Update 9/11/25: Available again. Valid until 01/21/2026

Extended to 10/15/25

Update 4/21/25: Extended to 7/16/2025

Update 1/17/25: Extended until 4/16/25

Update 10/3/24: Extended until 1/22/25

Update 7/29/24: Back until 10/16/24

Update 5/18/24: Extended through 7/24/24

Offer at a glance

- Maximum bonus amount: $3,000

- Availability: Nationwide, in-branch only

- Direct deposit required: None

- Additional requirements: Deposit $500,000 and maintain for 90 days

- Hard/soft pull: Soft

- ChexSystems: No

- Credit card funding: Cannot fund with debit or credit in branch.

- Monthly fees: None

- Early account termination fee:

Bonus taken back if closed within six monthsNone - Household limit: None listed

- Expiration date:

April 23rd, 2019 June 15th, 2019 August 6th, 2019 September 28th, 2019November 19th, 2019 October 19, 2022April 19, 2023July 24, 2024

Contents

The Offer

Direct link to offer (incognito)

- Meet with a Private Client Banker to upgrade (or open) your Chase account to Chase Private Client and receive a bonus of up to $3,000 when you meet the following requirements:

- Within 45 days transfer a total of $500,000 or more in new money to a combination of eligible check, savings and/or eligible investment accounts (deposit $500,000 for $3,000 bonus or $250,000 for $2,000 bonus or $150,000 for $1,000 bonus).

- Maintain that balance for at least 90 days from coupon enrollment.

- Bonus will be deposited into your account within 40 days.

The Fine Print

- Offer not available to existing Chase Private Client customers.

- To receive the $1,250 bonus: 1) Meet with a Private Client Banker to upgrade your existing account to Chase Private Client CheckingSM account. 2) Within 45 calendar days, transfer a total of $250,000 or more in qualifying new money or securities to an eligible checking, savings and/or J.P. Morgan investment accounts (opened in a Chase branch and serviced by a J.P. Morgan Private Client Advisor or Financial Advisor).

- Ineligible accounts: any You InvestSM accounts, Certificates of Deposit, insurance products; fixed and variable annuities; 529 College Savings Plans; any retirement accounts such as Traditional and Roth IRAs, Keogh, Simple IRAs, and 401(k) Plans.

- The qualifying new money or securities must be transferred from non-Chase or J.P. Morgan accounts and cannot be funds or securities held by Chase or its affiliates. AND 3) Maintain at least a $250,000 balance for at least 90 days from the date of funding (gains and losses to qualifying investment balances from trading or market fluctuation will not be counted for purposes of meeting the balance requirements).

- After you have completed all the above requirements, we will deposit the bonus in your existing Chase Private Client Checking account within 10 business days.

- The Annual Percentage Yield (APY), for Chase Private Client Checking effective as of 01/22/19 is 0.01% for all balances in all states. Interest rates are variable and subject to change. Additionally, fees may reduce earnings on the account.

- You can only participate in one Chase Private Client Checking, Sapphire Checking or You Invest new money bonus in a 12 month period.

- Coupon is good for one time use. Bonuses are considered interest and will be reported on IRS Form 1099-INT (or Form 1042-S, if applicable).

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

As far as I know there is no monthly fee, but if you don’t maintain the $250,000 balance requirement they might downgrade your account to something else

Early Account Termination Fee

Bonus taken back if closed within six months There is no longer any early termination fee.

Our Verdict

You could sign up for a $600 checking/savings bonus and then wait six months and then do this deal in branch. The fine print says you’re not eligible for this bonus if you’ve done any Sapphire Checking, Chase Private Client Checking or You Invest new money bonus in a 12 month period, rather than every two years on the regular Chase checking/savings bonus.

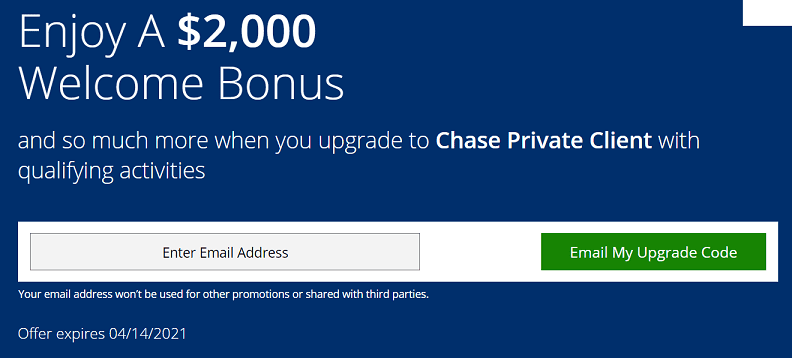

For most people this $2,000 Chase Private Client bonus isn’t worth considering because YouInvest balances do not qualify and Chase deposit accounts earn a very low APR and the other investment accounts have higher fees than other options. Because of that I wouldn’t recommend signing up for this deal.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Post history:

- Update 1/16/24: Extended to 04/17

- Update 10/6/23: Extended to 01/24/2024.

