Update 08/21/18: Reposting as the Chase Southwest Priority tour states the offer is available through August 22nd, so it might expire on the 23rd.

Update: Application link is actually live. Signup bonus will be available at least through August 22nd.

Earlier this year we shared a rumor about a new Chase Southwest Premium card. Readers have been eagerly asking for updates and thanks to reader Sheldon we now have more information. This card was seen in the wild during a Southwest flight, it looks like it went live early as the application link just goes to a standard Chase Southwest page.

Contents

Card Basics

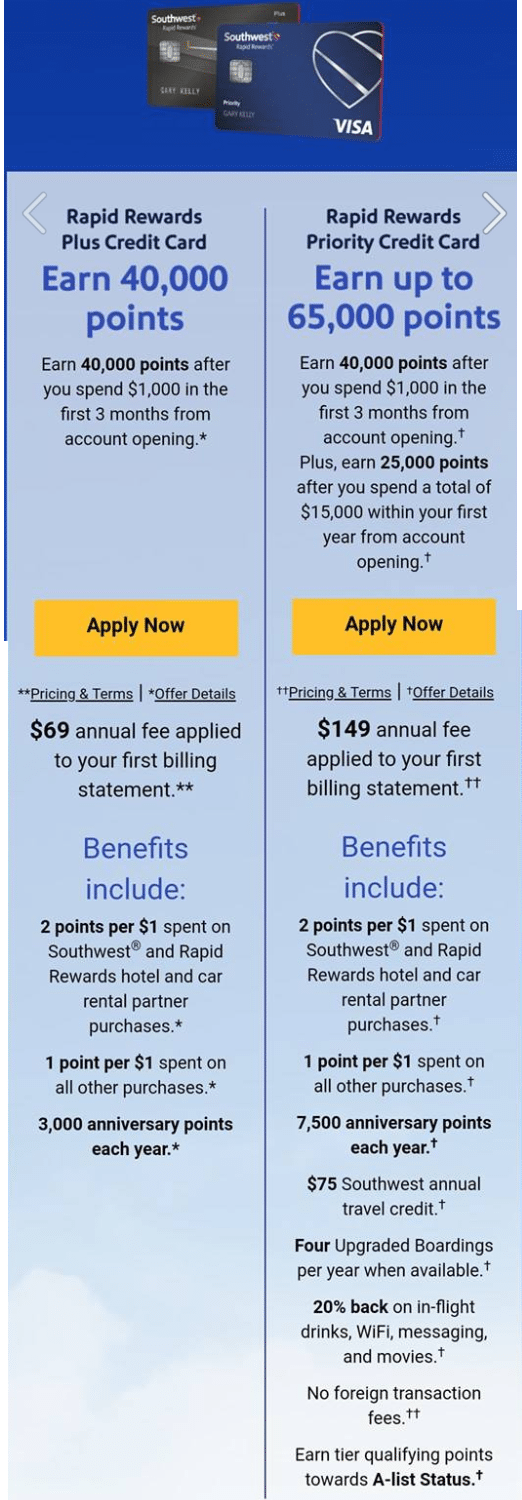

- $149 annual fee, not waived first year

- Sign up bonus (obviously subject to change). Up to 65,000 points:

- 40,000 points after you spend $1,000 within the first three months

- An additional 25,000 points after you spend a total of $15,000 within your first year of account opening

- $75 Southwest annual travel credit

- Four upgrade boardings per year when available

- 20% back on in-flight drinks, WiFi, messaging and movies

- No foreign transaction fees

- 7,500 anniversary points each year

- Earn tier qualifying points towards A-list status

- Card earns at the following rates:

- 2x Southwest points per $1 spent on Southwest and Rapid Rewards hotel and car rental partner purchases

- 1x Southwest points per $1 spent on all other purchases

- The product is not available to either (i) current Cardmembers of any Southwest Rapids Rewards® Credit Card, or (ii) previous Cardmembers of any Southwest Rapid Rewards Credit Card who received a new Cardmember bonus within the last 24 months. This does not apply to Cardmembers of the Southwest Rapid Rewards Business Card and Employee Credit Card products.

Our Verdict

I was hoping the sign up bonus would be big enough to make getting the companion pass easier to get just with credit cards. It’s big enough, but it’s not really easier with the massive $15,000 in spend required for the second 25,000 in points. Additionally you’re not eligible for the card if you’re a current cardholder of any of the other personal cards or have received a bonus on those in the last 24 months. You’d still be able to get this card and the business Southwest to get enough points for the companion pass. Given that the card comes with a $75 Southwest travel credit and 7,500 Southwest points each year (worth $96 towards Southwest flights) it’s not difficult to justify the annual fee and keep the card long term if you do fly Southwest. The other benefits aren’t amazing but the upgraded boardings and in flight discounts will be useful to regular Southwest fliers. What are your initial impressions on this new card?

Also, we don’t know if Chase 5/24 rule applies to this card. But it does apply to all the other Chase Southwest cards so I suspect it does.

I just spoke to chase:

$75 credit can be used:

1. to buy SW tickets on SW site

2. to purchase SW points on SW site

can not purchase gift card.

I bought a gift card and it was reimbursed

Same here. Bought a $75 SWA eGift card that I had sent to my own email. Used Chase SWA Priority Visa. Offsetting credit hit 3 days later. No fuss.

Looks like the offer is still available.

Link?

Oops, I’m not getting email notifications for comment replies!

