This bonus has expired, view the best checking bonuses by clicking here.

Update 1/14/18: Reader Phil lets us know about another offer for 50k points offer for opening a Performance business checking. Added to the post. Performance checking requires $35k balance to waive the $30 monthly fee. Fee won’t hit until the 3rd month, and by then you should have already gotten your bonus and can probably downgrade to Total (at least it’s worked that way in the past).

The Offer

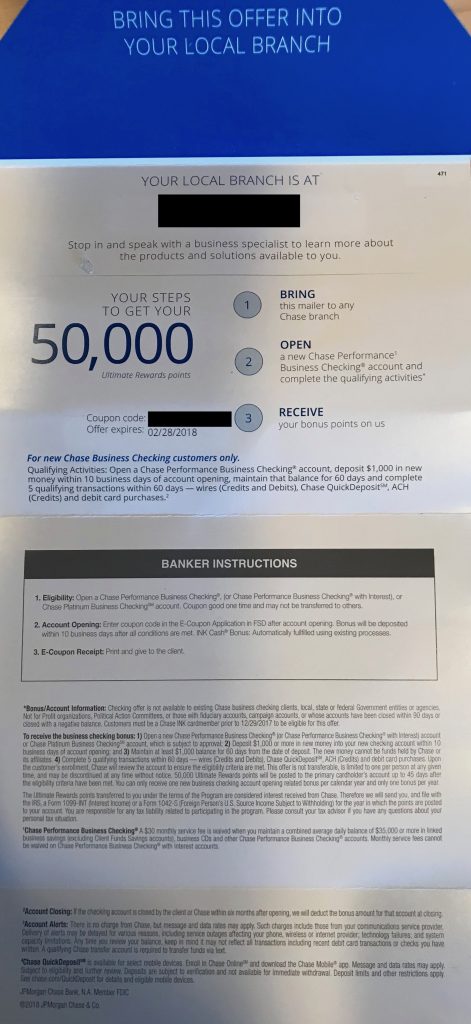

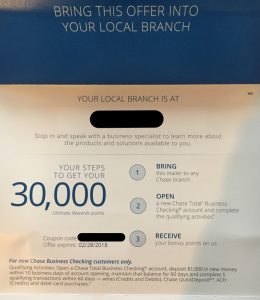

Chase is sending out physical mailers to some INK credit cardholders with an offer to get a bonus for opening a business checking bonus:

- Open a new Chase Total Business Checking account and get 30,000 Ultimate Rewards points

- Open a new Chase Performance Business Checking account and get 50,000 Ultimate Rewards points

To get the bonus, here are the requirements:

- Deposit $1,000 in new money within 10 business days and maintain it there for 60 days.

- Complete 5 qualifying transactions within 60 days. Qualifying transactions include wires, QuickDeposit, ACH credits, and debit card purchases.

The Fine Print

- Expires 2/28/18

- Offer not available to existing business checking account holders or those who have had accounts closed within the past 90 days

- Offer is not transaferrable

- Ultimate Rewards points will be deposited within 45 days of meeting qualifications

- Limit one business checking bonus per calendar year (this should be counted separately from personal Chase bank bonuses)

- Chase will send you a Form 1099-INT

Avoiding Fees

Chase Total Business Checking has no monthly fee when you maintain a daily minimum balance of $1,500 or more. Otherwise a $12 Monthly Service Fee will apply ($10 Monthly Service Fee when enrolled in Paperless Statements).

Chase Performance Business Checking has a monthly fee of $30 which can be waived with $35,000 in balances.

Other ways to waive the fee: if you maintain a linked Chase Private Client Checking or Chase Premier Platinum Checking personal account.

Reports indicate that Chase usually waives the fee for the first couple months.

Early Account Termination Fee

Accounts need to be kept open for a minimum of six months; otherwise, the bonus will be forfeited.

Our Verdict

Offer is targeted to select INK cardholders, and is especially a great deal for those who value UR points highly. You’ll have to park $1,500 there until the 6 month mark to keep it fee-free, then you can close the account.

The more standard bonus on business checking is $200 (currently available). We’ve also seen a $500 bonus which was slightly more complicated since it required a Performance checking which has a $30 monthly fee.

