It’s Monday which means it’s time for another Manufactured Monday’s post where we describe a new way to manufacture credit card spend (MS). If you’re not familiar with MS we suggest reading our introductory guide first. As always, if you decide to use this method: start slowly, always have an alternative exit plan, don’t spend more than you can afford to lose/have tied up for months.

Today we’re going to be looking at the AmEx for Target (AFT) reloadable card. This is a prepaid card that can be reloaded with any credit card (American Express, MasterCard or Visa), you can then use the card as a regular credit card or do an ATM withdrawal.

Contents

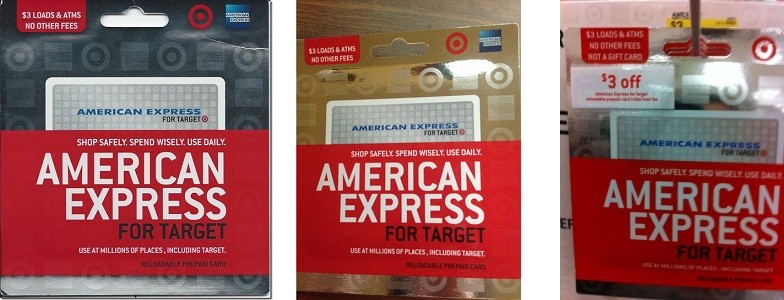

Finding The Card

This card must be purchased in person at a Target store. Unfortunately not all Target stores stock this reloadable card. You can click here to find a list of participating stores. Once you’ve found a store near you that stocks this card you’ll need to find the card itself. A lot of people have reported that it’s difficult to find this card. Here are some common places they are kept:

- With the rest of the gift cards

- Between registers in the end cap displays, often above the candy

- Near the service desk/customer returns area

Make sure the card says “American Express For Target” on it, it’s also a good idea to look out for words such as “reloadable”.

Thanks to Frequent Miler, Will Hernadez, Romsdeals for the images.

Purchasing The Card

Once you’ve found the card you’ll need to take it to the register. Make sure you have your drivers license with you. You’re then required to answer a bunch of personal questions such as:

- Full name

- Birthday

- Address

- E-mail address

- Phone number

- SSN

Make sure you answer these questions correctly, if they are answered incorrectly then you won’t receive your permanent card which can be reloaded. Your details should match the details found on your drivers license exactly (e.g st & street are different) You can then do your initial funding, up to a limit of $500. It’s possible to use multiple credit cards in a single transaction which is good news if you want to unload a bunch of prepaid cards. You can have a total of two cards per SSN. You can only purchase one every twenty four hours. Your permanent card should arrive within ten business days of purchasing the temporary card.

Funding Your Card

You have to go into a Target store to load funds onto your card. You can use American Express, Visa or a Mastercard credit card to fund your cards after you’ve received the permanent version. You can also use prepaid/gift cards (Visa, Mastercard, American Express) to fund your AmEx for target card. A lot of cashiers don’t have experience reloading these cards so you might have to guide them through the process, even though it’s ridiculously simple.

- Ask them to swipe your AmEx for target card

- It should then prompt them through the process, they’ll have to input the amount you want to load (e.g $1,000)

- Pay!

State the amount you want to reload and then swipe your gift card and input the PIN. The card reader is customer facing and the cashier will likely not notice.

It’s possible to use multiple credit cards/gift cards per transaction, meaning theoretically you can use this to unload a bunch of $50 cards. To do this ask to load a certain amount (we suggest always loading the maximum of $1,000 to avoid too many fees) and then state you want to do a split payment. Split payments will be done automatically if your gift card doesn’t have enough funds on it to cover the full amount. You can then drain one gift card, use another and so on. There is a limit of 7 card swipes. In practice a lot of cashiers are uncomfortable doing this and will often call their manager over to get approval. You are allowed to use these cards, but keep in mind it might take a lot longer to load due to them being unsure of the rules.

There is a load limit of $1,000 per 24 hours and you pay a fee of $3 per load, regardless of how many cards you use.

