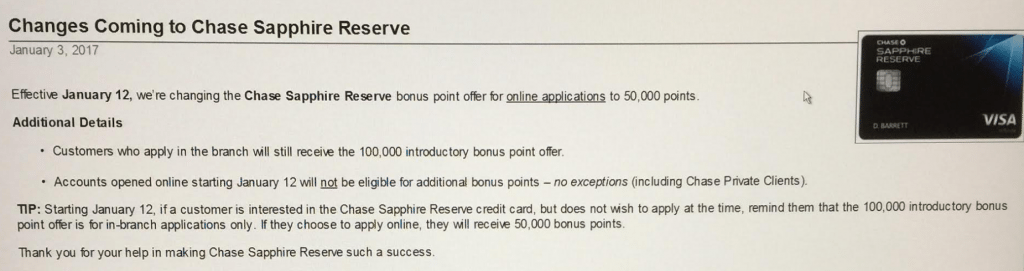

As we announced the other day the Chase Sapphire Reserve will have it’s bonus reduced from 100,000 points after $4,000 within the first three months in spend to 50,000 points after $4,000 in spend within the first three months. There are a few things that you should know about this change:

- The change goes into place on January 12th. This means that January 11th is your last chance to apply.

- This only affects online application, in branch applications will still have the 100,000 point bonus. When we originally posted we mentioned that March 12th would be the last day for in branch applications at the 100,000 point level. My sources say that isn’t a hard date, so it’s entirely possible/likely that we will continue to see 100,000 points in branch after that date.

- There are no exceptions to this change. This means that Chase Private Client customers will also only receive 50,000 points online.

- The Chase 5/24 rule is based on calendar months. For example if you currently have received 5 cards in the past 24 months then you will not be eligible, if you signed up for one of those cards on January 17th, 2015 then you won’t be eligible for another card until February 1st 2017. If you won’t be eligible until February 1st but still want the bonus what you can do though is apply for the card before January 12th and then call reconsideration on February 1st. You have 30 days from the date of your application to call reconsideration.

- I suspect the ‘selected offers for you’ that bypass Chase 5/24 will also have their bonus reduced to 50,000 but fingers crossed they stay at the 100,000 point level. In branch pre-approvals also bypass 5/24 and they will continue to be 100,000 points.

The chase private client benefits section still indicates 100k signup bonus, but your post says otherwise. I guess I should call the branch to find out.

CSR is still 100k in branch, that’s why that page still shows 100k. It’s just you can’t leverage CPC to get 100k online.

Data point: Applied for wife last month knowing she was over 5/24 but would be under on Feb 1. Got the “too many accounts” letter in the mail a few days later. She called the recon line tonight and was approved and also verified that she will get the 100k bonus. Good looking out DoC!

Welcome, glad it worked 🙂

Husband and wife each applied. Both told 7-10 business days! Should I call reconsideration? We both have an almost perfect FICO, and are both under 5/24, so I’m at a loss here.

Data point: I’m at 5/24 until January 22nd, which means if this rule is based on calendar months I wouldn’t be at 4/24 until February 1st. I just applied for the CSR, expecting that it’d go pending and I’d call recon after the 1st, but I was instantly approved.

Datapoints here.

07/2016 – last chase card was approved for, 7/24 at time.

09/2016 – was 8/24, applied online – denied

09/2016 – 8/24, tried applying in branch, no per-approval, denied

10/2016 – checked in branch for preapproval, none, didnt apply

11/2016 – checked in branch for preapproval, none, didnt apply, lowered limits between 2 chase cards by 20K

12/2016 – checked in branch for preapproval, none, didnt apply

01/2017 – checked in branch today for preapproval, exactly 6 months and 3 days after last chase card approval. pre approval showed up on screen, said banker to hit go, got approved. 21k

DP: lowered limits, wait 6 months since last chase approval seems to work like others have reported in /r/churning

Thanks for the DP

no problem. i should also mention and add the following:

01/2017 – i was at 12/24, so the in branch application did bypass 5/24 for sure.