The fine print indicates they’ll send a 1099 for this; I’m curious if anyone has a data point whether they actually do this, but let’s assume they do. A comment in a similar situation says to have heard from a banker that they 1099 at 1.25% since that’s how much it’s worth when redeemed for travel. Bummer, I’d have expected it to be counted as$300.

Note, only special bankers can open Chase business checking accounts; it’s probably worth making an appointment in advance. While at the Chase branch, check for credit card preapprovals. You may want to do a personal Chase bonus while you’re at it as well (no great bonuses are publicly available now; check eBay to see if there are any $500 coupons for sale.

Thanks to my friend Kevin for sharing this

My 30000 bonus for INK card posted today. Opened business checking account in branch on Jan 17 2018.

Was it posted on Tuesdays like other Chase bonuses? I already passed the 60 days but have not seen it posted yet.

I was targeted(my promo date is 3/28/18) and just returned from local chase branch. They would not open as they said I needed paperwork from the county to show my business is registered and legit. Has anyone hears of this before or should I go to a different branch

Just did this. Fam member got 2 mailers for $500, so we went in and they opened one for their legit business and I opened one for my “business”. My sole proprietorship eBay biz opened in like half an hour. The legit biz took longer as there are multiple owners involved and the bank needed info on all of them, but we didn’t know that ahead of time, that one took about an hour and a half. Banker said they will waive the fee for the first 3 months. Will update once bonus posts and if I successfully downgrade.

FWIW mailers were both addressed to the fam member’s company but the banker didn’t care. Two different coupon codes and different expiry dates. My sole prop opened 2nd and he had issues with the coupon code and had to override it but the system let him. He said he didn’t know why there was a problem with it.

any idea if cc funding is available for this too?

Can the 30K reward points earned, be transferred to the Sapphire / Reserve or INK Business points? Do the 30K points add up equally to say accepting a different promotion towards opening a new checking accounts that gives a $300 bonus? Thanks!

30k is worth a minimum of $300 when redeemed as cash. You can also transfer it to a Sapphire Preferred or Reserve or INK Plus or INK Preferred card to be able to redeem for travel, potentially at a higher value.

Just received the 30k mailer today. Chase shut down my personal checking/savings account late last year–presumably because I had opened and shut every year for the bonus 6 years running…

I wonder if this is worth trying or if I should steer clear under fear of getting completely shot by Chase.

How easy is it to open a chase business checking account with a “business” ?

i opened one with the $300 offer in Dec 2017. It was pretty simple. They do ask questions about your business a tiny bit… but nothing demanding.

What kind of questions?

I just got the $300 mailer for the total business checking account, Do i wait to see if i get the 30K UR mailer or do i just go ahead & use the 300$ mailer. Obviously i would prefer the 30K UR.

Unless you want the $300 asap, I’d wait until a week or so before the mailer you have expires to see if something better shows up. What do you have to lose? If nothing shows by then you could take your current mailer in before it expires and get your $300.

I probably will do that. & Hope i dont miss the expiration date :)… Thanks for the advise MoreSun.

It makes me wonder if this is similar to Citi bank’s TYP… as in, are these UR points transferable to an airline?

You will have to have a UR-earning card that has options to transfer to an airline. Since I do, I prefer to open a new business checking account with this UR offer. If I can redeem an award ticket at least 9 months in advance, one UR point is worth 1.5 cents for my situation (I do not live in a big city so I have always have to fly to a nearby hub airport to go to Southeast Asia.

confirmed? I get how you transfer, but like TYP earned through a bank account, you cannot transfer your TYP to a TYP earning credit card and then transfer it to an airline. Its something to do with tax reasons(bank accounts are subject to interest income vs a credit card point which isnt)… it makes me wonder if its the same here… Perhaps, only allowed to use in UR portal or cash back?

I say yes because the mailer above says points will be posted to the primary card member’s account (the Ink card). It also says you will receive a 1099-INT. Therefore it looks like people who get the 30K+ UR points will receive a 1099-INT to cover the cash value of the points and the flexibility to do with them what they want.

Update says they’ll be valued at 1.25cpp, sounds messy for tax purposes for those who run an actual business…

Would have prefer the 50k pts over the $500 i did last month.