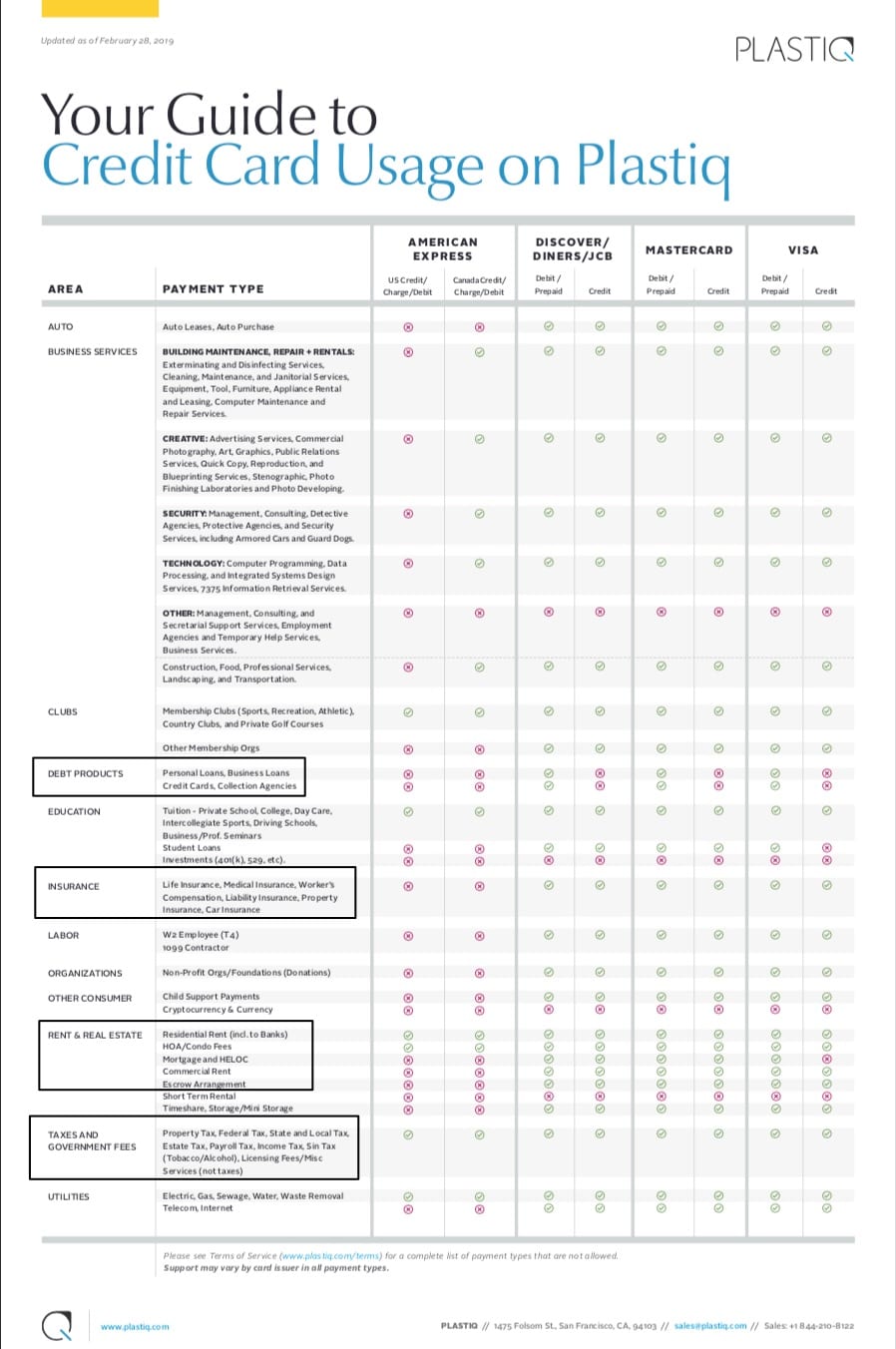

Our contact at Plastiq sent over a nifty graph which charts out which credit cards can be used for which types of payments. It even drills down the differences between credit cards and prepaid/debit cards.

For the unfamiliar, Plastiq is a bill payment service who allows payment with credit or prepaid cards for a fee of 2.5%, see our full review here. Each card issuer has individual rules about which cards can be used where, and it gets a bit confusing. Hopefully this chart simplifies things. I circled a few of the more commonly used categories which people often ask about.

