Deal has ended, view more bank account bonuses by clicking here.

Offer at a glance

- Maximum bonus amount: $200

- Availability: KY

- Direct deposit required: 3 totaling $3,000+

- Additional requirements: Use promo code

- Hard/soft pull: Unknown

- ChexSystems: Unknown

- Credit card funding: Up to $5,000

- Monthly fees:

- Early account termination fee: Unknown

- Household limit: None listed

- Expiration date: 12/31/24

Contents

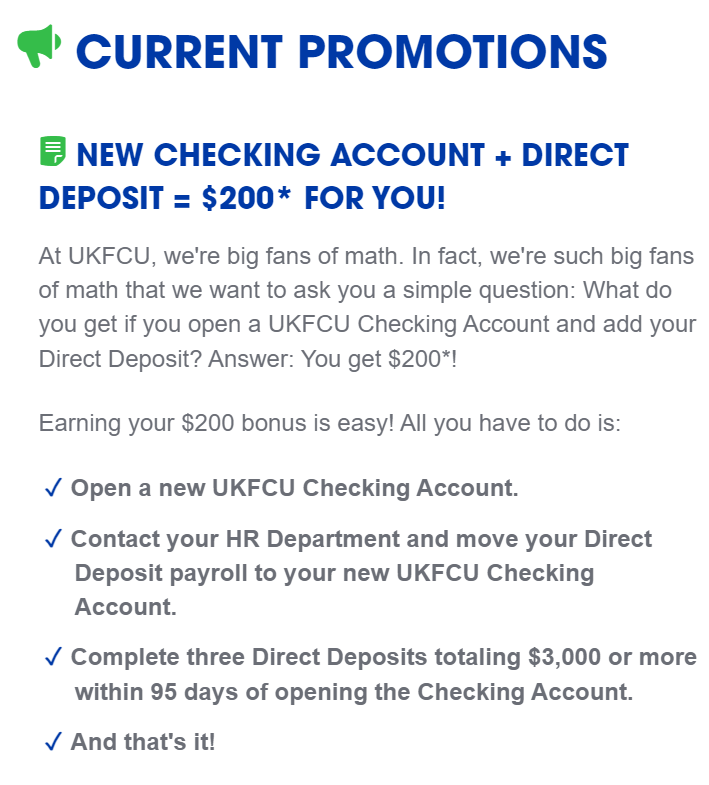

The Offer

- University of Kentucky Federal Credit Union is offering a $200 bonus when you open a new checking account and complete the following requirements:

- Receive three Direct Deposits totaling $3,000 or more within 95 days

- Use promo code 200Better

The Fine Print

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

ukfcu checking account has no monthly fees to worry about.

Early Account Termination Fee

I wasn’t able to find any EATF in the fee schedule.

Our Verdict

Seems to be a small service area, unfortunately applying through ACCC doesn’t help with out of state applications.

Hat tip to ShawntheShawn

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times