It used to be possible to use them back in 2012, but this is no longer the case.

Unloading Your Card

Via ATM Withdrawals

This card can be used with an ATM to get cash out. You can withdraw a maximum of $400 per card per day. The first ATM withdrawal per month (based on the first of the month, not rolling) is free, you then pay $3 per ATM withdrawal. You also have to pay any ATM owner fees. When withdrawing money it’ll ask you for “Checking”, “Savings” or “Credit Card”, make sure you select “Checking” otherwise the transaction will be rejected.

Via Credit Card Purchases

You can also use this card as a regular credit card. This might not make sense at first glance (why wouldn’t you just use one of your actual credit cards?). But makes more sense when you look at an example. Let’s say I have an upcoming purchase of $2,000 at a store that doesn’t have any bonus categories. At most I’m going to get 2.22% cash back by using the Barclay Arrival card.

What I could do instead is purchase Visa (or AmEx or MasterCard) gift cards from a store that gives me a better rate (e.g the Blue Cash Preferred which gives 6% on grocery store purchases) then add those gift cards to my AmEx for target card and use that for the purchase instead.

If I used the Arrival I’d get $22 back, if I used the Blue Cash Preferred I’d get $60 back. I’d need to pay the $3 AmEx for target loading and any fees associated with purchasing the gift cards but these would be less than the $35 in profit I’d be making by doing this.

Restrictions

- Can unload via an ATM, the maximum is $400 per card per day

- Everybody can have a limit of 2 cards, you can only purchase one every twenty-four hour period

- Maximum initial load of $500

- Maximum load of $1,000 per card in a 24 hour period

- Maximum load of $5,000 for both cards per 28 day rolling period

- Limit of 7 card swipes per transaction

- You can load until a balance of $2,500 per 28 day period

- Can only withdraw money within the United States

Fees

- $3 activation fee

- You pay a load fee of $3

- First ATM withdrawal per calendar month is free. Each additional ATM fee is $3. You will also need to pay any ATM owner fees as well.

- No other fees, no monthly or annual fees

Minimizing Fees

- Use ATMs that have no fees to withdraw cash, click here for a full list.

- Use ATMS with a low fee if a no fee alternative is not available, click here for a full list.

- Always load the maximum amount of $1,000 to avoid too many load fees ($3 per load)

How I Use This Method

This method is best suited for reaching minimum spend requirements due to the fees, it’s not very scale-able considering you can only load $5,000 per 28 day period. It’s also good for unloading gift cards if you have a lot of them from rebate programs or were able to pick them up on a credit card which earned at high rate due to a bonused category.

F.A.Q’s

Do Target/AmEx do a hard pull when you purchase this card?

No, no credit check is done when you purchase this card.

When I load this card with a credit card, will it be treated as a cash advance?

We don’t know of any banks who code it as a cash advance (it should just show up as a regular Target purchase). As always, we recommend setting your cash advance limit to $0 before engaging in any manufactured spending activities.

Can I use the Target red card to get 5% cash back when I fund this account?

No, you will not earn any money by using the Target red card on these transactions.

Can I purchase a Target for AmEx card and then reload it at a Target store that doesn’t sell them?

Yes, all Target’s are capable of reloading Target for AmEx cards.

Can I use target for AmEx to load funds onto bluebird or serve?

No you cannot do this, although I’m not sure why you’d want to in the first place.

What category is Target coded as?

Target is generally coded as a discount store (much like WalMart). Find out which MCC code your local Target has.

Do I need to be worried about shut down?

At the moment it doesn’t look like this is an issue, people have been doing load & unload without any natural spend and haven’t been shutdown. As always it’s a good idea to take precautions to prevent future shutdowns.

The terms & conditions state I can only unload $200 by ATM is this true?

No, you can unload $400 at a time.

If you load your AFT card with gift cards, do you need to register the gift cards first?

No, they just need a pin set (usually the last four digits of the card by default).

Hat tip to this flyertalk thread and these posts from frequent miler: 1, 2, 3

A little late on this, but do Vanilla GCs work for AFT reloads?