You can also access a pdf version for easier viewing/saving here.

As you can see, use of an Amex card is highly restricted whereas Visa, Mastercard, and Discover work for most bills. The one big exclusion that Visa has over the others is the mortgage exclusion, that’s a biggie. Mastercard and Discover do allow mortgage payments.

Separately, not addressed in this graph, some consumer Visa cards come through as a cash advance – check out this thorough list from Plastiq for more information on that. (Plastiq will always tell you with a popup if there is a cash advance issue.)

Overall, Mastercard, Discover, and prepaid Visa cards are the most versatile and can be used for most bills. Visa business cards can be used for most things, but not for mortgage payments. Amex can only be used for a few things like taxes, rent, and utilities.

[The biggest surprise for me from this chart is that, apparently, prepaid Visa and Mastercards can be used to pay down credit card bills and personal loans. Update: judging from the comments of this post, this may not work in practice.]

Plastiq also put out an easy infographic to show which payments can be used (click on the graphic to enlarge):

My thanks if you signup for Plastiq with our referral link – you’ll get $500 in free processing ($12.50 savings) after you spend $500 on Plastiq. More details on the Plastiq referral program here, and check out our full Plastiq review here. Plastiq is also running a special on business signups to get a bonus of $10,000 in free processing ($250 savings) – details on that can be found in this post.

I cannot pay property tax by using Vanilla VISA prepaid debit card, as of 3/21

is this a good way to use up a vanilla vgc? regular place I liquidate got killed, so I’m stuck with a $500. Of course I can spend it down, but I’d rather get rid of it quickly if I can. thanks for any help

“Vanilla Gift Issued by The Bancorp Bank

Prepaid cards from this issuer cannot be used to make payments through Plastiq.”

Paypal exploiting seems to be still the best option imo… Just have two independent accounts, one with your credit cards linked, and one with your bank account linked..

With this set up you can now send payment from any credit card to yourself; American Express, Discover, Visa, Mastercard, etc, to your 2nd account, and all paypal takes is 2.9%.. Which is just 0.4% more than Plastiq’s 2.5%, however the benefits far outweigh the added fee, because unlike Plastiq, you can now use this payment to yourself for any place/website/service that accepts paypal, or better yet, you can now withdraw that cash you sent to yourself into your linked bank account (no fee) for zero restrictions for use anywhere by using your bank account or debit card to fund whatever you need to fund.

This is a good workaround to pay off a credit card with another credit card or any of the other services listed in the chart above from Plastiq with the red X’s, or great if you need a cash advance with less cost than getting a cash advance from a 3rd party service.

The list of excluded VGCs is long, and seems to include all the VGCs that I’ve actually seen for sale at the stores I go to. What VGCs are NOT excluded?

Let me know if you find out.

Is their website still down?

OK, it says Visa CC can be used for “Escrow Arrangement”. Has anyone used it for escrow-arranged mortgage payment?

Look at all the red in the Amex column, No wonder they are so far behind Visa and Mastercard

Happy they finally updated that support article to call out VGCs don’t work. I won’t hold my breathe but cautiously optimistic that will change one day.

This chart shows prepaid visas do work. Where does it say VGCs don’t work? I know they don’t because I’ve tried and I have been frustrated with the PDF as being entirely inaccurate with respects to these.

https://help.plastiq.com/hc/en-us/articles/360005215254

Just finished reading all of this and went to the Plastiq site to pay my real estate tax with my MC (thanks sdsearch) and the site is down for repair LOL.

I noticed the same. Sometime on Mar 7 the login page literally disappeared (was displaying a server error that said the file did not exist). Today there is a page up that says “We’re currently improving our website”. I wonder what’s up. Very unusual for a site this large to be offline for more than 24hrs.

Other than creating spend for things like spend goals and maybe status levels with companies has anyone found a use for Plastiq that actually helps with point accumulation? Seems like the 2.5% fee offsets any real gains one may make. Even if you have a 4% card you pay 2.5% processing fee = net 1.5% Let me know if I’m missing an easy point churn.

I use it for spend bonuses and the like, not regular points churn. Businesses might enjoy it for the extra time it gives them to pay, also since they can often write off the cost.