Update 1/5/2020: Rate has been reduced to 2.1% APY from 2.3% APY (not 100% sure when this change occurred).

Update 10/10/19: Rate has been reduced from 2.46% to 2.3% APY.

Offer at a glance

- Interest Rate: 2.3%

- Minimum Balance: $25

- Maximum Balance: $250,000 (FDIC limit)

- Availability: Nationwide

- Hard/soft pull: Unknown

- ChexSystems: Unknown

- Credit card funding: Unknown

- Monthly fees: None

- Insured: FDIC

The Offer

- Brio Direct is offering 2.46% APY on their high-yield savings account.

Avoiding Fees

This account has no monthly fees to worry about

Our Verdict

This is the current highest basic savings account rate. I think this is a new offering, so not sure if the rate will remain competitive or not (always a concern when rate chasing). We also don’t know if it’s a hard or soft pull to open.

I called customer service and they said it’s a soft pull

I think it’s up to 3.75% now. I would love to hear more reviews on this bank.

Does anyone know how interest is calculated on this account? I got an interest payment on Aug. 15 that appears to be significantly less than 2.15% on my average daily balance from Jul. 15-Aug.14. like shorted me about $50ish.

I’ve written to customer support but wondering if I missed fine print somewhere about it.

definitely having a much higher rate of problems with accounts the past few months than ever before, really weird.

if others have this account, you might want to double check.

Be warned: I opened this account to get the 1.8% which is marginally higher than CIBC, SoFI, etc. I initiated a $70,000 transfer at account opening, which they IMMEDIATELY withdrew from one of the other high interest bank accounts. However, they are now trying not to pay interest on it for a WEEK since they took it from the other bank. That is significant loss on large transfers. and highly unethical IMO.

if anyone knows recourse for that, please lmk. I will experiment with a push transfer from a bank that reliably transfers quickly.

After it posts, call them complain. With the significant amount you deposited, figure out how much interest you lost and ask them for a courtesy credit. You might need to have a manager contact you.

And in the future, always open new accounts with the smallest amount possible. Wait to get the account number and then push in the big money from your external bank, as I did. No hold time once Brio gets it, and it usually posts next business day and interest begins to accrue that day.

Good luck.

How did you know they are not going to pay interest on it? They may put a hold on it so that you cannot use the money right now, but they may still pay you the interest because the money is in your account IMO.

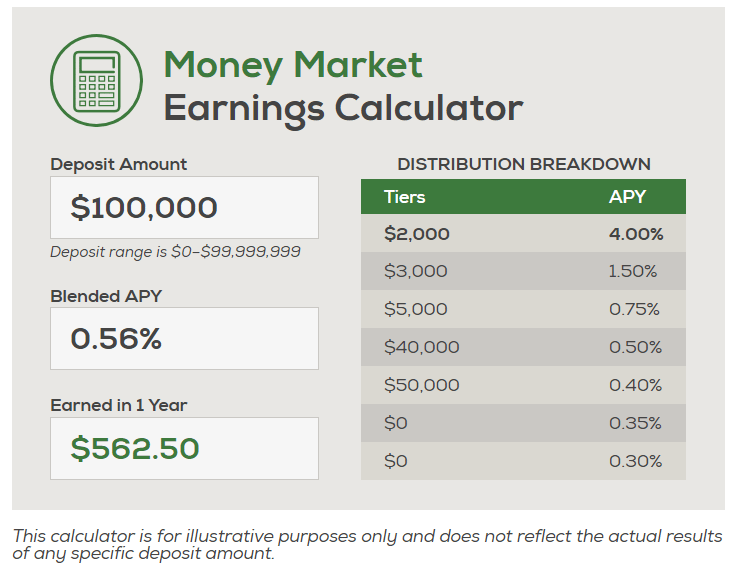

Brio has a new product as of this week – Money Market Savings.

With 25k minimum it pays 0.65% APY.

Now 0.45%

Rate is 0.65 now, I’m closing this account out, there’s no point in keeping it.

Rate dropped to 1.10% APY

Brio dropped to 1.55%

Brio is now 1.65%