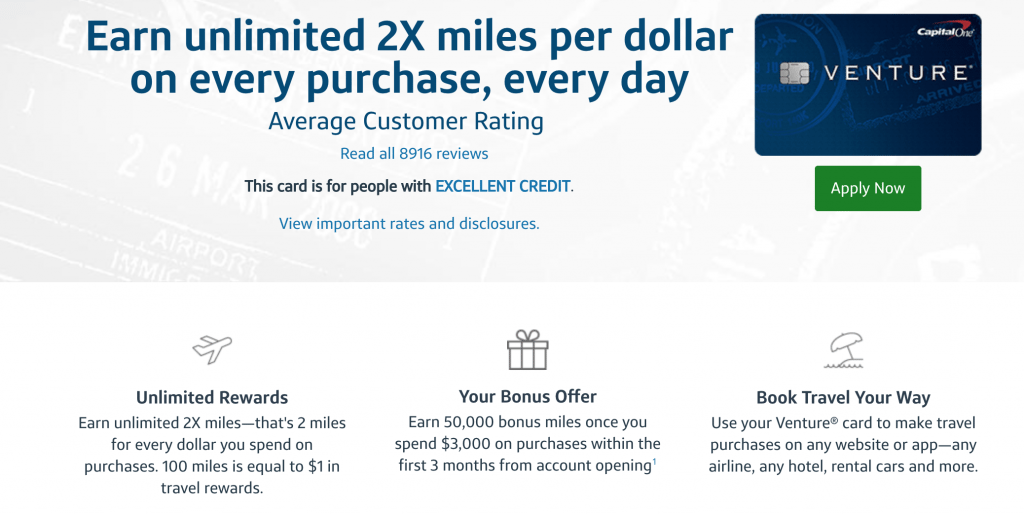

- Signup for the Capital One Venture and get 50,000 miles when you spend $3,000 within the first three months from card opening

The regular deal on Venture is to get 40,000 ($400), very rarely it goes up to 50,000. The 50,000 is worth $500 either as a travel credit to offset travel costs or in gift card redemption (e.g. Amazon).

At the same time, they’ve apparently raised the annual fee from $59 to $95 (nice sleight of the hand there, Capital One).

Card Details

- $95 annual fee; fee is waived the first year

- Card earns 2x points everywhere (the equivalent of 2% everywhere)

- No foreign transaction fees

- Visa Signature benefits

Our Verdict

Some people might be interested in the Venture as an everyday card, and the 50,000 bonus certainly makes it more enticing.

Being that the fee is waived the first year, this is a straight-up $500 profit which is pretty good for a card signup. Main reason we don’t hear much about Capital One is due to the fact that they pull all three credit bureaus for each application. Keep in mind, you can freeze your Experian or Transunion and limit the pulls to just two, plus a lot of us don’t care about hard pulls much anymore. Another issue is that they seem to be stricter with approvals than other card issuers, and they may also have a rule to only approve one card per six months (hard pull won’t even be done beyond that).

If you’re going to apply, it’s worth checking out these Things to Know about Capital One Credit Cards first.

Life hack here. CapOne post the rewards immediately for purchases, and you can redeem the points immediately. Before you close this account, max out the credit card with a few big purchases, make sure they are returnable. (I ordered some GPUs from amazon). Let the points post, reedeem points immediately. When your products arrive, return them. This will cause your points balance to go very negative. You should now have a negative balance on your account for the points you redeemed. Call customer service and have them mail you a credit balance refund check. Now your CC balance is 0, with a huge negative points balance. Then close the account. Cap one does not charge you for negative point balance.

This worked for me. I made about $200 extra on this. (10k cc limit, 2% rewards rate).

please someone share – how much will you get for 50,000 if you redeem for “Get gift cards” and “Redeem for cash” ?

thanks!

is the 50K offer is gone/changed? “Limited Time Offer: Earn up to 100,000 bonus miles ” ???

thx

Yes, bonus is now 100k. https://www.doctorofcredit.com/new-capital-one-venture-signup-offer-100000-points-with-20000-spend/

The 50k offer is still available – click the link in the post above and you’ll find this:

“Earn 100,000 bonus miles when you spend $20,000 on purchases in the first 12 months from account opening, or still earn 50,000 miles if you spend $3,000 on purchases in the first 3 months.”

I am planning to apply for this card. I am mainly interested in redeeming for cash. Any idea how can I redeem 50,000 miles for cash? Is it like a $500 statement credit?

Can I redeem like this? Will this work? Purchase a refundable hotel or flight, redeem points to cover, then cancel the reservation. You’re left with a cash statement credit. Then request a check.

I appreciate your input. Thanks.

I’m at 10/24 (12/24 if you count AU). Received a Venture Rewards offer code for 60k miles with $3,000 spend. Applied and instantly denied. Reason:

“Based on your credit report from one or more of the agencies on the back of this letter,

number of bank cards tradelines opened in the last 24 months”

So like other posters said, they absolutely have some sort of x/24 rule.

FWIW – I would also use Capital One – online before HP. Did this 11.2018 for me and P2 showed for P2 and approved, but

no PQ showing for me and was denied (I did open 2 cards that were already showing on CR). Checked after 6 months with no new personal cards on CR – showed PQ for this card and others.

Don’t forget about their $100 referral buried in your profile settings. I sent my referral to P2 and it still was show the 50k signup bonus.

%$&#, missed that on P2’s card. Doh!

Does that link show the $95 annual fee waived first year?

I did some digging but having trouble finding the referral – do you remember where it was?

Apparently the $100 referral bonus is available only to select cardholders:

https://wallethub.com/answers/cc/capital-one-venture-referral-2140694559/

I also have the Quicksilver card and the “Refer a Friend” option appears for me for that card but not for Venture.

Cap stinks in every way possible but especially their customer service sucks.

Instantly denied. 770 credit score, but 3 applications this year, and a VentureOne card from a prior year downgrade

CapOne is fradulent. They send you a mailer with an invite code…and they still don’t approve.

BAC does this BS too