It was available on Aug 23rd with the link you had in the article. Guess it went offline Aug 24th

Southwest (or Chase) is basically paying people to hold this card. If you fly Southwest at all it makes sense to get it. After the travel credit the effective annual fee is $74, which is more than wiped out by the 7500 RR point anniversary bonus. That’s even before any talk of the upgraded boardings or 40,000 point sign on bonus.

If your anniversary date is coming up and you don’t have any southwest flights coming up, can you just buy a $75 southwest gift card to get the $75 travel credit? I’d hate it to go to waste…

Thanks

This card is so new so data points are lacking. (Why would you risk making this purchase prior to being to the end of your cardmember year?) I suspect it could work.

I’m fairly certain there will at least be an easy way to extend it for another 12 months. Simply buy a ticket and have the fee and/or full ticket price given as a 12 month voucher rather than returned to the card.

NOTE: I don’t care much for these vouchers, but they are better than losing the money entirely. Note that these terms will also apply to gift cards funds used to book a flight if you then cancel. There is no option to return funds to a gift card as there are for credit cards. -Be careful using gift card funds for flights you aren’t certain about! It’s a very good way to end up losing your money!

Southwest Vouchers:

1. They are a huge pain to keep track of. Southwest provides very limited abilities to keep track them.

2. They are ONLY for the specific person. I.e. I haven’t even been able to combine them for the same person when one voicher has the middle name and one does not. I now put the full middle name on all reservations to make the vouchers easier to use.

3. The actual travel date has to be within 12 months of the original date. – Not just booked.

4. Obviously you can’t use these vouchers once youve already paid. (Typically the price goes up quickly. Then you wouldn’t want to cancel and rebook at a higher price.) If you’re booking several possible future trips, you may not know which to use the voucher for. – Then you end cancelling the flight with the voucher on it, and keep a flight you used other funds for.

– This seems like an unusual situation, but if you frequently book with points, it can be very common.

Doc- do you think this is effectively they end of the 50K-60K bonuses for the Plus/Premier?

I was wondering similarly… put another way, do you think at some point this year, they might bump the initial bonus up to 50,000 for the first $1,000 in spend, and then do another 25,000 when you hit $15,000 in spend (for a total of 75,000 points). Or do you think the bonus they are launching it with, is the highest it will be this year?

Not too sure, it doesn’t look good for 60k bonuses coming back based on this offer.

For the Plus/Premier it may go as high as 50k on the Premier, but definitely would not expect higher on the Plus.

As far as the Priority It’s a pretty high AF card (For Southwest considering a 2ppd only on select categories) I think they are giving it until the stated date and deciding at that point, based on the # of new apps, what they will decide what to do with it. But honestly I think 65k is the ceiling, especially considering I believe this card can be referred so they’re actually putting 75k on the table, which even very conservatively speaking (1.3 cent valuation) is worth $975, plus the $75 TC making it in reality $1050 on the table for only the $150 AF…

There’s going to be a tour with free stuff: https://www.southwestprioritycard.com

Do I need to cancel my current card in order to get these benefits then? I keep seeing people mention transferring but I’m not sure what that means… new here.

You’d need to upgrade to this new card to get the new benefits. Some people have been offered 5k points for doing so. Keep in mind you’ll need to pay the new annual fee. More details here: https://www.doctorofcredit.com/southwest-cardholders-get-5000-points-bonus-by-upgrading-to-southwest-priority-credit-card/

Is this card replacing the Premier card? The graphic above seems to indicate that the only two personal options going forward as Plus or Priority.

Quite a few questions regarding if I can upgrade my current premier card to this. (I also have the plus card so I may not qualify). If you upgrade a premier to the priority, could you earn the 40k bonus if you spend $1k in first three months? (and have earned a bonus within 24 months) I doubt they allow this but if they did that would be great! Also, what can the $75 travel credit be used for? Inflight purchases, the $5.60 tax when booking a flight with pts, or future flights? I plan on calling SW to get these questions ironed out but if anyone has any insight on this, it would be appreciated!

Called SW twice to verify the card promotion. (I have Plus and Premier cards and just got my annv bonus for both cards beginning of month, also have the CP until 12/18). The CSR said that the $75 credit could be used for the four upgrades or other inflight purchases. The card does not offer four free upgrades AND the $75 credit, not as good of a deal as originally thought. As far as upgrading the card, (in my scenario I would upgrade the premier) you are prorated the difference in the AF (for me it would be $50, they do not waive the AF, even if you ask politely, but can waive if you threaten to cancel the year prior to your one year annv in order to avoid the AF). Since I have signed up for two personal cards within 24 months, I am unable to receive the 40k signup bonus but I would be able to receive the other perks. I am eligible to sign up for a personal card and receive the bonus pts in 07/19…a whole year from now. Going to hold off upgrading to this card at the moment. Hope this clears some questions, but if anyone is looking to sign up for the card I would be happy to refer you 🙂

I was wondering the same, but I’m guessing they want to push the two extremes of the Plus on the lower end and the new card on the upper end. That way it looks like the Priority has a lot more benefits.

https://creditcards.chase.com/travel-credit-cards/southwest-premier this application page is still live

I think this card is great for those who fly SW a lot. And I think the benefit design is very insightful for other co-brand cards, i.e. how to identify and really benefit those most loyal customers. Not necessarily a good thing for churners, though.

Confirmed, 5/24 restricted