Update 4/5/19: Rate reduced to 2.5% from 2.6%

Offer at a glance

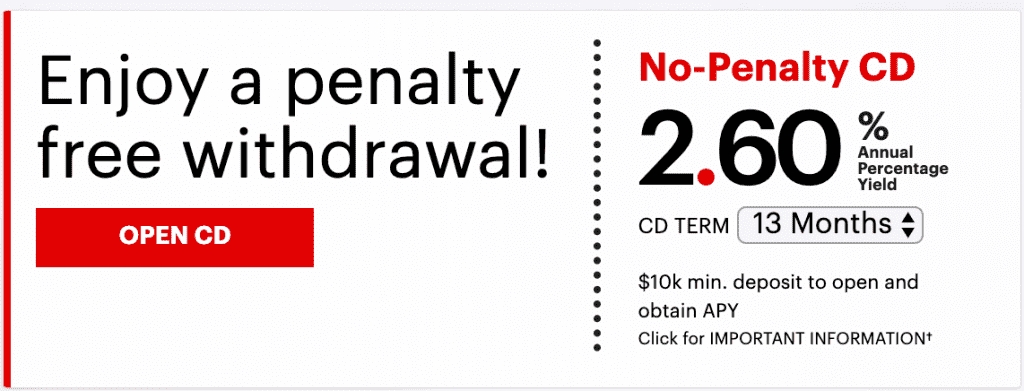

- Interest Rate: 2.60% APY

- Minimum Balance: $10,000

- Maximum Balance: None stated

- Availability: Nationwide

- Hard/Soft Pull: Soft

- Credit Card Funding: None

- Monthly Fees: None

- Insured: FDIC

The Offer

- PurePoint Financial released a new special with 2.60% APY on their 13 month no-penalty CD.

The Fine Print

- Annual Percentage Yields (APYs) are accurate as of 03/05/2019

- $10,000 minimum deposit to open and obtain APY

- You may withdraw your total balance beginning seven days after the day you fund your new CD without being charged a penalty. All other withdrawals will be subject to an Early Withdrawal Penalty, which may reduce account earnings.

- APY assumes interest remains on deposit until maturity date

- Rates valid for accounts opened online or by phone at 1-855-488-7873. Other rates may be available if account is opened in person at a Financial Center.

- Valid email address and Online Banking enrollment are required to open and maintain an account.

Our Verdict

2.60% is a terrific rate, especially given that the rise of interest rates seems to be slowing down. The best no-penalty competitors are Dime Bank at 2.45% on their 13-month offering. And then there are some high-yield savings accounts with rates up to 2.53%, though the best rates often have high minimums. This account has just a $10k minimum and is better than all other rates currently available.

No-penalty CD’s don’t have quite the same utility as ordinary savings accounts, but for someone not really planning on spending the funds they are almost as good. Just remember you’ll have to break the entire CD if you elect to pull your funds out, you can’t just pull out part of the funds.

Interesting option to consider. We’ll add this to our list of Best High Yield Savings Accounts. Please comment below with experiences using this bank. (Thanks to numerous readers who let us know about this new account.)

PurePoint got pretty lame pretty quickly. now no penalty is only 2%, interest is only 2.15%

Looks like the rate is now at 2% for a 13-month no-penalty CD

Oh wow, that’s quite a drop. Thanks for the heads up!

rate went down to 2.50% from 2.60%…FYI

Can someone explain how the no-penalty CDs work? If I decide at 6 months to pull my money out, do I still get the 2.6% for the 6 moths (essentially 1.3%)?

Is there any difference between the no-penalty CD and a high yield savings account with the same interest?

Effectively no difference. If you close your account too soon (for Ally it’s like 2 weeks?) you forfeit ALL the interest, I believe. Otherwise yes, you’ll get 1.3%ish (minus some compounding) if you pull out halfway through.

Wow – this made me go to their website and they also have a 12 mo. CD – 2.80% APY. (Not no-penalty but still). Thanks

“Thank you for your request to open a savings or CD account with PurePoint Financial. We are writing to inform you that we are unable to open an account for you at this time.”

Anyone got this?

Felix, Did you call to find out why?

I got this also. I have had a savings account with a significant amount of funds and no issues with Purepoint for almost 2 years. I find this to be rather insulting and am considering moving my savings account funds elsewhere.

Do you have a credit freeze in place? I’ve had soft pulls during new bank account opening that have resulted in this same cryptic message. Temporarily lifting the freeze seems to fix the issue.

which credit agent and how to freeze? thank you.

Ally 2.75% 12 month no minimum seems decent.

That rate is for a normal CD. For no-penalty, Ally offers 2.15% for $5k or 2.30% for $25k.

Should be fairly safe. This company rolls up to MUFG Union Bank https://en.wikipedia.org/wiki/MUFG_Union_Bank

“PurePoint Financial is a division of MUFG Union Bank, N.A.”

It’s FDIC insured anyways so unless you putting over $250k in there, you should be good.

that’s correct…You cannot do more than 250k each…its covered each cd…so up to 250k each…so you could have several 250k each…

wrong, its per institution

You are correct I was mistaken

Nice find 2.6% is really good for people who may just have cash for purchasing a home.

I’ve had no issues whatsoever from Purepoint. They have offered competitive savings rates in the past and their site is very easy to use. I’ve had to call in to their customer service one time and they were really great. I actually called to close out my account and they advised that it didn’t hurt to keep it open in case their rates again. Even though they don’t have the highest rate now, I’m comfortable keeping my funds in there because they make it so easy to move funds in and out. I just signed up for this CD too. I’m really happy with them. Thanks for posting this!