Update 11/9/19: Deal is back with promo code 2019LVEXPO. Available until January 9th, 2020. Hat tip to intervested99

Update 9/16/19: Deal is back with promo code SFMS19 through 10/17/19. Again, it might only work for Moneyshow attendees, as before.

Update 6/29/19: Deal is back for 2019, keep in mind the targeted language still applies.

The Offer

Direct Link to offer | New Link | Newest Link

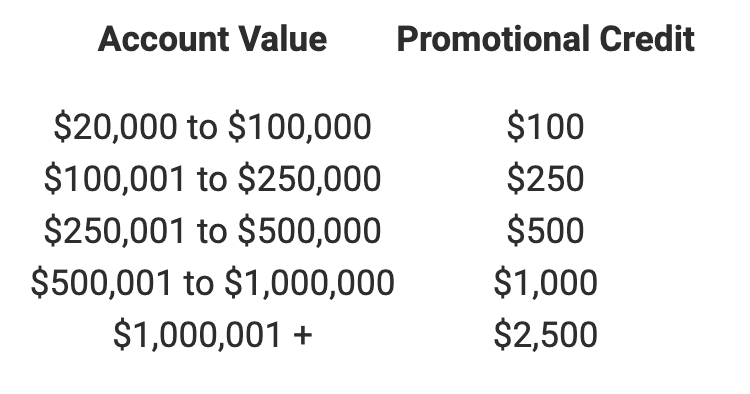

Open a new Merrill Edge account and transfer between $20,00 and $200,000 in assets to get the following bonus tiers:

- Transfer $200,000 or more and get a $1,000 bonus (standard is $600)

- Transfer $100,000 or more and get a $500 bonus (standard is $250)

- Transfer $50,000 or more and get a $250 bonus (standard is $150)

- Transfer $20,000 or more and get a $100 bonus (this is the standard)

Go to Merrill Edge, choose which type of investment account you want to open, and input offer code: CHEXPO19.

The offer page indicates this offer is only valid for TradersExpo attendees. Try calling in and get an advisor to open up the account with, and see if they’ll extend it to you.

The Fine Print

- Offer expires

12/31/17 12/15/17.September 5th, 2019 - Offer valid only for new personal Merrill Edge IRA or CMA accounts.

- Offer is limited to one per account type (CMA or IRA); two total per accountholder (or per all accountholders of a joint account). Eligible IRAs limited to Rollover, Traditional, Roth and Sole-Proprietor SEP IRAs only. This offer does not apply to Merrill Edge Guided Investing Accounts, Business/Corporate Accounts, Investment Club Accounts, Partnership Accounts and certain fiduciary accounts held with Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S).

- Merrill Edge reserves the right to change or cancel this offer at any time.

- You must have the qualifying balance 180 days after funding.

- Must fund your account within 45 days with funds originating outside Bank of America and MLPF&S. Funds cannot originate from 401(k) accounts administered by MLPF&S.

- For purposes of this offer, qualifying balances are calculated by adding total incoming assets or transfers (including cash, securities and/or margin debit balance transfers) from external accounts, and subtracting assets withdrawn or transferred out of the account within the 180-day holding period.

- Cash reward will be deposited into your IRA or CMA within two weeks after you meet qualifying criteria.

- The value of this reward you receive may constitute taxable income. In addition, Merrill Lynch may issue an Internal Revenue Service Form 1099 (or other appropriate form) to you that reflects the value of this reward. Please consult your tax advisor, as Bank of America Corporation and its affiliates and associates do not provide tax advice.

If your new account is a Merrill Edge self-directed IRA or CMA account, you also qualify for the following benefits:

- Commission-free trades begin within 5 business days of account opening and must be used within 90 calendar days; up to 300 trades per account.

- Merrill Edge MarketPro® Trial begins within 5 business days of opening your self-directed account and expires after 90 calendar days.

Our Verdict

There is no direct link for this offer, just input the promo code to see the offer details. You can check out last year’s link as the details are the same (our coverage of last year’s deal here). It might be a good idea to confirm the bonus with Merrill Edge first to ensure this is a public offer since there’s no landing page, but it shows the details clearly when you input the promo code so it should work regardless.

The standard Merrill Edge offer is to get between $100-$600; with this offer it’s $100-$1,000. Truth be told, Merrill agents might always be able to apply this offer if they choose, but it’s easier to do when it’s a public offer and you don’t have to beg. try calling in and seeing if they’ll extend this offer to you as well. Note that the standard $600 bonus offer only requires holding the funds there for 90 days while this $1k offer requires 180 days.

There are lots of brokerage bonuses (this one being from the better ones), but the real reason a lot of us are interested in using Merrill Edge is due to their Preferred Rewards structure which can give you a regular 2.62% earnings on all spend and other nice earning opportunities. The 2.62% rate works both on the new Premium Rewards card and on the Travel Rewards card. If you have the former, it’ll be simple 2.62% cash back while with the latter it’s cash back when offsetting travel purchases. Keep in mind, you do need also a Bank of America checking account to qualify for Preferred Rewards.

You can see more analysis of the Merrill Edge brokerage and their free trade offer here. Please do you own research or ask your financial advisers before making such a move. It won’t be right for everyone, plus there are tax implications if not done properly.

Hat tip to reader Richard8655

DP:

10/14/19 – Account opened with code SFMS19

10/24/19 – Securities transferred

4/27/20 – Expo-level bonus automatically received

09/30/2019 – Funds deposited

04/07/2020 – Bonus received

I was iffy about using the expo code so called in and they matched the deal after a 24 hour wait.

I’m currently waiting my 24 hours hopefully it works

update: they matched it for me in 5 hours. even though the code is expired and i told them i did not go to the expo, they matched the offer (i told them it would be about $200000 in assets. He actually asked if it was closer to 300000 and I said no.)

How long of a holding period?

Kind of a random question, but I opened my account last week and they’re now telling me I can’t have both a SIMPLE and a SEP, which I currently have with Ameriprise. They say it’s one or the other for each social. This can’t be right, can it?

is this churnable?

once per year they will let you use a bonus

I talked to a Merrill Edge CSR today and was told that visa holders can open brokerage account at ME if they bring >250k in investments, and if their visa is valid for upto 1 year from the date of opening the account. The account will have to be opened over the phone and documents will have to be mailed, as online applications are still limited to US citizens/permanent residents. You can call (855) 619-0915 to get more info.

For those of us visa holders who have 250k+ in IRAs and Taxable investments, this could be a way to get into the BofA Preferred Rewards system.

Is this churnable? I don’t see any language saying it isn’t. I closed down previous accounts last month. Could I open new ones and get the bonus again?

Back as merrilledge.com/Expo

How long do I need to keep the funds in the account after getting the bonus?

Zero time. But consider Preferred Rewards. Also watch out for full transfer out fee (no fee for partial).

Thanks. Schwab’s new no fee trading is quite interesting.

Is there landing page for the new code (SFMS19)?

Oh, sorry, added now. (It must have been cookied into my browser.)