Update 6/12/19: Rate has been increased from 3% to 3.5%.

Offer at a glance

- Interest Rate: Up to 3.50%

- Minimum Balance: $100

- Maximum Balance: $5,000 for 3% APY rate

- Availability: Must live, work, worship or attend school in one of the following counties: CA: Santa Clara, Alameda, Contra Costa, San Mateo, San Francisco AZ: Pima

- Direct deposit required: No

- Additional requirements: No

- Hard/soft pull: Mixed DP, make sure to opt out of overdraft

- ChexSystems: Unknown

- Credit card funding: Unknown

- Monthly fees: None

- Insured: NCUA

The Offer

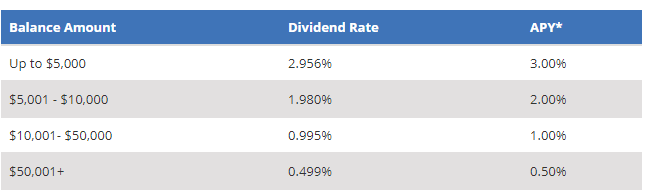

- Meriwest is offering 3.5% APY on balances up to $5,000 with no requirements on the Premier Savings account. The catch is that the account can only be opened in your first 30 days of membership. You still get an APY of 2% on balances up to $10,000 as well. Break down as follows:

- If you have say $6,000 in the account the first $5,000 earns at 3% and next $1,000 earns at 2% rather than the rate being blended.

The Fine Print

- Available only to new members during the first thirty (30) days from the date of opening a membership account.

- Minimum average daily balance of $100 required

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

This account has no monthly fees as far as I know

Our Verdict

3.5% APY with no requirements is great, even the maximum balance of $5,000 isn’t bad. You can also sign up for the checking account to get $125 and then do this deal. Only downsides are the mixed data points on it being a hard/soft pull. If anybody tries it, let us know in the comments below. Will be adding this to our high yield saving account page.

Hat tip to Travel With Grant via e-mail

Has the $300 offer expired? I keep getting a “403 – Access Denied” error when I follow the direct link.

Now it has 300 bonus and 2% APY up to 15000.

https://www.meriwest.com/smartbonus

Thanks, got that here: https://www.doctorofcredit.com/ca-az-meriwest-credit-union-125-checking-bonus/

Top tier rate is now 2.25% APY.

It is a hard pull with Experian. I just called them to verify.

this is down to 2.5 now.

Can anyone who’s had this account for a while confirm whether or not they are also now receiving 3.5% interest or is the 3.5 only for new applicants and previous members who opened at 3% are not getting the higher rate?

I see an increased rate on my account that seems to reflect the higher rate for balances up to $5k (I have more than that in the account). Thanks for the heads-up; I hadn’t caught this rate increase (supposedly dated June 1, 2019). https://www.meriwest.com/personal/other-services/rates

Opened mid last year when the rate was 3%. I just saw the June rate did update to 3.5%.

Fantastic. Will probably go for this soon then. Any confirmation of HP or if its just Soft pull?

Membership declined after I failed to respond to a shady-as-fun looking email from https://web1.zixmail.net/s/e?b=meriwest asking for a scan of my SSN card.

Business model: fake offers and collecting non-refundable joining fees.

I noticed there is another way to qualify for membership. You can be employed by any tech company in California or Arizona. That should include a lot of people outside of those specific counties. I still don’t qualify so I haven’t tried to become a member this way.

Any other tech employees out there?

i emailed them. their response today:

“Thank you for your interest in our credit union. When applying for a new membership, a hard credit inquiry is made. We also use Chexsytems in order to review previous financial institution reporting records.”

avoid!

That’s interesting. I checked fairly rigorously after applying and I didn’t see any records of a hard pull anywhere.

Seems like YMMV then…

Odd. Maybe that person didn’t know better, some people there don’t seem to know their products and how things work.

I didn’t have a hard pull when opening the savings or checking account.

They don’t do credit card funding when opening.

Just opened the savings account and was allowed to fund up to $500 by credit card

Coded as cash advance or purchase?