Applied for CSR on Christmas and was denied for 5/24, partly because I didn’t realize two AU accounts that had been downgraded in the past two years might count. I’ve since closed them and requested they be removed from Experian, and am planning to wait for that to happen before trying again. If they come off before my 30 days are up I gather I should call recon, even though it will likely be after 1/12. If it takes longer than 30 days I suppose I can apply again in branch for the higher bonus, if it’s still available.

Seems straightforward, but am I missing other alternatives I might try?

Even if it’s after 1/12 you’ll still get the 100k bonus because that’s the offer you applied for. Does that make sense?

Yes. And it seems that would be the ideal approach, although the window is tight for the accounts to fall off in time.

Update and a couple of datapoints.

Recap: 6/24 when initially applied, but three of those were AUs, two the result of downgrades (which I didn’t think would count but apparently did). Recon also mentioned two accounts in the 25th month. I was traveling and didn’t see the decline letter until 13 days after submitting app.

Datapoints: immediately closed two of the AUs (including one at Chase and one at Citi) and requested they be removed from my report. Citi said it would be completed within 3-5 days. I think Chase said 30 days, but not positive about that. Five days later I disputed the accounts with Experian. Normally I wouldn’t have done this but I wanted to get them off asap in an attempt to make the 30 day window when I could call recon. By day 28 the Chase account had fallen off, but not Citi (even though Citi said it would be quicker). Called recon anyway and explained the situation. CSR was initially skeptical but then said something like, “So your plan is remove your AUs so they’re not taken into consideration?” I said yes, they ran the app through again and an hour later it was showing in my login. Now I just need the 100,000 points to come through as expected since by this time I was past 1/12.

Hope this might be helpful to anyone else trying to time these types of decisions.

Wife was just approved today online. I thought she was over 5/24 but based on credit report she was 4/24. Chase Ink AU did NOT count towards her 5/24 as she would have been rejected if it did count….

Is it true that all the folks who got approved from the branch always have pre-approval? In other words, is ‘Pre-approval’ a prerequisite in order to get approved from branch?

Thanks.

If you are past 5/24, then yes.

To by-pass 5/24 you need pre-approval in branch from all of the datapoints I’ve seen.

Private clients need pre-approval too now if they’re over 5/24? Previously someone said those folks can bypass normal application process

No longer bypasses 5/24, more info here: https://www.doctorofcredit.com/chase-private-client-statushigh-value-customers-no-longer-bypass-chase-524/

Does this mean if I am under 5/24, then I will still have good chance to get approved in branch even if I don’t have pre-approval? Assuming I have high credit score.

Thanks

If you’re under 5/24 then just normal approval process applies, don’t think applying online/in branch will make a difference.

I’m 4/24, with most recent one 12/22/16 (with Barclay AA Red, before knowing CSR dropping down to 50k so soon). Wasn’t sure will be approved, but didn’t want to regret the “what if” so just applied online (no branch in MA) with no pre-approval. Score 800+. Instant approval with 10k limit. BTW, just canceled CSP in Nov.

Actually, from a few DPs that I’ve seen, Chase doesn’t seem to include the 24th month with regards to 5/24. Quite a few people have gotten approved for a 5/24 card while being in the same month that their first 5/24 card was opened two years ago. Someone was able to get approved for CSR as early as the 1st of -the month while their previous 5/24-card-in-question was opened in the middle of that same month two years ago.

Got any links to these DP? I’ve only seen the opposite 🙁

Are you sure about the 5/24 being to the exact date? I just got approved for a Ink Plus and I’m exactly at 5/24 with my earliest date being 1/31/15. I was denied in October for 5/24.

My plan was to apply today thinking maybe the referral links will stop working for this card any day and then call recon 2/1. I got the message to call in because of the Patriot Act/fraud verification. At least that’s what the lady on the phone said. The message was not the standard processing or deny so I decided to call in. Called and after a few minutes on hold approved for 9k.

Going to try for the CSR in branch in February.

5/24 is to the calendar month not exact day.