Update 11/28/23: Bonus now $150.

Update 9/16/23: 5% is limited to $1,000 a month now.

Update 12/29/22: Looks like the 5% rotating categories are being removed.

Update 4/29/20: They have added 5% on grocery, and streaming services for April, May & June. This in addition to 5% on gas. This means you’ll earn 7% on grocery and 6% on streaming. Hat tip to reader Scott F & Ari

Update 4/15/20: Readers are now being shown a $3,500 cap on bookstore purchases per month. It doesn’t show on the landing page at all, but under ‘Credit Card Rewards tab’ when logged in. This seems misleading to not display or mention this cap on the landing page. Hat tip to readers TinkoDinko & PG

Update 1/20/20: Card now has 5% rotating categories:

- January – March: Restaurants

- April – June: Gas

- July – September: Clothing & Home Furnishing

- October – December: Bookstores/discount retailers

This is in addition to the points you’d normally earn

Hat tip to reader David

Update 8/8/19: Card no longer has an annual fee of $95.

Update 3/6/19: This card also earns 5% back on restaurants for the month of March.

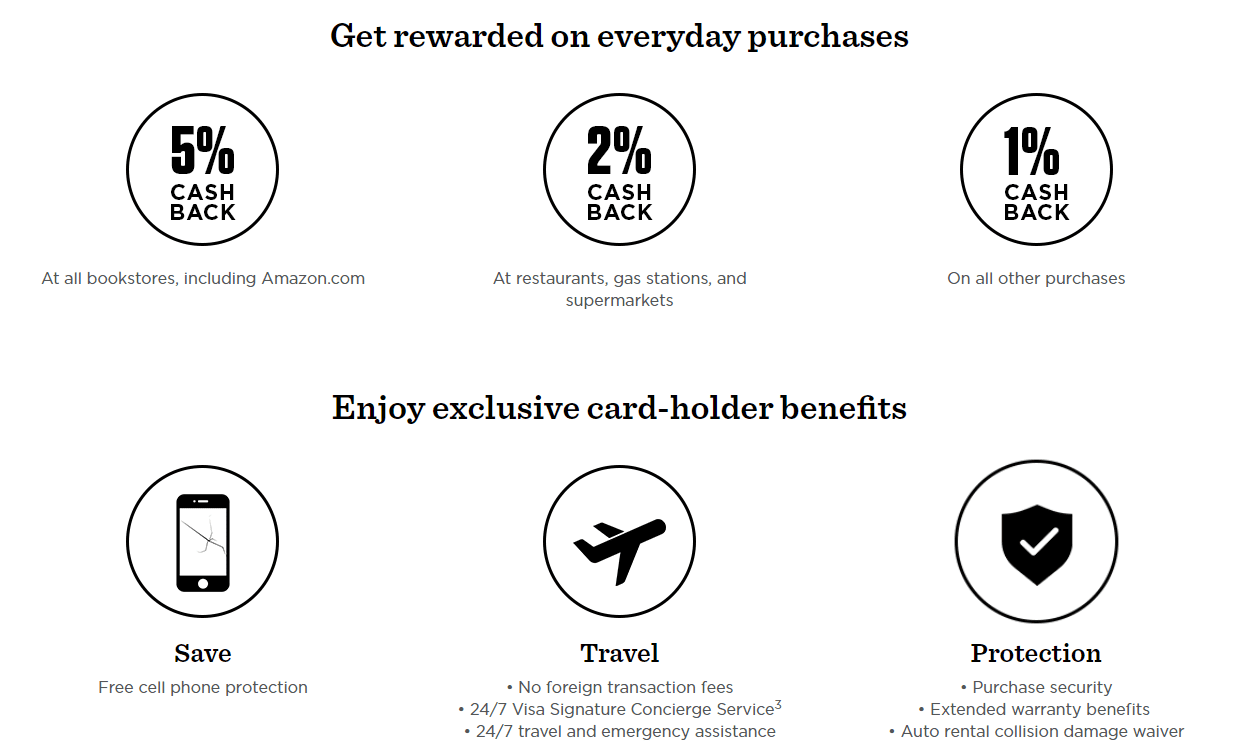

Affinity Federal Credit Union offers the ‘Affinity Cash Rewards Visa® Signature Credit Card‘. Let’s take a look at this card in more details

Contents

Card Basics

- $200 cash back after $3,000 in spend within the first 90 days

- Card earns at the following rates:

- 5% cash back at all bookstores including Amazon

- 2% cash back at restaurants, gas stations and supermarkets

- 1% cash back on all other purchases

Our Verdict

There are lots of cards that earn at a high rate on Amazon purchases. There aren’t really any that earn 5% back at all bookstores anymore. It also looks like you need to be a member to apply, anybody can become a member by donating $5.

Hat tip to reader batsy71