The Offer

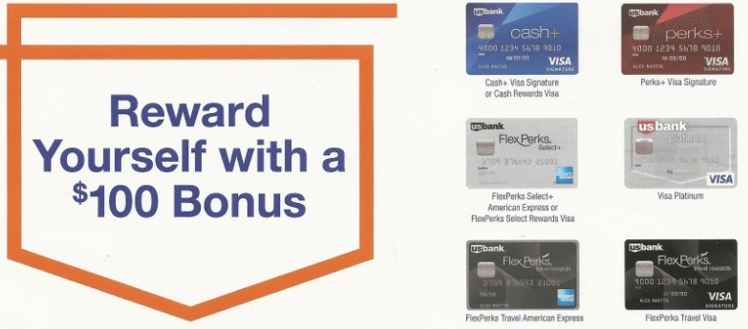

- US Bank is offering a statement credit of $100 (in addition to the regular sign up bonuses these cards offer) when you spend or do a balance transfer of at least $1,000 on the following cards within the first 30 days (regular bonus in brackets):

- Cash+ Visa Signature (no bonus, although has offered a $100 bonus in the past)

- Cash Rewards Visa (no bonus)

- Perks+ Visa Signature (no bonus)

- FlexPerks Select+ American Express (10,000 FlexPerks after $1,000 in spend within four months)

- FlexPerks Select Rewards Visa (10,000 FlexPerks after $1,000 in spend within four months)

- Visa Platinum (no bonus)

- FlexPerks American Express (20,000 FlexPerks after $3,500 in spend within four months)

- FlexPerks Rewards Visa (20,000 FlexPerks after $3,500 in spend within four months)

The Fine Print

- Application must be received by December 4th (approval date does not matter)

- One offer per household

- Balance transfers from other US Bank accounts do not count

Our Verdict

There are three cards worth considering: cash+, FlexPerks Visa & FlexPerks American Express. Here is why:

- The cash+ card lets you choose two categories to earn 5% in each quarter (with a $2,000 spending limit), although the categories they offer are quite limited after US Bank has continually crippled this card. It doesn’t currently offer a bonus, so at least $100 is something. Only really worth it if you can max out the 5% categories or at least get close.

- Both of the FlexPerks cards are worth considering as the points are worth up to 2¢ when redeeming for flights and 1.5¢ hotels.

- Visa card earns 2x points on the category you spend the most on (gas, groceries or airlines) and most cell phone expenses during each billing cycle and 3x points on charitable contributions (also now comes with 12 free GoGo passes)

- American express card earns 2x points on airlines, gas or groceries – whichever you spend most on each monthly billing cycle and also on restaurants. Also earns 3x points on charitable contributions but Kiva is excluded

In regards to the the FlexPerks cards, US Bank usually runs a promotion during the Olympics where they increase the sign up bonus based on how many medals team USA wins:

- 500 points for gold

- 250 for silver

- 100 for bronze

During the last winter Olympics this resulted in another 7,450 points and 13,350 last summer Olympics. I’m not sure if this promo will just be run on the Visa card (as Visa is a sponsor of the Olympics) or the American Express as well during the summer Olympics in August of next year.

I already hold the cards of interest, so I won’t be signing up for this promotion but it might be worth it for some of you. Especially if you can take advantage of some of those bonus categories and maximize the points value of the FlexPerks.

Hat tip to reader Taylor S

Currently considering the Flexperks Visa. I’ve frozen my credit report at SageStream and ARS. My only hesitation is the Olympics signing bonus, which might come up in the summer.

However, countervailing to that hesitation is that I have easy access to grocery store MS, and who knows how long that will last. My experience is that a store may go cash only or debit only any day.

Getting an extra $100 statement credit might be enough to make foregoing the (possible) Olympics bonus worth it.

Decisions, decisions.