- Update 7/23/23: Extended until 10/18/2023.

- Update 2/21/23: At some point the terms changed slightly so that you only need to have the funds in the account from day 45 through day 90. There has also been some discussion in the comments about using J.P. Morgan investing without paying fees. And so there might be ways for this offer to make sense.

- Update 2/20/23

: There’s a new link(open incognito) with a tiered deposit requirement – $1,000 bonus with $150,000; $2,000 bonus with $250,000; $3,000 bonus with $500,000. Still none of these are very interesting IMO given the loss of interest on the funds. - Update 1/13/23: Offer extended to 4/19/23.

- Update 10/15/22: Offer extended to 1/25/23

- Update 8/15/22: Deal is back at this link (incognito) and valid through 10/19/22. The fine print indicates it works for new Chase checking customers or existing checking customers who upgrade or existing Private Clients who make a $250,000 deposit. Requires Chase branch visit.

- Update 1/18/21: Deal is back, but has been reduced to $2,000. Valid until 4/14/21.

- Update 11/22/20: Deal has been increased to a maximum $3,000 bonus. Hat tip to reader EW

- Update 9/27/20: Deal extended until 11/23/20.

- Update 8/10/20: Extended until 10/1/20.

- Update 5/26/20: Deal might be better than we originally thought. Normally there is a 1.25% fee, YouInvest doesn’t have this fee but is excluded from counting for this bonus. They have another self directed account called “Full Service“, this has no management fee if your a Chase Private Client (CPC). There is an annual fee of $50, but this is waived if you are CPC or have $25,000 in investments.

- Update 5/25/20: Deal is back and valid until 8/10/20. Hat tip to reader Don

- Update 1/19/20: Deal has been extended until March 6th, 2020.

- Update 11/20/19: Bonus has been extended until January 17th, 2020.

- Update 11/8/19: Bonus has been increased to $2,000 (up from $1,250).

- Update 8/15/19: Deal has been extended until September 28th, 2019. Hat tip to MtM

- Update 6/17/19: Deal has been extended until August 6th, 2019.

- Update 4/24/19: Deal has been extended until June 15th, 2019.

I would do this one but I see its a fight to get this account opened for self directed only. They want their brokers to get new AUM fees. I know they will try and call and bug me.

Worth noting fwiw: assets in a self-directed acct will not count toward maintenance requirements

If you do the private banker one, dont let those jerks manage one penny of your money. Self directed only.

Last time I tried it, guy told me open text that the promo is to get people face time with advisors and get them on account with commissions. After long back and forth with me showing him language from their own website about full-service brokerage, he reluctantly agreed and asked me to email him ACAT inro. Turned out, just to get me out of his office. I emailed and never heard back. I guess could’ve followed up but didn’t think it was worth the aggravation and lost time.

would it be better to get the $300 for a new regular checking account and do the $700 brokerage then upgrade to this?

The total checking/savings bonuses are separate from CPC

What if you did the $700 bonus for the self-directed investing account recently, are you eligible for this?

This is the only limiting language that I see: “You can receive only one Chase Private Client Checking℠ new money bonus or savings promotional rate offer in a 12-month period from the last bonus coupon enrollment date.”

Also, as you probably aware: The Self Directed brokerage account isn’t an eligible account for this promo, in terms of parking new money.

FWIW – I have done this bonus twice now. The good thing is they came thru each time. The bad thing, as many have noted, is the in-person experience. For me, not so much the CPC banker who was pleasant, but the JPM broker, who was hostile and combative, even when I’m basically sitting there with $xxx,xxx to fund the account. There’s nothing in it for the broker, and they don’t mind letting you know that.

They are jerks. I am with you. I would never let those jerks try to manage a dime for me.

Taxable income

It now expires on 01/21/2026. Only one code for everyone:

Offer code:

DM22 2292 22CY 6KZM

What if the regular account already has that much money? Can I upgrade to the private client and get the bonus? Or it has to be new money?

With all due respect, pretty obvious that new money is required. Maybe read the terms?

new to Chase money, could theoretically transfer to fidelity then transfer back to chase though

The promo is back!

Looks like a static code this time.