Update 9/27/25: Deal is back and there is a $300 CD bonus as well this time. Wait period increased to 24 months between bonuses.

Offer at a glance

- Maximum bonus amount: $300

- Availability: FL only. Must be in one of the 48 counties they serve.

- Direct deposit required: Yes, $500+ within 60 days of opening

- Additional requirements: See below

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Up to $2,500

- Monthly fees: None

- Early account termination fee: $20, six months

- Household limit: None

- Expiration date: None listed

Contents

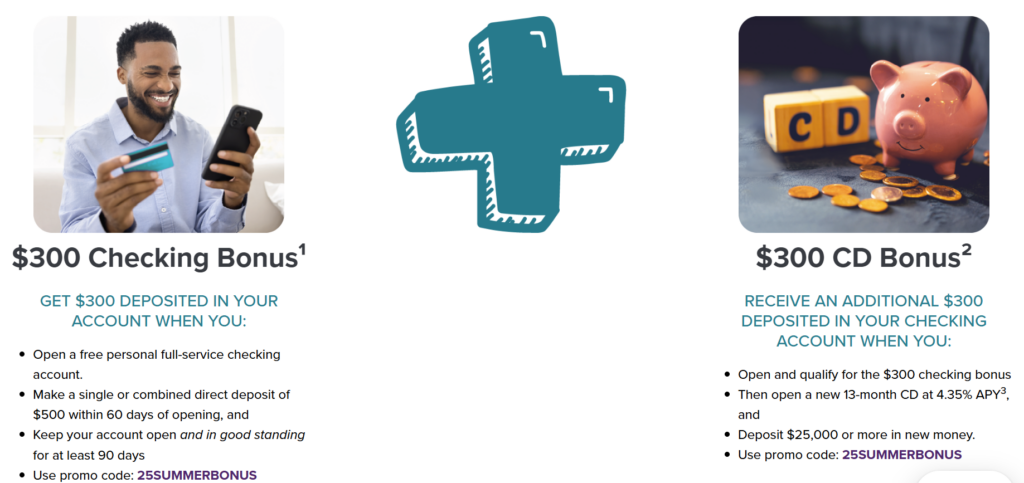

The Offer

- Florida Credit Union is offering a bonus of $300 when you complete the following requirements:

- Open a free personal full-service checking account and use promo code Use Promo Code 25SUMMERBONUS

- Make a single or combined direct deposit of $500 within 60 days of opening.

- Keep account open for at least 90 days.

- Receive an additional $300 CD bonus:

- Open and qualify for the $300 checking bonus

- Then open a new 13-month CD at 4.35% APY3, and

- Deposit $25,000 or more in new money.

- Use promo code: 25SUMMERBONUS

The Fine Print

- Offer can be cancelled at any time.

- Free membership is open to anyone within Florida Credit Union’s 45 county field of membership 1.

- Anyone who has held a checking account with FCU in the past 24 months will not qualify for the incentive.

- Must be 18 years of age or older to qualify for this offer.

- Credit approval and initial $5 open deposit required.

- $500 cumulative direct deposit amount must be made to this account within the first 60 days of account opening.

- Your direct deposit needs to be an electronic deposit of your paycheck, pension or, government benefit (such as SSI) from your employer or the government.

- Person-to-person payments (such as Cash App, Venmo or PayPal) are not considered a direct deposit.

- If the requirements are met and the account remains open and in good standing for 90 days, the $300 reward will be made available to the member.

- $300 is considered interest and will be reported on IRS form 1099-INT.

- Prior terms subject to change.

- Full-service checking includes direct deposit, Visa debit card, online banking, and eStatements.

- Interest-Bearing Checking rates accurate as of 4/6/21 and subject to change at anytime.

- Minimum to earn interest is $10,000 for the Interest-Bearing Checking. APY is Annual Percentage Yield.

- Interest credited monthly. Fees may reduce earnings.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Both accounts offered have no monthly fee to worry about.

Early Account Termination Fee

According to the fee schedule there is a $20 fee if account is closed within 6 months of opening.

Our Verdict

Hard pull might make it a no deal for some people, although those matter less and less with how strict card issuers are these days. Given it’s a $300 bonus and the requirements are still relatively easy to meet I’ll be adding this to our list of the best bank account bonuses.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Post history:

- Update 8/13/22: Deal is back for 2022. Hat tip to reader Katie P