Update 2/8/21: Today is the last day for this deal.

Update 12/1/20: Deal available again, also increased bonuses on the personal cards.

The Offer

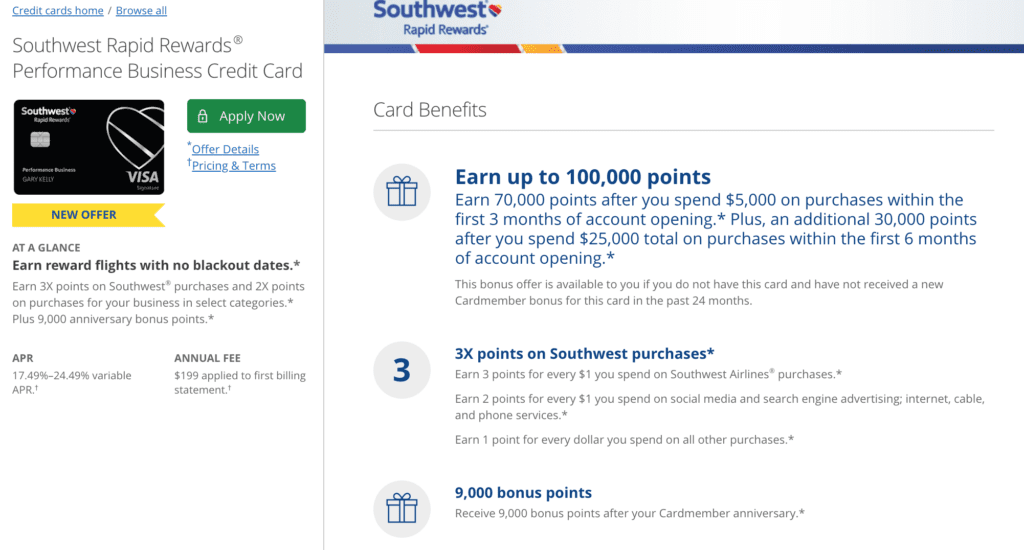

Chase increased the public offer on the Southwest Business Performance card:

- Earn 70,000 points after you spend $5,000 on purchases within 3 months of account opening.

- Earn an additional 30,000 points after you spend an additional $20,000 on purchases within the first 6 months of account opening ($25,000 total)

Card Details

Card earns at the following rates:

- 3x Southwest points per $1 spent on Southwest and Rapid Rewards hotel and car rental partner purchases

- 2x Southwest points per $1 spent on purchases in the following rewards categories: social media and search engine advertising; internet, cable, and phone services

- 1x Southwest points per $1 spent on all other purchases

Other Details:

- $199 annual fee (not waived first year)

- Four upgrade boardings per year when available

- Every anniversary year you will be reimbursed for the purchase of 4 upgraded boardings. Upgraded boardings are positions A1-A15. These can be purchased on the day of travel only at either the departure gate or ticket counter and aren’t always available. Price of these upgraded boardings varies based on the itinerary, I think it’s usually $30-$40.

- The benefits of being in this boarding position is you may be able to get an exit row seat (and at worst you’ll get another seat you want) and you can find overhead bin space.

- Anniversary year is defined as ‘the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year.’

- Up to $100 Global Entry or TSA PreCheck Fee Credit

- No foreign transaction fees

- 9,000 anniversary points each year

- Inflight WiFi Credits, up to a total of 365 $8 credits per year for all WiFi transactions on the overall business card account

- Earn tier qualifying points towards A-list status

- For every $10,000 in purchases you make you’ll earn 1,500 tier qualifying points (TQPs), you’re limited to $100,000 in spend or 15,000 TQPs. These can be used towards qualifying for A-List status (35,000 TQPs or 25 qualifying one way flights) or A-List preferred (70,000 TQPS or 50 qualifying one way flights).

- For this benefit, “Annually” means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date.

- Points earned count towards Companion Pass

- Employee cards at no additional cost

- 5/24 does apply to this card

Our Verdict

The base offer here is the same as the previous offer, but now they added the additional tier to get an extra 30,000 points with $20,000 additional spend. You’re getting a bonus 1.5x on the final $20,000 in spend for a total of 30,000 points (on top of regular credit card earn).