Yes, even ordinary credit cards work currently.

Can Chime be loaded with AFT?

Sure, but it wouldn’t make much sense to do that since you can just unload the chime card directly at an ATM.

Sorry for miscomunication. I meant the reverse. Can I transfer money that I have on AFT to a Chime card. It would make loading considerably easier since Chime now has a paper check feature.

I believe Chime only accepts Visa and MC.

Newbie questions: Can you get AFT & redcard simultaneously? Do you need to close bluebird to get AFT? My target don’t have AFT but plenty of Redcards. Is Redcard better than Bluebird? Thanks

You can get both, but you can only have one or bluebird/serve and redbird.

Redcard is better than bluebird if you find it easier to load in target instead of Walmart, it looks like you can also load with a CC directly at the moment.

I just tried to use MCgc at Target to load without showing cashier the card, it showed up as a credit card. The cashier asked to see it and said no gift cards whatsoever. I said it’s a debit card. She called mgr and they renamed it a debit gift card, said it has to have my name on it. 🙁

can you use the AFT to buy money orders?

Hi, thanks for the good post however have tried several of the atms listed as no fee in the sf bay area link but all have charged a fee so far, including some that do not charge a fee for amex serve.

Any further ideas?

Thanks

Updated the post with a link to our no fee atm list which can be found here: https://www.doctorofcredit.com/low-fee-no-fee-atms/

Hello DoctorOfCredit, can you tell me if the “Amex for Target” can be activated at any store? I know that they are only stocked in certain stores, but are other locations hard-coded in such a way that would prevent activation?

I want to pick up 2 of them and activate them in my home state where they are no stocked.

You’ll activate them when you purchase the temporary card. Once you receive your perm card you can load it at any store. You might run into issues if you take the temp cards to a store that doesn’t stock them, but I’m not sure why you would want to do that anyway.

So if my local Target is coded by Visa as a grocery store, and I have 5x grocery rewards with my Visa (TD Easy Rewards), I will earn 5x back on these Amex loads? Seems too good to be true haha.

It depends on how you target is categorized, but if it is coded as grocery by Visa as you state it should work fine. Only way to make sure is by trying it.

With respect to “make sure you select “Checking” otherwise the [ATM] transaction will be rejected,” I’ve always selected credit card at the ATM and never had any problem.

Good information, I’ll try this next withdrawal and see what happens.

If you can buy VGC at $3.95/$500 and do not have a free ATM you can unload the card this way with much less work/fewer trips to Costco/cheapest ATM option.

3.25/$400 vs 3.95/$500

Someone else can do the math but the ability to drain the card in one or two days instead if 6-7 is worth something as well as saved time and gas.

I’m not sure I understand this comment. also what place sells VGCs for $3.95.

Lets do the math for 2 scenarios:

a) buy 2 VGCs @ $4.95 each. if BB/Serve capacity is used up for the month, best option is MO for $.70 (one can do BP and such as well) … so in this case to buy and liquidate $1k in MS costs = $10.60

b) for cheapest option, skip VGCs, load $1k with your fav CC directly to AFT @ Target for $3. first $400 is free withdrawal (assuming you find one with no ATM owner fees or $1) = $3 to $4… next $400 will be $3-4 as well. you could leave it at that and roll over (till next load) to max out the $400 per day withdrawal. otherwise the last $200 would also cost anywhere from $3-4 or more. total varies from $9 to $12. so many steps and hunting ATMs etc, seems not worth it.

the only scenario this makes sense in is if Target provides a better CB rate than the place you buy VGCs at. even then at $5k total a month Target isnt all that scalable, compared to say CVS. and if you use a CC that gives the same rate at both stores, I dont think its worth it. but I suppose its a decent *addition* to your arsenal. on 2nd thought not a good idea to carry all that cash around and def not a good idea to straight up deposit a bunch of cash at your bank. so you’re back to square one (buy a MO and deposit that instead or buy VRs with cash but added costs…)