U.S Bank has quietly re-branded their existing business card to a new business credit card called “Business Edge Rewards”. There are four versions of this card:

- Business Edge Cash Rewards

- Business Edge Select Rewards

- FlexPerks Business Edge Travel Rewards

- Business Edge Platinum

These cards are pretty unremarkable, all cards come with the following:

- 0% APR on purchases for the first nine billing cycles

- No cap on points/cash back earnings

- No annual fee

Contents

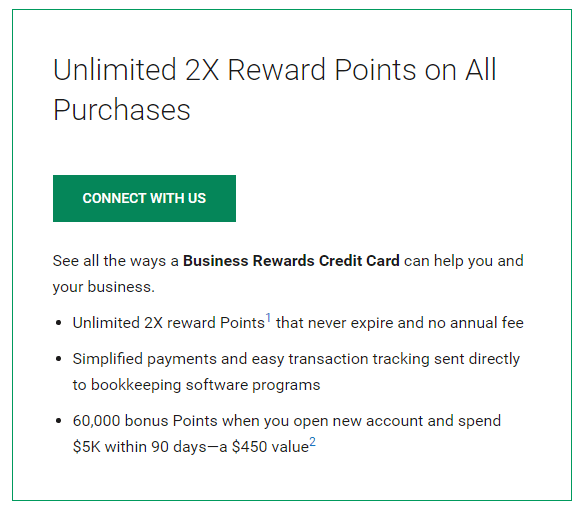

Card Highlights For The Business Edge™ Select Rewards Card

Our full review

Our full review

Application link

- Earn 3x points on one the following categories:

- Day-to-day expenses, such as shipping, advertising, utilities, office supplies, telecom and professional services

- Automotive, such as gas, service, tires, tolls, dealerships, car washes and repairs

- Travel and entertainment, such as airlines, auto rental, hotels, restaurants and travel agencies

- Earn 1x points on all other purchases

- Sign up bonus of 10,000 points after you spend $500 within the first 90 days of account opening

Redeeming Points

Points can be redeemed for the following:

- U.S Bank visa gift cards or gift cards from other participating merchants

- Name brand merchandise

- Travel

- Statement credit

Usually you can get at least 1¢ per point in value.

Our Thoughts

At first glance this card didn’t seem too bad, but that was before I realized you could only pick one of the three point earning categories. These categories are a lot broader than they usually are (for example I’ve never seen a card that has a bonuses category on car repair expenses), which is a definite upside.

Card Highlights For The Business Edge™ Cash Rewards Card

Our full review

Our full review

Application link

- Earn 3% cash back cellular, gas and office supply store

- Earn 1% cash back on all other purchases

- Receive a 25% bonus on the previous years cash back earned, up to $250

Our Thoughts

With the 25% annual bonus this card actually earns 3.75% cash back on cellular gas and office supply stores. Unfortunately other cards on the market allow you to easily get 5% cash back on the same bonuses categories.

Card Highlights For The FlexPerks® Business Edge™ Travel Rewards Card

Our full review

Our full review

Application link

- 20,000 FlexPoint bonus after you spend $3,500 within the first three months

- $25 airline allowance for each award ticket booked for incidental expenses such as baggage and food

- Earn 2x FlexPoints on gas, office supplies or airline purchases, whichever you spend most on each monthly billing cycle

- Earn 2x FlexPoints most cell phone purchases, including monthly bills, accessories and Internet charges

Redeeming FlexPoints

FlexPoints can be redeemed at a maximum of 2¢ per point when redeeming for airline travel. Here is the award chart:

You can book any airline that is part of the online portal (which is pretty much all airlines from what we’ve seen). You can also redeem for gift cards at 1¢ per point.

Our Thoughts

The sign up bonus is decent on this card if you’re going to redeem for airline travel ($400), you’d need to put in some extra spend to hit the next level ($5k total in bonused spend or $10k in non bonused spend, which would give you $600). The problem is the Ink cards from Chase earn 5x Chase UR points in the same bonuses categories.

Card Highlights On The Business Edge™ Platinum Card

Our full review

Our full review

Application link

- No annual fee

- 0% APR for the first twelve months

- No rewards program

Our Thoughts

This card is useless, I’m not sure why they bothered to add it.

Our Overall Thoughts

These cards are decent earners, but they all fall short of being amazing credit cards. The upside is that they have no annual fee, the downside is that they earn a lot less than existing business cards on the market (e.g the Ink Bold/Ink Plus).

The only one of real interest for most people will be the select card and that’s solely because it includes bonused earnings on things (e.g automotive repair) which no other card offers.

All of these cards have been added to the master list of business credit card sign up offers.

What do you think of these new cards offered by US Bank? Will you be applying for any of them?

Hat tip to pfdigest from saverocity

The 3% cash back or even 1% cash back is misleading for the Business Edge Select Rewards card as if you actually do a statement credit, it is $16.75 for every 2,500 points which is 0.67% for every $1 at the 1 point and basically 2.01% for every $1 at the 3 point.

I got a 50k targeted in mail for $3k spend with 18 mos 0% . Trying to get a grip on the value of that. Ideally transfer to flex perks cards I have or maybe even combinable with the new US bank reserve points . But guessing that’s not possible. Able to get 1% value if at least redeeming for visa gift card? Anything better?

Same situation/question as Matt. Just got a 50k targeted offer via snail mail on the Business Edge Select

I contacted US Bank about this offer specifically and was told that the 50K bonus can be redeemed for a $500 statement credit or deposited into a US Bank Checking/Savings account. Each point is worth 1 cent per point when redeeming for statement credit or deposit. For travel 50K points is worth $450 in airfare. Treating the Business Edge Select Rewards as a cash back card makes it a decent card, especially in a world where many of us in the hobby can’t get the Chase Ink cards.

Never mind, you were correct. I was misinformed by two people when calling in to US Bank to ask about the points value. You are correct. 2500 points is worth $16.75 in statement credit, or 50,000 points is worth $335 in statement credit. I’m still working with US Bank to get this mishap sorted out. I do NOT recommend any of the Select Rewards credit cards to anyone. Choose the cash back or FlexPerks cards instead.

Never even heard of this card before but just got a targeted mailer for $500 cash after $4,500 spend. I love non-mainstream great deals like that.

Not available in Michigan I was told

I read that US Bank Edge Business Credit Card can be obtained with NO social security number

EIN TAX I’D NUMBER ONLY

True or False ???

How much are the “Business Edge™ Select Rewards” points worth when redeeming for a statement credit?

$16.75 for 2500 points which means it’s worth 0.67% at 1% and 2.01% at 3%.

Do you think Egde Select Reward version is good to manufacture points by buying gift card at 7 Eleven?

It’s good if you can get the maximum value of 2c per point, but there are lots of gas credit cards that earn 5% cash back which I’d chose over the Edge: https://www.doctorofcredit.com/best-gas-credit-cards/

It’s 0.67c per point at 1% and 2.01c per point at 3% when you redeem since it’s 2,500 points for $16.75.