It’s not amazing, especially if you’re giving up a referral bonus (e.g. from a spouse), but the numbers work out perfectly for the Companion Pass 125,000 points requirement making it overall a really nice deal. It especially makes sense especially for someone who anyway finds Southwest points worth earning at 1x, or for someone who can make use of the 2x or 3x categories offered on the card.

The referral and public offer is still 70k points on $5k spend, it’s not known if they’ll change the referral offer to match this one. If you did signup up with the referral or web offer, you should be able to get it matched with this public 100k offer. Check out these other Things to Know about Chase as well.

READ:

- Everything You Ever Wanted To Know About The Southwest Companion Pass

- New Card Review: Chase Southwest Performance Business Card with 70,000 Points Signup Bonus and $199 Annual Fee

Hat tip to Cow_Boy_Roy

is this actually any better then the premier SW business card? 60,000 points instead of 80,000, but lower spend ($3000) and lower fee ($99)

P2 applied (I know just for 80k points but want a companion pass).

Went to “in review” status. Haven’t received that from Chase for a long time.

Anyone else getting this on cobranded cards?

P2 has one SW personal card (approved on October 5th) and three INK cards with a lowered to $500 credit limit.

Update: had to confirm P2 social security number through a DocuSign. After that approved.

Hi there, can I transfer miles or issue an award ticket with earned from SUB for someone else? its the only chase biz card I seem to be able to get now but I dont fly SW at all, I would apply only if I can get use to those points (perhaps exchange)… I have no experience at all w SW program, I dont fly SW. thx

Does anyone know; can I use the $500 credit to transfer points from my kids Southwest frequent flyer account to my account? I know I can get the credit transferring points to others, but what about to me?

I always assumed that Chase would not know who transfers to whom, and just would reimburse the charge, but I never tested it. I think it is a safe question to ask Chase and/or SW.. as it is fully legitimate question.

Would you please reply with your DP when you do that. Thank you!!!

Applied today and auto approved for $6k CL. 80K/$5k SUB. I’ll take it. Won’t use it much and just need to meet the SUB.

First of two SW cards checked off for round three of CP :).

‘Anniversary year is defined as ‘the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year.’

Does this mean you can’t get this benefit until after you have had the card for a whole year? I can’t tell if I’m reading this right or not. Thanks

Yeah, I don’t quite understand it either. Doesn’t seem like it’s succinct.

Why does the title say “Expired”.

William Charles

William Charles

It looks like 80k points on 5k spend is still good as of today. Am I missing anything?

The 100k is expired, that’s what the title is reflecting

This post is regarding the 100k deal

Targeted today for 80k/$5,000 MSR.

Do not get discouraged, but this is a public offer for this card at the moment (and has been for awhile). It is a great card if you are after Companion Pass, as it can be paired with practically any other card to get you a CP. Even another business card (Premier) would work for that purpose too.

It has a number of benefits to offset the higher AF such as wi-fi purchase credits, Global Entry credit, priority boarding credits and higher anniversary bonus, so all together hopefully can reconcile a higher AF for you.

Good Luck.

Can you get 2 with 2 different EINs [same SSN?]

@jpv you cannot. A friend of mine tried that a few years ago with Biz Premier card and did not get the second bonus. Apparently Chase tracks it also by the RR account #, and you are not eligible for the same product bonus twice if it linked to the same RR account (even though the biz entities are different).

This was the case 3-4 years ago, so unless somebody has a more recent DP, I would consider that a NO.

BUT…

Since now Chase has 2 different biz cards, and unlike the personal cards the verbiage on Biz cards is specific to the particular card, not the “family” of cards – you can get bonuses under 2 biz cards even under the same biz entity if you get approved for both. Have a couple of DPs for that too (one DP under the diff biz, and one DP under the same SP).

Unlike SW biz cards, with INK cards you CAN get the bonus from the same INK card under different biz entities.

Good luck.

VL, thanks so much!

I’ve been able to rack up quite a few Inks with different cards/EINs. Probably had over a dozen in the past few 5 years..

I’ll try the other business card and see if that helps [screwed up a bonus and got it 2 days before the end of the year for the companion pass]/

@jpv Glad to help!

Good luck!

I was just approved for the 80k offer. I need the points for some trips so I’ll take it.

6k credit line. Ugh.

You only need to spend $5k so why do you need more than a $6k credit limit.